0000819050FYFALSE2023P3Y0000008190502023-01-012023-12-3100008190502023-06-30iso4217:USD00008190502024-03-15xbrli:shares00008190502023-12-3100008190502022-12-31iso4217:USDxbrli:shares0000819050us-gaap:ProductAndServiceOtherMember2023-01-012023-12-310000819050us-gaap:ProductAndServiceOtherMember2022-01-012022-12-310000819050us-gaap:RoyaltyMember2023-01-012023-12-310000819050us-gaap:RoyaltyMember2022-01-012022-12-3100008190502022-01-012022-12-310000819050us-gaap:SeriesAPreferredStockMember2021-12-310000819050us-gaap:CommonStockMember2021-12-310000819050us-gaap:AdditionalPaidInCapitalMember2021-12-310000819050us-gaap:RetainedEarningsMember2021-12-3100008190502021-12-310000819050us-gaap:SeriesAPreferredStockMember2022-01-012022-12-310000819050us-gaap:CommonStockMember2022-01-012022-12-310000819050us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000819050us-gaap:RetainedEarningsMember2022-01-012022-12-310000819050us-gaap:SeriesAPreferredStockMember2022-12-310000819050us-gaap:CommonStockMember2022-12-310000819050us-gaap:AdditionalPaidInCapitalMember2022-12-310000819050us-gaap:RetainedEarningsMember2022-12-310000819050us-gaap:CommonStockMember2023-01-012023-12-310000819050us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000819050us-gaap:RetainedEarningsMember2023-01-012023-12-310000819050us-gaap:SeriesAPreferredStockMember2023-12-310000819050us-gaap:CommonStockMember2023-12-310000819050us-gaap:AdditionalPaidInCapitalMember2023-12-310000819050us-gaap:RetainedEarningsMember2023-12-31frtx:segment0000819050srt:MinimumMember2023-12-310000819050srt:MaximumMember2023-12-310000819050us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310000819050us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310000819050us-gaap:WarrantMember2023-01-012023-12-310000819050us-gaap:WarrantMember2022-01-012022-12-310000819050us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000819050us-gaap:EmployeeStockOptionMember2022-01-012022-12-3100008190502022-05-2500008190502022-07-012022-07-310000819050frtx:VoronoiIncMember2021-08-272021-08-2700008190502021-08-272021-08-27xbrli:pure0000819050frtx:CarnaBiosciencesIncMember2022-02-020000819050srt:MaximumMemberfrtx:KakenMemberfrtx:MilestonePaymentsMember2022-05-030000819050srt:MaximumMemberus-gaap:RoyaltyMemberfrtx:KakenMember2022-05-030000819050us-gaap:RoyaltyMemberus-gaap:CollaborativeArrangementMemberfrtx:BotanixMember2022-01-012022-12-310000819050frtx:BotanixMember2023-07-212023-07-210000819050frtx:BotanixMemberfrtx:BodorLaboratoriesInc.Member2023-07-212023-07-210000819050frtx:BotanixMember2022-05-030000819050frtx:MilestonePaymentsMemberfrtx:BotanixMember2022-05-030000819050srt:MaximumMemberfrtx:MilestonePaymentsMemberfrtx:PaymentCriteriaOneMemberfrtx:BotanixMember2022-05-030000819050frtx:MilestonePaymentsMemberfrtx:PaymentCriteriaTwoMemberfrtx:BotanixMember2022-05-030000819050frtx:PaymentCriteriaThreeMemberfrtx:BotanixMember2022-05-030000819050frtx:ConsultingServicesMemberfrtx:BotanixMember2022-05-032022-05-030000819050frtx:BotanixMember2022-05-032022-05-030000819050frtx:BuyoutOfPostClosingObligationsMemberfrtx:BotanixMember2023-01-012023-12-310000819050frtx:BuyoutOfPostClosingObligationsMemberfrtx:BotanixMember2022-01-012022-12-310000819050frtx:BotanixMemberfrtx:SublicenseIncomeMember2023-01-012023-12-310000819050frtx:BotanixMemberfrtx:SublicenseIncomeMember2022-01-012022-12-310000819050frtx:ConsultingServicesMemberfrtx:BotanixMember2023-01-012023-12-310000819050frtx:ConsultingServicesMemberfrtx:BotanixMember2022-01-012022-12-310000819050frtx:UpfrontConsiderationReceivedFromBotanixMemberfrtx:BotanixMember2023-01-012023-12-310000819050frtx:UpfrontConsiderationReceivedFromBotanixMemberfrtx:BotanixMember2022-01-012022-12-310000819050frtx:MilestonePaymentReceivedUponAcceptanceByFDAOfNDAFilingMemberfrtx:BotanixMember2023-01-012023-12-310000819050frtx:MilestonePaymentReceivedUponAcceptanceByFDAOfNDAFilingMemberfrtx:BotanixMember2022-01-012022-12-310000819050frtx:ReimbursedDevelopmentExpendituresUnderTheAssetPurchaseAgreementMemberfrtx:BotanixMember2023-01-012023-12-310000819050frtx:ReimbursedDevelopmentExpendituresUnderTheAssetPurchaseAgreementMemberfrtx:BotanixMember2022-01-012022-12-310000819050frtx:BotanixMember2023-01-012023-12-310000819050frtx:BotanixMember2022-01-012022-12-310000819050frtx:BotanixMember2022-12-310000819050frtx:BotanixMember2023-12-310000819050frtx:BotanixMember2021-12-310000819050frtx:BodorLaboratoriesInc.Member2022-05-032022-05-0300008190502022-11-102022-11-100000819050frtx:BodorLaboratoriesInc.Member2022-11-102022-11-100000819050frtx:BodorLaboratoriesInc.Member2023-01-012023-12-310000819050frtx:BodorLaboratoriesInc.Member2022-01-012022-12-3100008190502023-05-04frtx:vote0000819050us-gaap:WarrantMember2023-12-310000819050us-gaap:CommonStockMemberfrtx:October2020OfferingMember2020-10-012020-10-310000819050frtx:CommonStockWarrantsMemberfrtx:October2020OfferingMember2020-10-310000819050frtx:October2020OfferingMember2020-10-310000819050frtx:CommonStockWarrantsMember2020-10-3100008190502020-10-012020-10-310000819050frtx:CommonStockPublicOfferingMember2020-06-300000819050frtx:PreFundedWarrantMemberfrtx:CommonStockPublicOfferingMember2020-06-300000819050frtx:CommonStockPublicOfferingMemberfrtx:AccompanyingCommonWarrantMember2020-06-300000819050frtx:CommonStockPublicOfferingMember2020-06-012020-06-300000819050frtx:A2021AtMarketIssuanceSalesAgreementMember2021-03-310000819050frtx:A2021AtMarketIssuanceSalesAgreementMember2023-01-012023-12-310000819050frtx:A2021AtMarketIssuanceSalesAgreementMember2022-01-012022-12-310000819050frtx:A2021AtMarketIssuanceSalesAgreementMember2023-12-310000819050frtx:A2020AtMarketIssuanceSalesAgreementMember2020-04-300000819050frtx:A2020AtMarketIssuanceSalesAgreementMember2022-01-012022-12-310000819050frtx:A2020AtMarketIssuanceSalesAgreementMember2023-01-012023-12-310000819050frtx:A2020AtMarketIssuanceSalesAgreementScenario2Member2023-12-310000819050frtx:PrivatePlacementOfferingsMember2020-02-290000819050frtx:PrivatePlacementOfferingsMemberus-gaap:SeriesAMember2020-02-290000819050frtx:PrivatePlacementOfferingsMemberus-gaap:SeriesBMember2020-02-290000819050frtx:PurchaseAgreementMemberfrtx:LincolnParkMember2020-02-2900008190502022-05-252022-05-250000819050us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000819050us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000819050us-gaap:EmployeeStockOptionMembersrt:WeightedAverageMember2022-01-012022-12-310000819050us-gaap:EmployeeStockOptionMember2022-12-310000819050us-gaap:EmployeeStockOptionMember2023-12-310000819050us-gaap:RestrictedStockUnitsRSUMember2022-12-310000819050us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000819050us-gaap:RestrictedStockUnitsRSUMember2023-12-310000819050us-gaap:RestrictedStockUnitsRSUMember2023-12-282023-12-280000819050us-gaap:SubsequentEventMemberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-01-310000819050us-gaap:EmployeeStockMemberfrtx:EmployeeStockPurchasePlanMember2023-01-012023-12-310000819050us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310000819050us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310000819050us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310000819050us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310000819050us-gaap:EmployeeStockMember2023-01-012023-12-310000819050us-gaap:DomesticCountryMember2023-12-310000819050us-gaap:DomesticCountryMember2022-12-310000819050frtx:NOLsGeneratedAfter2017Memberus-gaap:DomesticCountryMember2023-12-310000819050frtx:NOLsGeneratedBefore2018Memberus-gaap:DomesticCountryMember2023-12-310000819050frtx:FederalResearchAndDevelopmentCreditsAndOrphanDrugCreditMemberus-gaap:DomesticCountryMember2023-12-310000819050frtx:FederalResearchAndDevelopmentCreditsAndOrphanDrugCreditMemberus-gaap:DomesticCountryMember2022-12-310000819050us-gaap:StateAndLocalJurisdictionMember2023-12-310000819050us-gaap:StateAndLocalJurisdictionMember2022-12-310000819050frtx:TaxYear2024Memberfrtx:Sections382And383Memberus-gaap:DomesticCountryMember2023-12-310000819050us-gaap:StateAndLocalJurisdictionMemberfrtx:TaxYear2024Memberfrtx:Sections382And383Member2023-12-310000819050frtx:FederalResearchAndDevelopmentMemberfrtx:TaxYear2024Member2023-12-310000819050frtx:TaxYear2024Memberfrtx:FederalOrphanDrugMember2023-12-310000819050frtx:TaxYear2024Memberfrtx:StateResearchAndDevelopmentMember2023-12-310000819050frtx:TaxYear2025Memberfrtx:Sections382And383Memberus-gaap:DomesticCountryMember2023-12-310000819050us-gaap:StateAndLocalJurisdictionMemberfrtx:TaxYear2025Memberfrtx:Sections382And383Member2023-12-310000819050frtx:FederalResearchAndDevelopmentMemberfrtx:TaxYear2025Member2023-12-310000819050frtx:TaxYear2025Memberfrtx:FederalOrphanDrugMember2023-12-310000819050frtx:TaxYear2025Memberfrtx:StateResearchAndDevelopmentMember2023-12-310000819050frtx:TaxYear2026Memberfrtx:Sections382And383Memberus-gaap:DomesticCountryMember2023-12-310000819050us-gaap:StateAndLocalJurisdictionMemberfrtx:TaxYear2026Memberfrtx:Sections382And383Member2023-12-310000819050frtx:FederalResearchAndDevelopmentMemberfrtx:TaxYear2026Member2023-12-310000819050frtx:TaxYear2026Memberfrtx:FederalOrphanDrugMember2023-12-310000819050frtx:TaxYear2026Memberfrtx:StateResearchAndDevelopmentMember2023-12-310000819050frtx:TaxYear2027AndThereafterMemberfrtx:Sections382And383Memberus-gaap:DomesticCountryMember2023-12-310000819050us-gaap:StateAndLocalJurisdictionMemberfrtx:TaxYear2027AndThereafterMemberfrtx:Sections382And383Member2023-12-310000819050frtx:FederalResearchAndDevelopmentMemberfrtx:TaxYear2027AndThereafterMember2023-12-310000819050frtx:TaxYear2027AndThereafterMemberfrtx:FederalOrphanDrugMember2023-12-310000819050frtx:TaxYear2027AndThereafterMemberfrtx:StateResearchAndDevelopmentMember2023-12-310000819050frtx:IndefiniteMemberfrtx:Sections382And383Memberus-gaap:DomesticCountryMember2023-12-310000819050us-gaap:StateAndLocalJurisdictionMemberfrtx:IndefiniteMemberfrtx:Sections382And383Member2023-12-310000819050frtx:FederalResearchAndDevelopmentMemberfrtx:IndefiniteMember2023-12-310000819050frtx:IndefiniteMemberfrtx:FederalOrphanDrugMember2023-12-310000819050frtx:IndefiniteMemberfrtx:StateResearchAndDevelopmentMember2023-12-310000819050frtx:Sections382And383Memberus-gaap:DomesticCountryMember2023-12-310000819050us-gaap:StateAndLocalJurisdictionMemberfrtx:Sections382And383Member2023-12-310000819050frtx:FederalResearchAndDevelopmentMember2023-12-310000819050frtx:FederalOrphanDrugMember2023-12-310000819050frtx:StateResearchAndDevelopmentMember2023-12-310000819050us-gaap:DomesticCountryMember2023-01-012023-12-310000819050us-gaap:ForeignCountryMember2023-01-012023-12-3100008190502023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(mark one)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-21088

