0000819050Q1FALSE202312/31.022200008190502023-01-012023-03-3100008190502023-05-04xbrli:shares00008190502023-03-31iso4217:USD00008190502022-12-31iso4217:USDxbrli:shares0000819050us-gaap:ProductAndServiceOtherMember2023-01-012023-03-310000819050us-gaap:ProductAndServiceOtherMember2022-01-012022-03-310000819050us-gaap:RoyaltyMember2023-01-012023-03-310000819050us-gaap:RoyaltyMember2022-01-012022-03-3100008190502022-01-012022-03-310000819050us-gaap:CommonStockMember2021-12-310000819050us-gaap:AdditionalPaidInCapitalMember2021-12-310000819050us-gaap:RetainedEarningsMember2021-12-3100008190502021-12-310000819050us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310000819050us-gaap:RetainedEarningsMember2022-01-012022-03-310000819050us-gaap:CommonStockMember2022-03-310000819050us-gaap:AdditionalPaidInCapitalMember2022-03-310000819050us-gaap:RetainedEarningsMember2022-03-3100008190502022-03-310000819050us-gaap:CommonStockMember2022-12-310000819050us-gaap:AdditionalPaidInCapitalMember2022-12-310000819050us-gaap:RetainedEarningsMember2022-12-310000819050us-gaap:CommonStockMember2023-01-012023-03-310000819050us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000819050us-gaap:RetainedEarningsMember2023-01-012023-03-310000819050us-gaap:CommonStockMember2023-03-310000819050us-gaap:AdditionalPaidInCapitalMember2023-03-310000819050us-gaap:RetainedEarningsMember2023-03-3100008190502022-07-052022-07-05xbrli:purefrtx:segment0000819050us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310000819050us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000819050us-gaap:WarrantMember2023-01-012023-03-310000819050us-gaap:WarrantMember2022-01-012022-03-310000819050us-gaap:EmployeeStockOptionMember2023-01-012023-03-310000819050us-gaap:EmployeeStockOptionMember2022-01-012022-03-310000819050us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310000819050us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-03-310000819050frtx:VoronoiIncMember2021-08-272021-08-2700008190502021-08-272021-08-270000819050frtx:CarnaBiosciencesIncMember2022-02-020000819050srt:MaximumMemberfrtx:MilestonePaymentsMemberfrtx:KakenMember2022-05-030000819050srt:MaximumMemberus-gaap:RoyaltyMemberfrtx:KakenMember2022-05-030000819050frtx:BotanixMemberus-gaap:CollaborativeArrangementMemberus-gaap:RoyaltyMember2022-01-012022-03-310000819050frtx:BotanixMember2022-05-030000819050frtx:BotanixMemberfrtx:MilestonePaymentsMember2022-05-030000819050frtx:BotanixMembersrt:MaximumMemberfrtx:MilestonePaymentsMemberfrtx:PaymentCriteriaOneMember2022-05-030000819050frtx:BotanixMemberfrtx:PaymentCriteriaTwoMemberfrtx:MilestonePaymentsMember2022-05-030000819050frtx:BotanixMemberfrtx:PaymentCriteriaThreeMember2022-05-030000819050frtx:BotanixMemberfrtx:ConsultingServicesMember2022-05-032022-05-030000819050frtx:BotanixMember2022-05-032022-05-030000819050frtx:BotanixMember2023-01-012023-03-310000819050frtx:BotanixMember2022-12-310000819050frtx:BotanixMember2023-03-310000819050frtx:BodorLaboratoriesInc.Member2022-05-032022-05-0300008190502022-11-102022-11-100000819050frtx:BodorLaboratoriesInc.Member2022-01-012022