FRESH TRACKS THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | 93-0948554 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| | | | | | | |

| 2000 Central Avenue, | Suite 100, | Boulder, | CO | | 80301 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (720) 505-4755

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

N/A | N/A | N/A |

Securities registered pursuant to section 12(g) of the Act: Common stock, $0.01 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |

| | Emerging growth company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant, based upon the closing sale price of the registrant’s common stock on June 30, 2023, as reported on The Nasdaq Capital Market, was $4.1 million. Shares of common stock held by each executive officer and director and by each person who owns 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 15, 2024, there were 5,973,306 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

FRESH TRACKS THERAPEUTICS, INC.

INDEX

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. All statements contained in this Annual Report other than statements of historical fact, including statements relating to future financial, business, conditions, plans, prospects, impacts, shifts, trends, progress, or strategies and other such matters, including without limitation, our proposed liquidation and dissolution (the “Dissolution”) pursuant to our proposed plan of liquidation and dissolution (the “Plan of Dissolution”), the timing of filing of the Certificate of Dissolution, the Company’s intent to continue to seek approval to dissolve and the results of such action, the amount, number, and timing of liquidating distributions, if any, to our stockholders, the amount of reserves, and similar statements, are forward-looking statements. The words “may,” “could,” “should,” “might,” “delist,” “suspend,” “appeal,” “request,” “stay,” “notify,” “cancel,” “expeditiously,” “quickly,” “approve,” “show,” “maximize,” “advise,” “continue,” “additional,” “range,” “announce,” “anticipate,” “explore,” “reflect,” “believe,” “sufficient,” “transform,” “estimate,” “expect,” “intend,” “plan,” “file,” “make,” “timely,” “promptly,” “attempt,” “distribute,” “discontinue,” “dissolve,” “dissolution,” “wind down,” “best interests,” “predict,” “potential,” “will,” evaluate,” “aim,” “help,” “progress,” “meet,” “support,” “look forward,” “develop,” “strengthen,” “promise,” “successful,” “positive,” “provide,” “commit,” “opportunity,” “disrupt,” “reduce,” “restore,” “demonstrate,” “suggest,” “target,” “shift,” “inhibit,” and similar expressions and their variants, are intended to identify forward-looking statements. Such statements are based on management’s current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors. Unless otherwise mentioned or unless the context requires otherwise, all references in this Annual Report to “Fresh Tracks,” “Brickell Subsidiary,” “Company,” “we,” “us,” and “our,” or similar references, refer to Fresh Tracks Therapeutics, Inc. and its consolidated subsidiaries.

We based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our proposed Dissolution and Plan of Dissolution, status and return of product licenses and management, wind down of Company operations and assets, financial condition, results of operations, business operations and objectives, employees, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those described in Part I, Item 1A, “Risk Factors” in this Annual Report and under a similar heading in any other periodic or current report we may file with the U.S. Securities and Exchange Commission (the “SEC”) in the future. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge quickly and from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business and operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Annual Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement. You should read carefully the factors described in Part I, Item 1A, “Risk Factors” in this Annual Report and under a similar heading in any other periodic or current report we may file with the SEC to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements. You are advised to consult any further disclosures we make on related subjects in our future public filings and on our website.

RISK FACTORS SUMMARY

Our business, financial condition, and operating results may be affected by a number of factors, whether currently known or unknown. Any one or more of such factors could directly or indirectly cause our actual results of operations and financial condition to vary materially from past or anticipated future results of operations and financial condition. Any of these factors, in whole or in part, let alone combined with any of the others, could materially and adversely affect our business, financial condition, results of operations, and stock price. We have provided a summary of some of these risks below, with a more detailed explanation of those and other risks applicable to the Company in Part I, Item 1A. “Risk Factors” in this Annual Report. On September 19, 2023, we announced the Plan of Dissolution and our intent to discontinue all clinical and preclinical development programs and reduce our workforce. In connection with the Plan of Dissolution, effective October 2, 2023, we discontinued all clinical and preclinical development programs and terminated most of our employees, except for certain employees, consultants, and advisors who will supervise or facilitate the dissolution and wind down of the Company. We held special meetings of stockholders on November 16, 2023, November 30, 2023, December 15, 2023, December 27, 2023, and February 15, 2024 (the “Special Meetings”) to seek stockholder approval of the Dissolution and the Plan of Dissolution. However, the Dissolution and Plan of Dissolution did not receive the affirmative vote of a majority of the outstanding shares of our common stock entitled to vote at the Special Meetings, and as a result, we intend to continue to seek approval to dissolve and distribute all remaining cash to stockholders over time. The following risks are related to the Dissolution:

•We cannot assure you as to the timing, amount, or number of distributions, if any, to be made to our stockholders.

•The Board of Directors (“Board”) may determine not to proceed with the Dissolution, or the Company may not obtain the necessary approval to effect the Dissolution.

•Our stockholders may be liable to third parties for part or all of the amount received from us in our liquidating distributions if cash reserves are inadequate.

•Our stockholders of record will not be able to buy or sell shares of our common stock after we close our stock transfer books at the effective time of the Dissolution (the “Effective Time”).

•We plan to initiate steps soon to exit from certain reporting requirements under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which may substantially reduce publicly available information about us. If the exit process is protracted, we will continue to bear the expense of being a public reporting company despite having no source of revenue.

•The loss of key personnel could adversely affect our ability to efficiently dissolve, liquidate, and wind down.

PART I.

ITEM 1. BUSINESS

On September 19, 2023, we announced the Plan of Dissolution and our intent to discontinue all clinical and preclinical development programs and reduce our workforce. Historically, we were a clinical-stage pharmaceutical company striving to transform patient lives through the development of innovative and differentiated prescription therapeutics. Our pipeline aimed to disrupt existing treatment paradigms and featured several new chemical entities that inhibit novel targets with first-in-class potential for autoimmune, inflammatory, and other debilitating diseases.

Our Board and executive management team conducted a comprehensive process to explore and evaluate strategic alternatives with the goal of maximizing stockholder value. Potential alternatives that were under evaluation included, but were not limited to, a financing, a merger or reverse merger, the sale of all or part of the Company, licensing of assets, a business combination, and/or other strategic transactions or series of related transactions involving the Company.

On September 18, 2023, after conducting an extensive, months-long potential strategic alternatives process, including four unsuccessful attempts to find a merger or reverse merger partner due to the potential acquirer’s inability to secure its own necessary financing and/or inability to offer adequate value to consummate the transaction, and combined with the unsuccessful outreach to approximately 125 other possible counterparties and investors who operate or invest in both life sciences and other industry sectors, our Board unanimously approved the Dissolution and the Plan of Dissolution, subject to the approval of our stockholders. In connection with the Plan of Dissolution, effective October 2, 2023, we discontinued all clinical and preclinical development programs and terminated most of our employees, except for certain employees, consultants, and advisors who will supervise or facilitate the dissolution and wind down of the Company.

We held Special Meetings on November 16, 2023, November 30, 2023, December 15, 2023, December 27, 2023, and February 15, 2024 to seek stockholder approval of the Dissolution and the Plan of Dissolution. However, the Dissolution and Plan of Dissolution did not receive the affirmative vote of a majority of the outstanding shares of our common stock entitled to vote at the Special Meetings, and as a result, we intend to continue to seek approval to dissolve and distribute all remaining cash to stockholders over time.