-03-310000819050frtx:BodorLaboratoriesInc.Member2023-01-012023-03-31frtx:vote0000819050us-gaap:WarrantMember2023-03-310000819050frtx:SharebasedPaymentArrangementOptionOutstandingMember2023-03-310000819050us-gaap:RestrictedStockUnitsRSUMember2023-03-310000819050us-gaap:EmployeeStockMember2023-03-310000819050frtx:A2020OmnibusPlanMemberus-gaap:EmployeeStockOptionMember2023-03-310000819050us-gaap:CommonStockMemberfrtx:October2020OfferingMember2020-10-012020-10-310000819050frtx:CommonStockWarrantsMemberfrtx:October2020OfferingMember2020-10-310000819050frtx:October2020OfferingMember2020-10-310000819050frtx:CommonStockWarrantsMember2022-03-3100008190502020-10-012020-10-310000819050frtx:CommonStockPublicOfferingMember2020-09-300000819050frtx:CommonStockPublicOfferingMemberfrtx:PreFundedWarrantMember2020-09-300000819050frtx:CommonStockPublicOfferingMemberfrtx:AccompanyingCommonWarrantMember2020-09-300000819050frtx:CommonStockPublicOfferingMember2020-06-012020-06-300000819050frtx:A2021AtMarketIssuanceSalesAgreementMember2021-03-310000819050frtx:A2021AtMarketIssuanceSalesAgreementMember2023-01-012023-03-310000819050frtx:A2021AtMarketIssuanceSalesAgreementMember2022-01-012022-03-310000819050frtx:A2021AtMarketIssuanceSalesAgreementMember2023-03-310000819050frtx:A2020AtMarketIssuanceSalesAgreementMember2020-04-300000819050frtx:A2020AtMarketIssuanceSalesAgreementScenario2Member2023-03-310000819050frtx:A2020AtMarketIssuanceSalesAgreementMember2023-01-012023-03-310000819050frtx:A2020AtMarketIssuanceSalesAgreementMember2022-01-012022-03-310000819050frtx:PrivatePlacementOfferingsMember2020-02-290000819050frtx:PrivatePlacementOfferingsMemberus-gaap:SeriesAMember2020-02-290000819050us-gaap:SeriesBMemberfrtx:PrivatePlacementOfferingsMember2020-02-290000819050frtx:PurchaseAgreementMemberfrtx:LincolnParkMember2020-02-290000819050frtx:PurchaseAgreementMemberfrtx:LincolnParkMember2020-02-012020-02-290000819050frtx:LincolnParkMemberfrtx:RegularPurchaseMember2020-02-012020-02-290000819050frtx:LincolnParkMemberfrtx:RegularPurchaseMember2020-02-290000819050frtx:LincolnParkMember2020-02-012020-02-290000819050frtx:PurchaseAgreementMemberfrtx:LincolnParkMember2023-01-012023-03-310000819050frtx:PurchaseAgreementMemberfrtx:LincolnParkMember2022-01-012022-03-310000819050frtx:PurchaseAgreementMember2023-03-3100008190502022-09-092022-09-090000819050us-gaap:SeriesAPreferredStockMember2023-03-310000819050us-gaap:EmployeeStockOptionMemberfrtx:EquityIncentivePlan2009Member2023-03-310000819050frtx:VicalStockIncentivePlanMemberus-gaap:EmployeeStockOptionMember2023-03-310000819050frtx:A2020OmnibusPlanMemberus-gaap:EmployeeStockOptionMember2022-05-172022-05-170000819050frtx:EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2023-01-012023-03-310000819050frtx:EmployeeStockPurchasePlanMember2021-04-202023-03-310000819050us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-03-310000819050us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-03-310000819050us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-03-310000819050us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2023