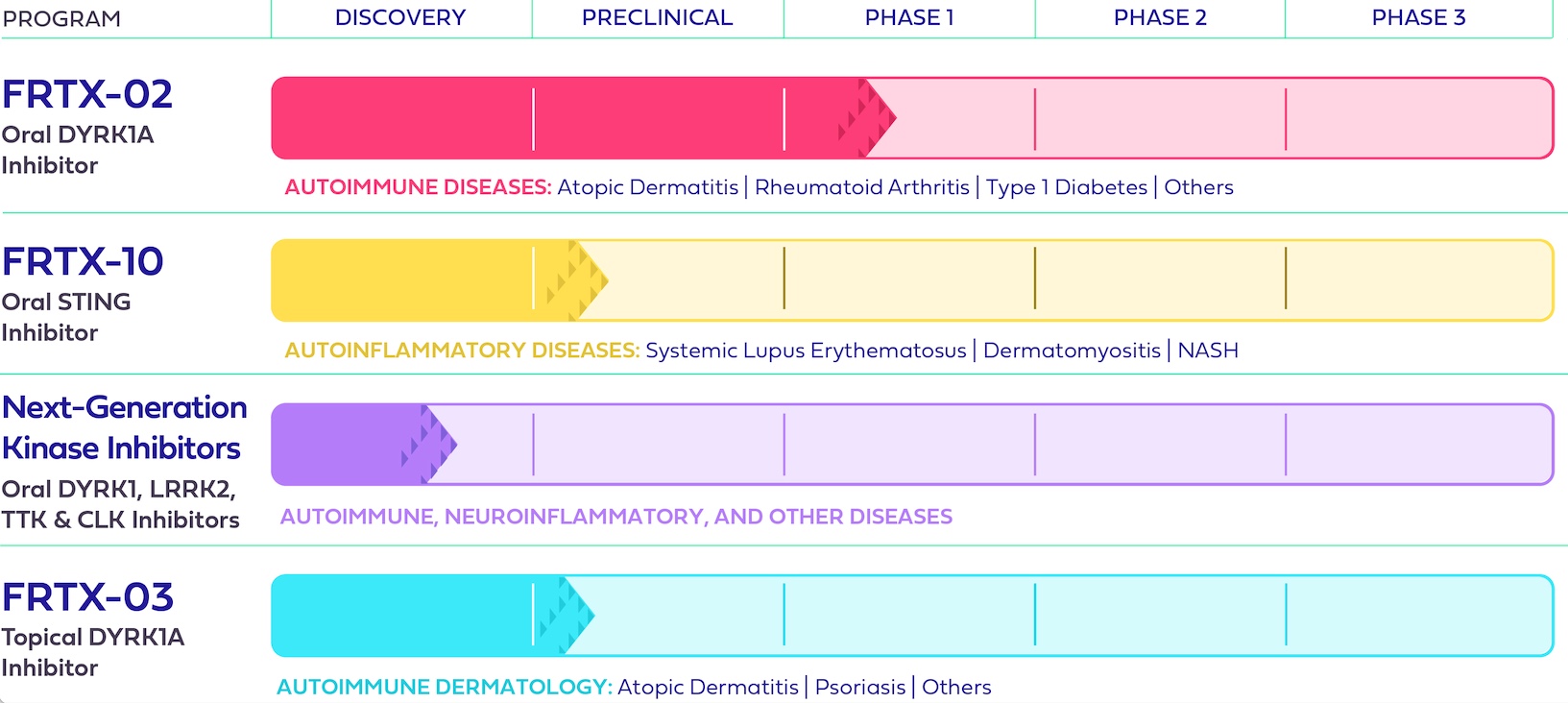

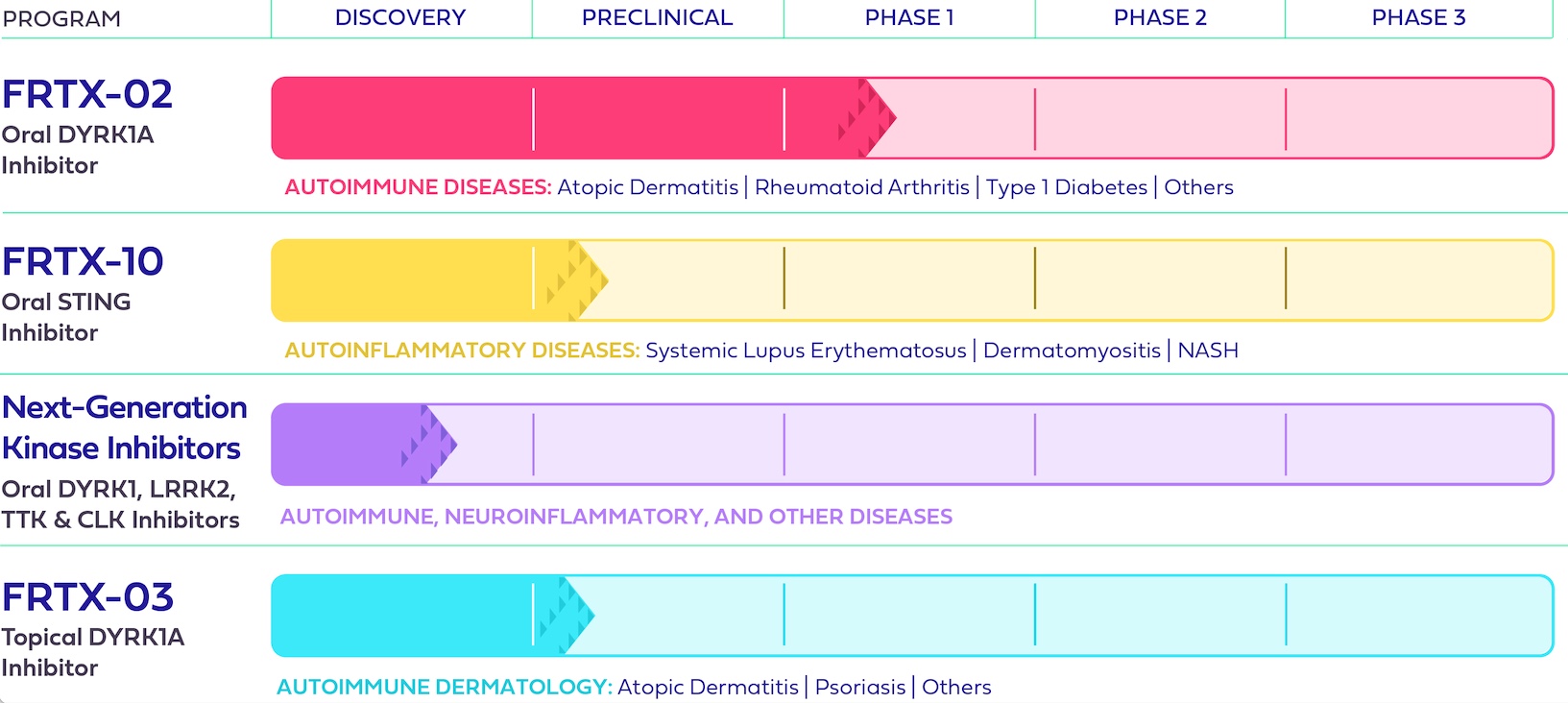

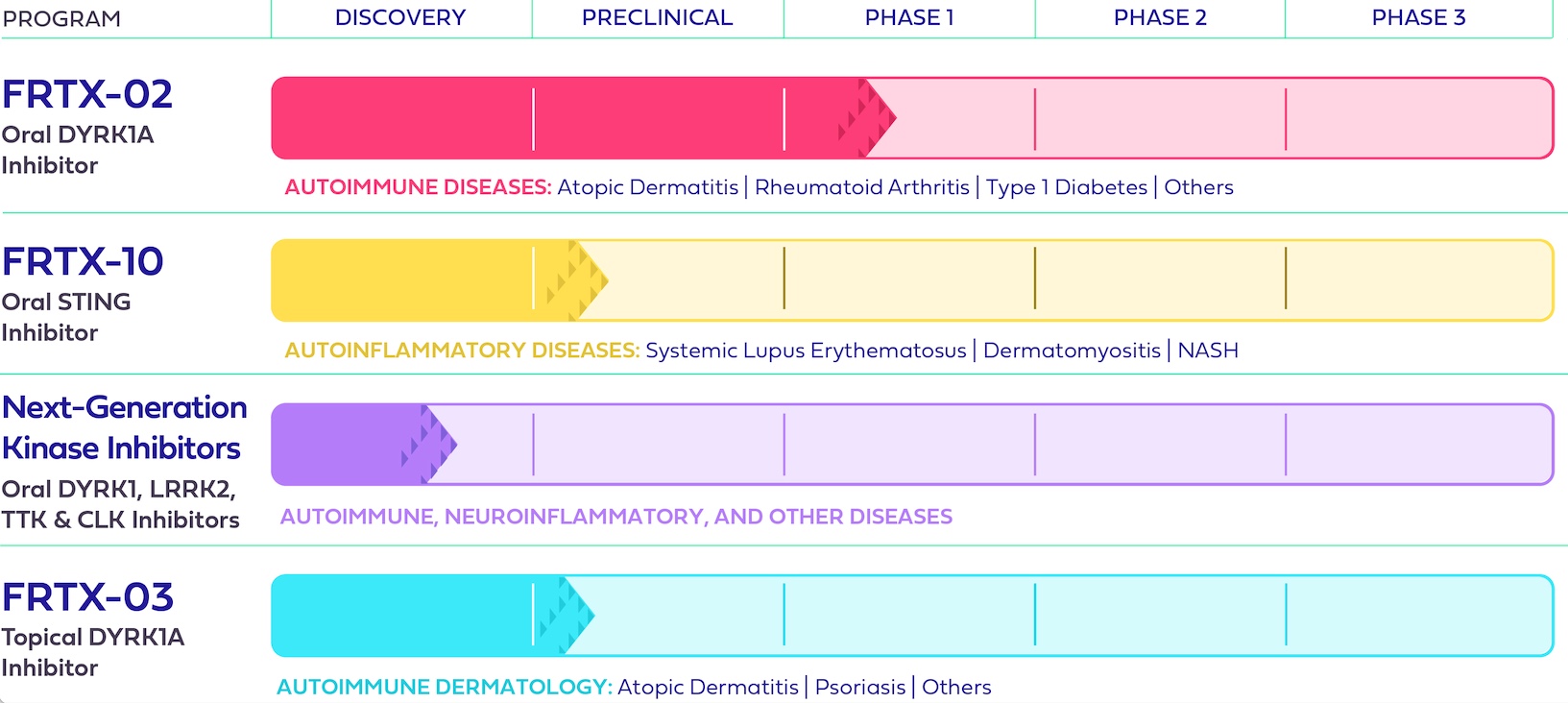

Research and Development Assets

The following image summarizes our current or previous research and development assets, corresponding stage of development, and potential therapeutic areas for each program:

Research & Development Programs

FRTX-02: A Potential First-in-Class Oral DYRK1A Inhibitor for the Treatment of Autoimmune and Inflammatory Diseases

FRTX-02 is a novel, potent, highly selective, and orally bioavailable potential first-in-class, small molecule DYRK1A inhibitor that aims to restore immune balance in patients whose immune systems have become dysregulated. FRTX-02 was our lead development-stage program and has demonstrated promising results in various preclinical and clinical models, including potentially for atopic dermatitis (“AD”) and rheumatoid arthritis.

FRTX-10: A covalent Stimulator of Interferon Genes (STING) inhibitor for the Potential Treatment of Autoimmune, Inflammatory, and Rare Genetic Diseases

FRTX-10 is an early-stage Stimulator of Interferon Genes (“STING”) inhibitor candidate and a novel, potent, and orally bioavailable covalent STING inhibitor that specifically targets the palmitoylation site of STING. STING is a well-known mediator of innate immune responses. Excessive signaling through STING is linked to numerous high unmet-need diseases, ranging from autoimmune disorders, such as systemic lupus erythematosus, to interferonopathies, which are a set of rare genetic conditions characterized by interferon overproduction and could have orphan drug potential. Effective March 1, 2024, the license to develop FRTX-10 was terminated by mutual agreement.

Next-Generation Kinase Inhibitors: A Cutting-Edge Platform with the Potential to Produce Treatments for Autoimmune, Inflammatory, and Other Debilitating Diseases

We have global rights to a cutting-edge platform of next-generation kinase inhibitors. This library of new chemical entities includes next-generation DYRK1 inhibitors, as well as other molecules that specifically inhibit Leucine-Rich Repeat Kinase 2 (“LRRK2”), CDC2-like kinase (“CLK”), and TTK protein kinase (“TTK”), also known as Monopolar spindle 1 (Mps1) kinases. A number of these drug candidates have the potential to penetrate the blood-brain barrier, presenting an opportunity to address neuroinflammatory conditions of high

unmet need, such as Down Syndrome, Alzheimer’s Disease, and Parkinson’s Disease, while other peripherally acting novel LRRK2, TTK, and CLK kinase inhibitors could be developed in additional therapeutic areas within autoimmunity, inflammation, and oncology.

Intellectual Property

Patents extend for varying periods according to the date of patent filing or grant, applicable laws allowing for patent term extension, and the legal term of patents in various countries where patent protection is obtained. The actual protection afforded by a patent can vary from country to country and depends on the type of patent, the scope of its coverage, and the availability of legal remedies in the country.

Under the terms of the Voronoi License Agreement, the Company is responsible for the development and commercialization activities, including the first right to prosecute and maintain patents, related to all the licensed compounds. FRTX-02 is covered by a composition of matter patent issued in the U.S., Japan, China, and other key countries through at least 2038, subject to patent term extensions and adjustments that may be available depending on how this early-stage asset is developed, as well as a pending Patent Cooperation Treaty (“PCT”) application, and other foreign and U.S. applications for FRTX-02, as of the date of this Annual Report. Compounds from the next-generation kinase inhibitor platform are covered by U.S. and foreign composition of matter patent applications, as well as other applications, that are currently pending in global prosecution and being managed directly by our licensor. The Company continues to assess prosecution deadlines for the licensed patents and has so far elected to transfer the prosecution, maintenance, and costs of managing such patents directly to our licensor.

We protect our proprietary information by requiring any of our directors, officers, employees, consultants, contractors, and other advisors to execute nondisclosure and assignment of invention agreements upon commencement of their respective employment or engagement. Agreements with our employees also prevent them from bringing the proprietary rights of third parties to our company without adequate permission to do so. In addition, we require confidentiality or service agreements from third parties that receive our confidential information or materials.

Strategic, Licensing, and Other Arrangements

License and Development Agreement with Voronoi

In August 2021, we entered into a License and Development Agreement (the “Voronoi License Agreement”) with Voronoi Inc. (“Voronoi”), pursuant to which we acquired exclusive, worldwide rights to research, develop, and commercialize FRTX-02 and other next-generation kinase inhibitors.

With respect to FRTX-02, the Voronoi License Agreement provides that we will make payments to Voronoi of up to $211.0 million in the aggregate contingent upon achievement of specified development, regulatory, and commercial milestones. With respect to the compounds arising from the next-generation kinase inhibitor platform, we will make payments to Voronoi of up to $107.5 million in the aggregate contingent upon achievement of specified development, regulatory, and commercial milestones. Further, the Voronoi License Agreement provides that we will pay Voronoi tiered royalty payments ranging from low-single digits up to 10% of net sales of products arising from the DYRK1A inhibitor programs and next-generation kinase inhibitor platform. All of the contingent payments and royalties are payable in cash in U.S. Dollars, except for $1.0 million of the development and regulatory milestone payments, which amount is payable in equivalent shares of our common stock. Under the terms of the Voronoi License Agreement, we are responsible for, and bear the future costs of, all development and commercialization activities, including the first right to prosecute and maintain patents, related to all the licensed compounds. As of December 31, 2023 and through the date of this Annual Report, we have not yet made any payments or recorded any liabilities related to the specified

development, regulatory, and commercial milestones or royalties on net sales pursuant to the Voronoi License Agreement.

The Voronoi License Agreement also provides that upon termination of the Voronoi License Agreement, Voronoi will be entitled to receive a non-exclusive license to any information and know-how independently developed by the Company for FRTX-02 and other licensed assets in consideration for payment(s) at an arms’-length royalty rate on net sales that must be negotiated in good faith between the parties.

Exclusive License and Development Agreement with Carna

In February 2022, we entered into an Exclusive License Agreement (the “Carna License Agreement”) with Carna Biosciences, Inc. (“Carna”), pursuant to which we acquired exclusive, worldwide rights to research, develop, and commercialize Carna’s portfolio of novel STING inhibitors. In accordance with the terms of the Carna License Agreement, in exchange for the licensed rights, we made a one-time cash payment of $2.0 million.

The Carna License Agreement provided that we would make success-based payments to Carna of up to $258.0 million in the aggregate contingent upon achievement of specified development, regulatory, and commercial milestones. Further, the Carna License Agreement provided that we would pay Carna tiered royalty payments ranging from mid-single digits up to 10% of net sales. Under the terms of the Carna License Agreement, we were responsible for all development and commercialization activities, including patenting, related to all the licensed compounds. As of December 31, 2023 and through the date of this Annual Report, we have not made any payments or recorded any liabilities related to the specified development, regulatory, and commercial milestones or royalties on net sales pursuant to the Carna License Agreement.

Effective March 1, 2024, the Carna License Agreement was terminated by mutual agreement.

Agreements with Botanix

Asset Purchase Agreement with Botanix

On May 3, 2022 (the “Effective Date”), we and Brickell Subsidiary, Inc. (“Brickell Subsidiary”) entered into an asset purchase agreement with Botanix SB, Inc. and Botanix Pharmaceuticals Limited (“Botanix”) (the “Asset Purchase Agreement”), pursuant to which Botanix acquired and assumed control of all rights, title, and interests to assets primarily related to the proprietary compound sofpironium bromide that were owned and/or licensed by us or Brickell Subsidiary (the “Assets”). Prior to the sale of the Assets, we had previously entered into a License Agreement with Bodor Laboratories, Inc. (“Bodor”), dated December 15, 2012 (last amended in February 2020) that provided us with a worldwide exclusive license to develop, manufacture, market, sell, and sublicense products containing sofpironium bromide through which the Assets were developed (the “Amended and Restated License Agreement”). As a result of the Asset Purchase Agreement, Botanix became responsible for all further research, development, and commercialization of sofpironium bromide globally and replaced us as the exclusive licensee under the Amended and Restated License Agreement.

In accordance with the sublicense rights provided to us under the Amended and Restated License Agreement, we also had previously entered into a License, Development, and Commercialization Agreement with Kaken Pharmaceutical Co., Ltd. (“Kaken”), dated as of March 31, 2015 (as amended in May 2018, the “Kaken Agreement”), under which we granted to Kaken an exclusive right to develop, manufacture, and commercialize the sofpironium bromide compound in Japan and certain other Asian countries (the “Territory”). In exchange for the sublicense, we were entitled to receive aggregate payments of up to $10.0 million upon the achievement of specified development milestones, which were earned and received in 2017 and 2018, and up to $19.0 million upon the achievement of sales-based milestones, as well as tiered royalties based on a percentage of net sales of licensed products in the Territory. In September 2020, Kaken received regulatory approval in

Japan to manufacture and market sofpironium bromide gel, 5% (“ECCLOCK®”) for the treatment of primary axillary hyperhidrosis, and as a result, we began recognizing royalty revenue earned on a percentage of net sales of ECCLOCK in Japan. Pursuant to the Asset Purchase Agreement, the Kaken Agreement was assigned to Botanix, which replaced us as the exclusive sub-licensor to Kaken.

We determined that the development of and ultimate sale and assignment of rights to the Assets is an output of our ordinary activities and Botanix is a customer as it relates to the sale of the Assets and related activities.

On July 21, 2023, we and Brickell Subsidiary entered into Amendment No. 1 to the Asset Purchase Agreement (the “Asset Purchase Agreement Amendment”) with Botanix. The Asset Purchase Agreement Amendment provided that, in lieu of any remaining amounts potentially payable by Botanix to us pursuant to the Asset Purchase Agreement (collectively, the “Post-Closing Payment Obligations”), Botanix would pay $6.6 million to us and $1.7 million on behalf of us to Bodor. The payments from Botanix to the Company and Bodor were made on July 26, 2023. The Asset Purchase Agreement Amendment also provided that upon payment of the amounts by Botanix thereunder, all Post-Closing Payment Obligations under the Asset Purchase Agreement were terminated and of no further force or effect.

In accordance with the terms of the Asset Purchase Agreement, in exchange for the Assets, we (i) received an upfront payment at closing in the amount of $3.0 million, (ii) were reimbursed for certain recent development expenditures in advancement of the Assets, (iii) received a milestone payment of $2.0 million upon the acceptance by the U.S. Food and Drug Administration (“FDA”) in December 2022 of the filing of a new drug application (“NDA”) for sofpironium bromide gel, 15%, and (iv) would have been eligible to receive, prior to the Asset Purchase Agreement Amendment, a contingent milestone payment of $4.0 million if marketing approval in the U.S. for sofpironium bromide gel, 15%, had been received on or before September 30, 2023, or $2.5 million if such marketing approval had been received after September 30, 2023 but on or before February 17, 2024. Botanix submitted an NDA for sofpironium bromide gel, 15%, to the FDA in September 2022, which was accepted for filing by the FDA in December 2022. Under the Asset Purchase Agreement, we also would have been eligible to receive, prior to the Asset Purchase Agreement Amendment, additional success-based regulatory and sales milestone payments of up to $168.0 million. Further, we would have been eligible to receive, prior to the Asset Purchase Agreement Amendment, tiered earnout payments ranging from high-single digits to mid-teen digits on net sales of sofpironium bromide gel (the “Earnout Payments”).

The Asset Purchase Agreement also provided that Botanix would pay us a portion of the sales-based milestone payments and royalties that Botanix received from Kaken under the assigned Kaken Agreement (together, the “Sublicense Income”). Sublicense Income represented our estimate of payments that would be earned by us in the applicable period from sales-based milestone payments and royalties Botanix would receive from Kaken to the extent it was probable that a significant reversal in the amount of cumulative revenue recognized would not occur. Royalties vary based on net sales that are impacted by a wide variety of market and other factors. We recorded a contract asset equal to the amount of revenue recognized related to the Sublicense Income, less the amount of payments received from or due by Botanix in relation to the Sublicense Income.

All other consideration due under the Asset Purchase Agreement was contingent upon certain regulatory approvals and future sales subsequent to such regulatory approvals, or was based upon future sales that we determined were not yet probable due to such revenues being highly susceptible to factors outside of our influence and uncertainty about the amount of such consideration that would not be resolved for an extended period of time. Therefore, we determined that such variable consideration amounts were fully constrained up through the date of the Asset Purchase Agreement Amendment, and, as such, did not recognize such amounts as contract revenue.

Transition Services Agreement with Botanix

In connection with the sale of the Assets, on the Effective Date, we and Botanix entered into a transition services agreement (the “TSA”) whereby we provide consulting services as an independent contractor to Botanix in support of and through filing and potential approval of the U.S. NDA for sofpironium bromide gel, 15%. In accordance with the terms of the TSA, in exchange for providing these services, (i) prior to the acceptance of the filing by the FDA of such NDA in December 2022, we received from Botanix a fixed monthly amount of $71 thousand, and (ii) after the acceptance of the filing in December 2022, we receive from Botanix, a variable amount based upon actual hours worked, in each case plus related fees and expenses of our advisors (plus a 5% administrative fee) and our out-of-pocket expenses. As of the date of this Annual Report, we do not expect to provide any further services or receive any additional fees related to the TSA.

Contract Revenue under the Botanix Agreements

During the year ended December 31, 2023, we recorded contract revenue of $8.0 million. For additional information regarding contract revenue described above, see Note 3. “Strategic Agreements” of the notes to our consolidated financial statements included in this Annual Report.