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-21088

FRESH TRACKS THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | | 93-0948554 | |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) | |

| | | | | | | |

| 5777 Central Avenue, | Boulder, | CO | | | 80301 | |

| (Address of principal executive offices) | | (Zip Code) | |

(720) 505-4755

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock, $0.01 par value per share | FRTX | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 4, 2023, there were 5,906,475 shares of the registrant’s common stock outstanding.

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (“Quarterly Report”) contains forward-looking statements that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. All statements contained in this Quarterly Report other than statements of historical fact, including statements relating to future financial, business, and/or research and investigational, preclinical, or clinical performance, conditions, plans, prospects, trends, or strategies and other such matters, including without limitation, our strategy; future operations; future potential; future financial position; future liquidity; future revenue and payments of any type; territorial focus; projected expenses; results of operations; the anticipated timing, scope, design, progress, results, possible impact of, and/or reporting of data of ongoing and future nonclinical and clinical trials; intellectual property rights, including the acquisition, validity, term, and enforceability of such; the expected timing and/or results of regulatory submissions and approvals; and prospects for commercializing (and competing with) any product candidates of Fresh Tracks or third parties, or research and/or licensing collaborations with, or actions of, its partners, including in the United States (“U.S.”), Japan, South Korea, or any other country, or business development activities with other potential partners. The words “may,” “could,” “should,” “might,” “announce,” “anticipate,” “advancing,” “reflect,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predict,” “potential,” “will,” evaluate,” “advance,” “excited,” “aim,” “strive,” “help,” “progress,” “select,” “initiate,” “looking forward,” “promise,” “provide,” “commit,” “best-in-class,” “first-in-class,” and similar expressions and their variants, are intended to identify forward-looking statements. Such statements are based on management’s current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors. Unless otherwise mentioned or unless the context requires otherwise, all references in this Quarterly Report to “Fresh Tracks,” “Brickell Subsidiary,” “Company,” “we,” “us,” and “our,” or similar references, refer to Fresh Tracks Therapeutics, Inc. and its consolidated subsidiaries.

We based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy and business development activities, pipeline legal status, short-term and long-term business operations and objectives, employees, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those described in Part I, Item 1A. “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, in Part II, Item 1A, “Risk Factors” in this Quarterly Report, and under a similar heading in any other periodic or current report we may file with the U.S. Securities and Exchange Commission (the “SEC”) in the future. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge quickly and from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business and operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Quarterly Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement.

You should read carefully the factors described in Part I, Item 1A. “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, in Part II, Item 1A, “Risk Factors” in this Quarterly Report, and under a similar heading in any other periodic or current report we may file with the SEC to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements. You are advised to consult any further disclosures we make on related subjects in our future public filings and on our website.

FRESH TRACKS THERAPEUTICS, INC.

FORM 10-Q

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

FRESH TRACKS THERAPEUTICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | |

| |

| | | |

| March 31,

2023 | | December 31,

2022 |

| | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 10,764 | | | $ | 8,680 | |

| | | |

| Prepaid expenses and other current assets | 1,049 | | | 1,403 | |

| Total current assets | 11,813 | | | 10,083 | |

| Property and equipment, net | 65 | | | 75 | |

| Contract asset, net of current portion | 64 | | | 64 | |

| Operating lease right-of-use asset | 25 | | | 49 | |

| | | |

| Total assets | $ | 11,967 | | | $ | 10,271 | |

Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 635 | | | $ | 571 | |

| Accrued liabilities | 1,438 | | | 2,457 | |

| Lease liability | 28 | | | 49 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total current liabilities | 2,101 | | | 3,077 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Commitments and contingencies (Note 5) | | | |

| | | |

| | | |

| Stockholders’ equity: | | | |

Common stock, $0.01 par value, 300,000,000 shares authorized as of March 31, 2023 and December 31, 2022; 5,906,475 and 3,018,940 shares issued and outstanding as of March 31, 2023 and December 31, 2022, respectively | 59 | | | 30 | |

| Additional paid-in capital | 180,552 | | | 173,633 | |

| | | |

| Accumulated deficit | (170,745) | | | (166,469) | |

| Total stockholders’ equity | 9,866 | | | 7,194 | |

| Total liabilities and stockholders’ equity | $ | 11,967 | | | $ | 10,271 | |

| | | |

See accompanying notes to these condensed consolidated financial statements.