Agreements with Bodor

In connection with the sale of the Assets, on the Effective Date, we, Brickell Subsidiary, and Bodor entered into an agreement (the “Rights Agreement”) to clarify that we and Brickell Subsidiary have the power and authority under the Amended and Restated License Agreement to enter into the Asset Purchase Agreement and the TSA, and that Botanix would assume the Amended and Restated License Agreement pursuant to the Asset Purchase Agreement. The Rights Agreement included a general release of claims and no admission of liability between the parties. Pursuant to such Rights Agreement, as subsequently amended on November 10, 2022, we agreed to pay Bodor (i) 20% of the amount of each payment due to us from Botanix for upfront and milestone payments, subject to deductions, credits, or offsets applied under the Asset Purchase Agreement, as well as (ii) certain tiered payments, set as a percentage ranging from mid-single digits to mid-teen digits, of the amount of each of the applicable Earnout Payments due to us from Botanix after deductions, credits, or offsets applied under the Asset Purchase Agreement.

Pursuant to the terms of the Asset Purchase Agreement, we retained our obligation under the Amended and Restated License Agreement to issue $1.0 million in shares of our common stock to Bodor upon the FDA’s acceptance of an NDA filing for sofpironium bromide gel, 15%. On November 10, 2022, we entered into an Acknowledgment and Agreement Related to Asset Purchase Agreement and Amended and Restated License Agreement (the “Acknowledgment”) with Brickell Subsidiary, Botanix, and Bodor. Pursuant to the Acknowledgment, we paid $1.0 million in cash to Bodor in full satisfaction of our obligation to issue shares upon the FDA’s acceptance of the NDA. We determined to prepay this obligation in cash in order to avoid the substantial dilution to our stockholders that would have resulted if we had issued the shares of our common stock originally provided for in the Amended and Restated License Agreement.

In connection with the Asset Purchase Agreement Amendment, on July 21, 2023, we, Brickell Subsidiary, and Bodor entered into a Second Amendment to Rights Agreement (the “RA Amendment”). The RA Amendment provides that in exchange for the one-time payment of $1.7 million by Botanix on behalf of us to Bodor, we shall have no further payment obligations to Bodor under or in connection with the Rights Agreement or the Amended and Restated License Agreement. Except as explicitly amended by the RA Amendment, the Rights Agreement remains in full force and effect.

During the year ended December 31, 2023, we incurred $1.7 million of general and administrative expenses associated with payments due to Bodor. For additional information regarding obligations due to Bodor

described above, see Note 3. “Strategic Agreements” of the notes to our consolidated financial statements included in this Annual Report.

Manufacturing and Supply

Because we discontinued all clinical and preclinical development programs in October 2023, we currently do not have any contracts with third parties for the manufacture of drug substances and drug products for use in nonclinical and clinical studies.

Government Regulation

Although our operations are currently focused on winding down our operations in connection with our anticipated Dissolution, we remain subject to numerous federal, state and local laws and regulations, including securities, tax, anti-bribery and privacy laws and regulations.

Employees

As of December 31, 2023, we had four full-time employees. In October 2023, we discontinued all clinical and preclinical development programs and terminated most of our employees, except for certain employees, consultants, and advisors who will supervise or facilitate the dissolution and wind down of the Company.

Corporate History

Vical Incorporated (“Vical”) was incorporated in Delaware in 1987. On August 31, 2019, the Delaware corporation formerly known as “Vical Incorporated” completed a reverse merger transaction in accordance with the terms and conditions of the Agreement and Plan of Merger and Reorganization, dated June 2, 2019, as further amended on August 20, 2019 and August 30, 2019, by and among Vical, Brickell Biotech, Inc. (“Private Brickell”) and Victory Subsidiary, Inc. (“Merger Sub”), pursuant to which Merger Sub merged with and into Private Brickell, with Private Brickell surviving the merger as a wholly-owned subsidiary of Vical (the “Merger”). Additionally, on August 31, 2019, immediately after the completion of the Merger, the Company changed its name from “Vical Incorporated” to “Brickell Biotech, Inc.” On September 7, 2022, Brickell Biotech, Inc.’s name was changed to Fresh Tracks Therapeutics, Inc.

Corporate Information

Our corporate headquarters are in Boulder, Colorado, where we maintain our corporate offices at 2000 Central Avenue, Suite 100, Boulder, CO 80301 under a virtual office lease. We lease our corporate office premises under a monthly rental agreement at a nominal cost. We consider our current office space adequate for our current operations.

This Annual Report contains references to our trademarks and trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this Annual Report, including logos, artwork, and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

ITEM 1A. RISK FACTORS

Our business, financial condition, and operating results may be affected by a number of factors, whether currently known or unknown, including but not limited to those described below. Any one or more of such factors could directly or indirectly cause our actual results of operations and financial condition to vary

materially from past or anticipated future results of operations and financial condition. Any of these factors, in whole or in part, alone or combined with any of the other factors, could materially and adversely affect our business, financial condition, results of operations, and stock price. The following information should be read in conjunction with Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes in Part II, Item 8, “Financial Statements and Supplementary Data” of this Annual Report.

Risks Related to the Dissolution

We cannot predict the timing of the distributions, if any, to stockholders.

We held Special Meetings on November 16, 2023, November 30, 2023, December 15, 2023, December 27, 2023, and February 15, 2024 to seek stockholder approval of the Dissolution and the Plan of Dissolution. However, the Dissolution and Plan of Dissolution did not receive the affirmative vote of a majority of the outstanding shares of our common stock entitled to vote at the Special Meetings, and as a result, we intend to continue to seek approval to dissolve and distribute all remaining cash to stockholders over time. The Board retains the discretion to determine not to proceed with the Dissolution in its sole discretion and, if it does proceed with the Dissolution, would have discretion as to the timing of the filing of the Certificate of Dissolution. However, if the Board determines that the Dissolution is not in our best interest or in the best interest of our stockholders, the Board may, in its sole discretion, abandon the Dissolution or may amend or modify the Plan of Dissolution to the extent permitted by the Delaware General Corporation Law (the “DGCL”) without the necessity of stockholder approval. After the Certificate of Dissolution has been filed, revocation of the Dissolution would require stockholder approval under the DGCL.

Under Delaware law, utilizing the procedures of Section 281(b) of the DGCL (which is contemplated by the Plan of Dissolution unless otherwise determined by the Board), before a dissolved corporation may make any distribution to its stockholders, it must: (i) pay or make reasonable provision to pay all of its claims and obligations, including all contingent, conditional or unmatured contractual claims known to the corporation, (ii) make such provision as will be reasonably likely to be sufficient to provide compensation for any claim against it which is the subject of a pending action, suit or proceeding to which it is a party, and (iii) make such provision as will be reasonably likely to be sufficient to provide compensation for claims that have not been made known to the corporation or that have not arisen but that, based on facts known to the corporation, are likely to arise or to become known to the corporation within ten years after the date it dissolves. Among other things, our potential liabilities that may require provision could include those relating to indemnification obligations, if any, to third parties or to our current and former officers and directors, and to resolve any stockholder or other litigation that may emerge. It might take significant time to resolve these matters, and as a result we are unable to predict the timing, amount, or number of distributions, if any are made, to our stockholders.

We cannot assure you as to the timing, amount, or number of distributions, if any, to be made to our stockholders.

We cannot predict with certainty the timing, amount, or number of distributions, if any, to our stockholders. Any such amounts may be paid in one or more distributions over a period of several years. Any such distributions will not occur until after the Certificate of Dissolution is filed, and we cannot predict the timing, amount, or number of any such distributions, or whether any such distributions will occur, as uncertainties as to the ultimate amount and scope of our liabilities, the operating costs and amounts to be set aside for claims, obligations, and provisions during the liquidation and winding-up process, and the related timing to complete such transactions, make it impossible to predict with certainty the actual net cash amount, if any, that will ultimately be available for distribution to stockholders or the timing of any such distributions. Examples of uncertainties that could reduce the value of distributions to our stockholders include: the incurrence by the Company of expenses relating to the Dissolution being different than estimated; the receipt of no, or lower than

expected, proceeds in the course of our efforts to monetize our remaining assets and intellectual property; unanticipated costs relating to the defense, satisfaction or settlement of lawsuits or other claims that may be threatened against us or our current or former directors or officers; amounts necessary to resolve claims of any creditors or other third parties; and delays in the Dissolution or other winding-up process.

In addition, as we wind down, we will continue to incur expenses from operations, including directors’ and officers’ insurance, severance payments, payments to service providers and any continuing employees or consultants, taxes, legal, accounting and consulting fees, costs associated with patent prosecution and transitioning this responsibility back to our licensors, expenses related to our filing obligations with the SEC and/or others, and costs associated with continuing to seek approval to dissolve, which will reduce any amounts available for distribution to our stockholders. As a result, we cannot assure you as to any amounts, if any, to be distributed to our stockholders if the Board proceeds with the Dissolution. Because our stockholders did not approve the Dissolution and the Plan of Dissolution, we are not currently able to proceed with the Dissolution and no liquidating distributions will be made in connection therewith, until and unless the Company is able to obtain stockholder or judicial approval to dissolve the Company.

It is the current intent of the Board, assuming approval of the Dissolution, that any cash will first be used to pay our outstanding current liabilities and obligations, and then will be retained to pay ongoing corporate and administrative costs and expenses associated with winding down the Company, liabilities and potential liabilities relating to or arising out of any litigation matters and potential liabilities relating to our indemnification obligations, if any, to our service providers, or to our current and former officers and directors, before such cash, if any remains, will be available for distribution to stockholders.

The Board will determine, in its sole discretion, the timing and number of the distributions of the remaining amounts, if any, to our stockholders in the Dissolution. We can provide no assurance as to if or when any such distributions will be made, and we cannot provide any assurance as to the amount to be paid to stockholders in any such distributions, if any are to be made. Stockholders may receive substantially less than the amount that we currently estimate that they may receive, or they may receive no distribution at all.

The Board may determine not to proceed with the Dissolution.

The Board may determine in its sole discretion not to proceed with the Dissolution, especially if some other alternative emerges, which we do not expect, that would provide greater value to the stockholders than Dissolution and the Plan of Dissolution. If our Board elects to pursue any alternative to the Plan of Dissolution, our stockholders may not receive any of the funds that might otherwise have been available now or in the future for distribution to our stockholders. After the Certificate of Dissolution has been filed, revocation of the Dissolution would require stockholder approval under the DGCL.

Our stockholders may be liable to third parties for part or all of the amount received from us in our liquidating distributions if cash reserves are inadequate.

If the Dissolution becomes effective, we are required to establish a cash reserve designed to satisfy any additional claims and obligations that may arise. Any reserve may not be adequate to cover all of our claims and obligations. Under the DGCL, if we fail to create an adequate reserve for payment of our expenses, claims, and obligations, each stockholder could be held liable for payment to our creditors for claims brought prior to or after the Effective Time (or such longer period as the Delaware Court of Chancery may direct) (the “Survival Period”) (or, if we choose the Safe Harbor Procedures under DGCL Section 280 and 281(a), for claims brought prior to the expiration of the Survival Period), up to the lesser of (i) such stockholder’s pro rata share of amounts owed to creditors in excess of the reserve and (ii) the amounts previously received by such stockholder in the Dissolution from us and from any liquidating trust or trusts. Accordingly, in such event, a stockholder could be required to return part or all of the distributions previously made to such stockholder, and a stockholder could ultimately receive nothing from us under the Plan of Dissolution. Moreover, if a stockholder

has paid taxes on amounts previously received, a repayment of all or a portion of such amount could result in a situation in which a stockholder may incur a net tax cost if the repayment of the amount previously distributed does not cause a commensurate reduction in taxes payable in an amount equal to the amount of the taxes paid on amounts previously distributed.

Our stockholders of record will not be able to buy or sell shares of our common stock after we close our stock transfer books at the Effective Time of the Dissolution.

If the Board determines to proceed with the Dissolution, we intend to close our stock transfer books and discontinue recording transfers of our common stock at the Effective Time of the Dissolution. After we close our stock transfer books, we will not record any further transfers of our common stock on our books except at our sole discretion by will, intestate succession, or operation of law. Therefore, shares of our common stock will not be freely transferable after the Effective Time. As a result of the closing of the stock transfer books, all liquidating distributions in the Dissolution will likely be made to the same stockholders of record as the stockholders of record as of the Effective Time.

We plan to initiate steps to exit from certain reporting requirements under the Exchange Act, which may substantially reduce publicly available information about us. If the exit process is protracted, we will continue to bear the expense of being a public reporting company despite having no source of revenue.

Our common stock is currently registered under the Exchange Act, which requires that we, and our officers and director with respect to Section 16 of the Exchange Act, comply with certain public reporting and proxy statement requirements thereunder. Compliance with these requirements is costly and time-consuming. We plan to initiate steps to exit from such reporting requirements in order to curtail expenses; however, such process may be protracted and we may be required to file Current Reports on Form 8-K or other reports to disclose material events, including those related to the Dissolution. Accordingly, we will continue to incur expenses that will reduce any amount available for distribution, including expenses of complying with public company reporting requirements and paying our service providers, among others. If our reporting obligations cease, publicly available information about us will be substantially reduced.

The loss of key personnel could adversely affect our ability to efficiently dissolve, liquidate, and wind down.

We intend to rely on a few individuals in key management roles and as contractor support to dissolve, liquidate our remaining assets, and wind-down operations, which will continue for at least three years during the Survival Period. Loss of one or more of these key individuals, or inability to contract with essential personnel, could hamper the efficiency or effectiveness of these processes.

We may not be able to find a purchaser for our remaining non-cash assets during the Dissolution.

We own several non-cash assets, including but not limited to preclinical and clinical data packages that we generated in developing FRTX-02 and other product candidates. We may try to find a buyer for these assets but there may be no buyers forthcoming or the offers for the assets may not be adequate. As such there may be no opportunity for any additional distribution to stockholders for these retained assets including during the Survival Period or thereafter.

Stockholders may not be able to recognize a loss for U.S. federal income tax purposes until they receive a final distribution from us.

As a result of the Dissolution, for U.S. federal income tax purposes, a stockholder that is a U.S. person generally will recognize gain or loss on a share-by-share basis equal to the difference between (1) the sum of the amount of cash and the fair market value of property, if any, distributed to the stockholder with respect to each share, less any known liabilities assumed by the stockholder or to which the distributed property (if any) is subject,

and (2) the stockholder’s adjusted tax basis in each share of our common stock. A liquidating distribution pursuant to the Plan of Dissolution may occur at various times and in more than one tax year. Any loss generally will be recognized by a stockholder only in the tax year in which the stockholder receives our final liquidating distribution, and then only if the aggregate value of all liquidating distributions with respect to a share of our common stock is less than the stockholder’s tax basis for that share. Stockholders are urged to consult with their own tax advisors as to the specific tax consequences to them of the Dissolution pursuant to the Plan of Dissolution.

The tax treatment of any liquidating distribution may vary from stockholder to stockholder, and the discussions in this proxy statement regarding tax consequences are general in nature.

We have not requested a ruling from the Internal Revenue Service with respect to the anticipated tax consequences of the Dissolution, and we will not seek an opinion of counsel with respect to the anticipated tax consequences of any liquidating distributions. If any of the anticipated tax consequences described in this Annual Report prove to be incorrect, the result could be increased taxation at the corporate or stockholder level, thus reducing the benefit to our stockholders and/or us from the Dissolution. Tax considerations applicable to particular stockholders may vary with and be contingent on the stockholder’s individual circumstances.

Risks Related to Our Liquidity, Financial Matters, and Our Common Stock

We are currently operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by geopolitical conflict in and around Ukraine, Israel, the broader Middle East, and other areas of the world. Our business, financial condition, and results of operations may be materially adversely affected by the negative impact on the global economy and capital markets resulting from these geopolitical conflicts or other geopolitical tensions.

U.S. and global markets are experiencing volatility and disruption following the escalation of geopolitical tensions and conflict in and around Ukraine, Israel, the broader Middle East, and other areas of the world. Although the length and impact of ongoing military conflicts are highly unpredictable, these conflicts have led to market disruptions, including significant volatility in commodity prices, credit and capital markets, as well as supply chain disruptions. Russian military actions and the resulting sanctions could further adversely affect the global economy and financial markets and lead to instability and lack of liquidity in capital markets.

The extent and duration of the military action, sanctions, and resulting market disruptions are impossible to predict, but could be substantial. Any such disruptions may also magnify the impact of other risks described in this Annual Report.

Our operating results and liquidity needs could be affected negatively by global market fluctuations and economic downturns.

Our operating results and liquidity could be affected negatively by global economic conditions generally, both in the U.S. and elsewhere around the world, including but not limited to that related to geopolitical conflict in and around Ukraine, Israel, the broader Middle East, and other areas of the world, global IT threats, and elevated interest rates. Domestic and international equity and debt markets are experiencing and may in the future experience heightened volatility and turmoil based on domestic and international economic conditions and concerns. In the event these economic conditions and concerns continue or worsen and the markets remain volatile, or an economic recession occurs, our operating results and liquidity could be affected adversely in many ways, making it more difficult for us to operate, and our stock price may decline.

Our stock price and volume of shares traded have been and may continue to be highly volatile, and our common stock may continue to be illiquid.

The market price of our common stock has been subject to significant fluctuations. Market prices for securities of biotechnology and other life sciences companies historically have been particularly volatile and subject to large daily price swings. In addition, there has been limited liquidity in the trading market for our securities, which may adversely affect stockholders. Some of the factors that may cause the market price of our common stock to continue to fluctuate include, but are not limited to:

•the payment of any distribution to stockholders as part of the Dissolution while our outstanding common stock continues to be listed on the OTC Pink market;

•material developments in, or the conclusion of, any litigation to enforce or defend any intellectual property rights or defend against the intellectual property rights of others; and

•the entry into, or termination of, or breach by us or our partners of material agreements, including key commercial partner or licensing agreements.