FRESH TRACKS THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2023 | | 2022 |

| Revenue | | | | | | | |

| Contract revenue | | | | | $ | 9 | | | $ | — | |

| Royalty revenue | | | | | — | | | 92 | |

| Total revenue | | | | | 9 | | | 92 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Research and development | | | | | 1,936 | | | 6,013 | |

| General and administrative | | | | | 2,414 | | | 3,486 | |

| Total operating expenses | | | | | 4,350 | | | 9,499 | |

| Loss from operations | | | | | (4,341) | | | (9,407) | |

| Other income | | | | | 68 | | | 1 | |

| | | | | | | |

| Interest expense | | | | | (3) | | | (4) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net loss attributable to common stockholders | | | | | $ | (4,276) | | | $ | (9,410) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net loss per common share attributable to common stockholders, basic and diluted | | | | | $ | (1.14) | | | $ | (3.55) | |

| | | | | | | |

| Weighted-average shares used to compute net loss per common share attributable to common stockholders, basic and diluted | | | | | 3,756,613 | | | 2,652,828 | |

See accompanying notes to these condensed consolidated financial statements.

FRESH TRACKS THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands, except share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common Stock | | Additional

Paid-In-Capital | | | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| | | | | Shares | | Par Value | | |

| Balance, December 31, 2021 | | | | | 2,652,828 | | | $ | 27 | | | $ | 170,247 | | | | | $ | (145,367) | | | $ | 24,907 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Stock-based compensation | | | | | — | | | — | | | 551 | | | | | — | | | 551 | |

| | | | | | | | | | | | | | | |

| Net loss | | | | | — | | | — | | | — | | | | | (9,410) | | | (9,410) | |

| Balance, March 31, 2022 | | | | | 2,652,828 | | | $ | 27 | | | $ | 170,798 | | | | | $ | (154,777) | | | $ | 16,048 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common Stock | | Additional

Paid-In-Capital | | | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| | | | | Shares | | Par Value | | |

| Balance, December 31, 2022 | | | | | 3,018,940 | | | $ | 30 | | | $ | 173,633 | | | | | $ | (166,469) | | | $ | 7,194 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Common stock issued pursuant to ATM agreements, net of issuance costs of $202 | | | | | 2,887,535 | | | 29 | | | 6,540 | | | | | — | | | 6,569 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Stock-based compensation | | | | | — | | | — | | | 379 | | | | | — | | | 379 | |

| | | | | | | | | | | | | | | |

| Net loss | | | | | — | | | — | | | — | | | | | (4,276) | | | (4,276) | |

| Balance, March 31, 2023 | | | | | 5,906,475 | | | $ | 59 | | | $ | 180,552 | | | | | $ | (170,745) | | | $ | 9,866 | |

| | | | | | | | | | | | | | | |

See accompanying notes to these condensed consolidated financial statements.

FRESH TRACKS THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

| | | | | | | | | | | |

| Three Months Ended

March 31, |

| 2023 | | 2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net loss | $ | (4,276) | | | $ | (9,410) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Stock-based compensation | 379 | | | 551 | |

| Non-cash operating lease expense | 24 | | | 14 | |

| Depreciation | 10 | | | 7 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Prepaid expenses and other current assets, including noncurrent portion of contract asset | 354 | | | (688) | |

| Accounts payable | 64 | | | 1,377 | |

| Accrued liabilities | (1,019) | | | (1,375) | |

| Operating lease liability | (21) | | | (16) | |

| | | |

| | | |

| | | |

| | | |

| Net cash used in operating activities | (4,485) | | | (9,540) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| | | |

| | | |

| Proceeds from the issuance of common stock pursuant to ATM agreements, net of issuance costs | 6,569 | | | — | |

| Payments of taxes related to net share settlement of equity awards | — | | | (55) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net cash provided by (used in) financing activities | 6,569 | | | (55) | |

| | | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | 2,084 | | | (9,595) | |

| CASH AND CASH EQUIVALENTS—BEGINNING | 8,680 | | | 26,884 | |

| CASH AND CASH EQUIVALENTS—ENDING | $ | 10,764 | | | $ | 17,289 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

See accompanying notes to these condensed consolidated financial statements.