Moreover, the stock markets in general have experienced substantial volatility in our industry, especially for microcap biotechnology companies, and such volatility has often been unrelated to the operating performance of individual companies or a certain industry segment, such as the ongoing reaction of global markets to geopolitical conflicts and other economic disruptions or concerns, including inflation and interest rate increases. These broad market fluctuations may also adversely affect the trading price of our common stock.

In the past, following periods of volatility in the market price of a company’s securities, stockholders have often instituted class action securities litigation against those companies. Such litigation, if instituted, could result in substantial costs and diversion of management attention and resources, which could significantly harm our reputation and could expose us to liability or negatively impact our business, financial condition, and operating results.

We are a “smaller reporting company” and the reduced disclosure and governance requirements applicable to smaller reporting companies may make our common stock less attractive to some investors.

We qualify as a “smaller reporting company” under Rule 12b-2 of the Exchange Act. As a smaller reporting company, we are entitled to rely on certain exemptions and reduced disclosure requirements, such as simplified executive compensation disclosures and reduced financial statement disclosure requirements, in our SEC filings. These exemptions and decreased disclosures in our SEC filings due to our status as a smaller reporting company may make it harder for investors to analyze our results of operations and financial prospects. We cannot predict if investors will find our common stock less attractive because we rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our common stock price may be more volatile.

We do not anticipate paying any dividends in the foreseeable future.

Our current expectation is that we will retain any future earnings to maximize intended distributions of all remaining cash to stockholders, pending stockholder or judicial approval of the Dissolution and the Plan of Dissolution.

Our ability to use our net operating loss carryforwards and other tax assets to offset future taxable income may be subject to certain limitations.

As of December 31, 2023, we had approximately $432.7 million of federal and $452.3 million of state net operating loss (“NOL”) carryforwards available to offset any future taxable income, of which $217.4 million will carryforward indefinitely and the remainder will expire in varying amounts beginning in 2024 for federal and state purposes if unused. Utilization of these NOLs depends on many factors, including our future income, which cannot be assured. Under the U.S. Tax Cuts and Jobs Acts, U.S. federal NOLs incurred in 2018 and later years may be carried forward indefinitely, but our ability to utilize such U.S. federal NOLs to offset taxable income is limited to 80% of the current-year taxable income. In addition, under Sections 382 and 383 of the Internal Revenue Code of 1986 and corresponding provisions of state law, if a corporation undergoes an “ownership change” (which is generally defined as a greater than 50 percentage points change (by value) in its equity ownership over a rolling three-year period), the corporation’s ability to use its pre-change NOL carryforwards and other pre-change tax attributes to offset its post-change income or taxes may be limited. We have not determined whether we have experienced Section 382 ownership changes in the past and if a portion of our NOLs is therefore subject to an annual limitation under Section 382. Therefore, we cannot provide any assurance that a change in ownership within the meaning of the Internal Revenue Code of 1986 and corresponding provisions of state law has not occurred in the past, and there is a risk that changes in ownership could have occurred. We may experience ownership changes as a result of subsequent changes in our stock ownership, which may be outside of our control. In that case, the ability to use NOL carryforwards to offset any future taxable income will be limited following any such ownership change and could be eliminated. If eliminated, the related asset would be removed from the deferred tax asset schedule with a corresponding reduction in the valuation allowance on our financial statements.

Risks Related to Legal, Regulatory, and Compliance Matters

Our business and operations would suffer in the event of system failures, illegal stock trading or manipulation by external parties, cyber-attacks, or a deficiency in or exploitation of our cyber-security.

We rely on cloud-based software to provide the functionality necessary to operate our company, utilizing what is known as “software as a service” (“SaaS”). SaaS allows users like us to connect to and use cloud-based applications over the Internet, such as email, calendaring, and office tools. SaaS provides us with a complete software solution that we purchase on a subscription basis from a cloud service provider. Despite our efforts to protect confidential and sensitive information from unauthorized disclosure across all our platforms, and similar efforts by our cloud service provider(s) and our other third-party contractors, consultants, and vendors, whether information technology (“IT”) providers or otherwise, including but not limited to law firms accountants, and government regulators, this information, and the systems used to store and transmit it, are vulnerable to damage from computer viruses, unauthorized access, computer hacking or breaches, natural disasters, epidemics and pandemics, terrorism, war, labor unrest, and telecommunication and electrical failures. The risk of a security breach or disruption, particularly through cyber-attacks or cyber-intrusion, or other illegal acts, including by computer hackers, foreign governments, and cyber-terrorists, has generally increased as the number, intensity, and sophistication of attempted attacks and intrusions from around the world have increased. Other emerging threats we face include: phishing, account takeover attacks, data breach or theft (no matter where the data are stored), loss of control, especially in SaaS applications, over which users have access to what data and level of access, new malware, zero-day threats, and threats within our own organization. In addition, malicious cyber actors may increase malware and ransom campaigns and phishing emails targeting teleworkers as well as company systems, global conflicts like with Ukraine, Israel, and the broader Middle East, or other world trends and events, which exposes us to additional cybersecurity risks, or may try to illegally obtain material inside information to manipulate our stock price. If such an event were to occur and cause interruptions in our operations, or substantial manipulation of our stock price, it could result in a material disruption of our business operations. In addition, since we have sponsored clinical trials, any breach that compromises patient data and identities, thereby causing a breach of privacy, could generate significant reputational damage and legal

liabilities and costs to recover and repair. For example, the loss or theft of clinical trial data from completed clinical trials could result in stock manipulation and significantly increase our costs to recover or reproduce the data. To the extent that any disruption or security breach were to result in a loss of, or damage to, our data or applications or inappropriate disclosure of confidential or proprietary information, we could incur liability or suffer from stock price volatility or decline.

We may face product liability exposure, and if successful claims are brought against us, we may incur substantial liability if our insurance coverage for those claims is inadequate.

We face an inherent risk of product liability or similar causes of action as a result of the clinical testing (and use) of our product candidates or product candidates we have previously sub-licensed, sold, and/or assigned. This risk exists even if a product is manufactured in facilities licensed and regulated by the FDA or an applicable foreign regulatory authority. Our products and product candidates, past and present, are designed to affect important bodily functions and processes. Any side effects, manufacturing defects, misuse, or abuse associated with our product candidates could result in actual or perceived injury to a patient that may or may not be reversible or potentially even cause death. We cannot offer any assurance that we will not face product liability or other similar suits in the future or that we will be successful in defending them, nor can we assure that our insurance coverage will be sufficient to cover our liability under any such cases.

In addition, a liability claim may be brought against us even if our product candidates merely appear to have caused an injury. If we cannot successfully defend against product liability or similar claims, we will incur substantial liabilities, reputational harm, and possibly injunctions and punitive actions. In addition, regardless of merit or eventual outcome, product liability claims may result in:

•impairment of our business reputation;

•substantial costs of any related litigation or similar disputes;

•distraction of management’s attention and other resources; or

•substantial monetary awards to patients or other claimants against us that may not be covered by insurance.

Large judgments have been awarded in class action or individual lawsuits based on drugs that had unanticipated side effects. Our insurance coverage may not be sufficient to cover all of our product liability-related expenses or losses and may not cover us for any expenses or losses we may suffer. Moreover, insurance coverage is becoming increasingly expensive, restrictive, and narrow, and, in the future, we may not be able to maintain adequate insurance coverage at a reasonable cost, or through self-insurance, in sufficient amounts or upon adequate terms to protect us against losses due to product liability or other similar legal actions. A successful product liability claim or series of claims brought against us could, if judgments exceed our insurance coverage, decrease our cash, expose us to liability and harm our business, financial condition, and operating results and lessen the amount, timing, and number of any distributions to stockholder pursuant to the Plan of Dissolution.

We are and may be subject to strict healthcare laws, regulation, and enforcement, and our failure to comply with those laws could expose us to liability or adversely affect our business, financial condition, and operating results.

Certain federal and state healthcare laws and regulations pertaining to patients’ rights and privacy, as well as other rights and obligations, are and may be applicable to our business. We are subject to regulation by the federal government and the states where we or our partners conduct business. The healthcare laws and regulations that may affect our ability to operate include: the Federal Food, Drug and Cosmetic Act, as amended; Title 21 of the Code of Federal Regulations Part 202 (21 CFR Part 202); and civil monetary penalty

laws; federal and state disclosure laws; the Foreign Corrupt Practices Act as it applies to activities both inside and outside of the U.S.; and state law equivalents of many of the above federal laws.

Because of the breadth of these laws and the narrowness of the statutory exceptions and safe harbors available, it is possible that some of our business activities could be subject to challenge under one or more of such laws. In addition, healthcare reform legislation has strengthened these laws.