FRESH TRACKS THERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

NOTE 1. ORGANIZATION AND NATURE OF OPERATIONS

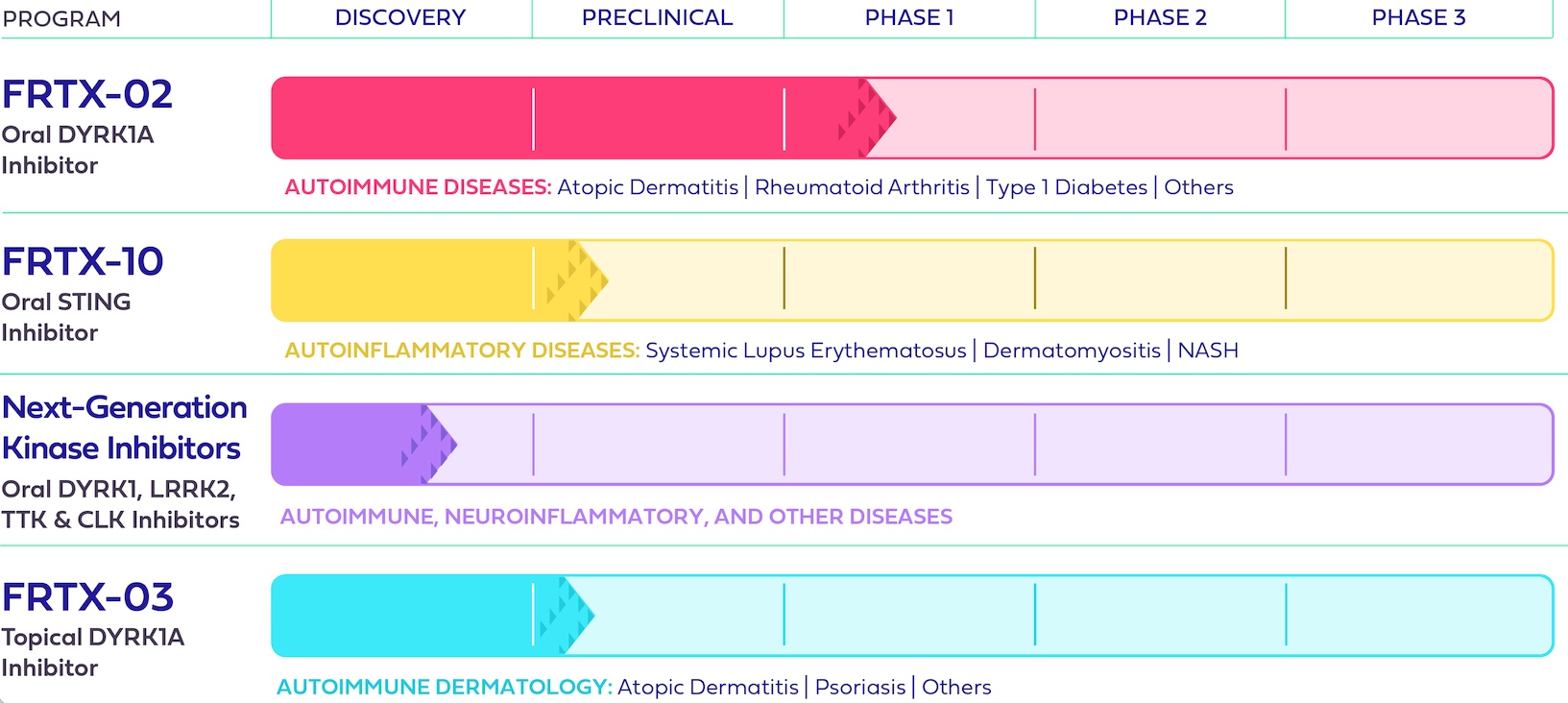

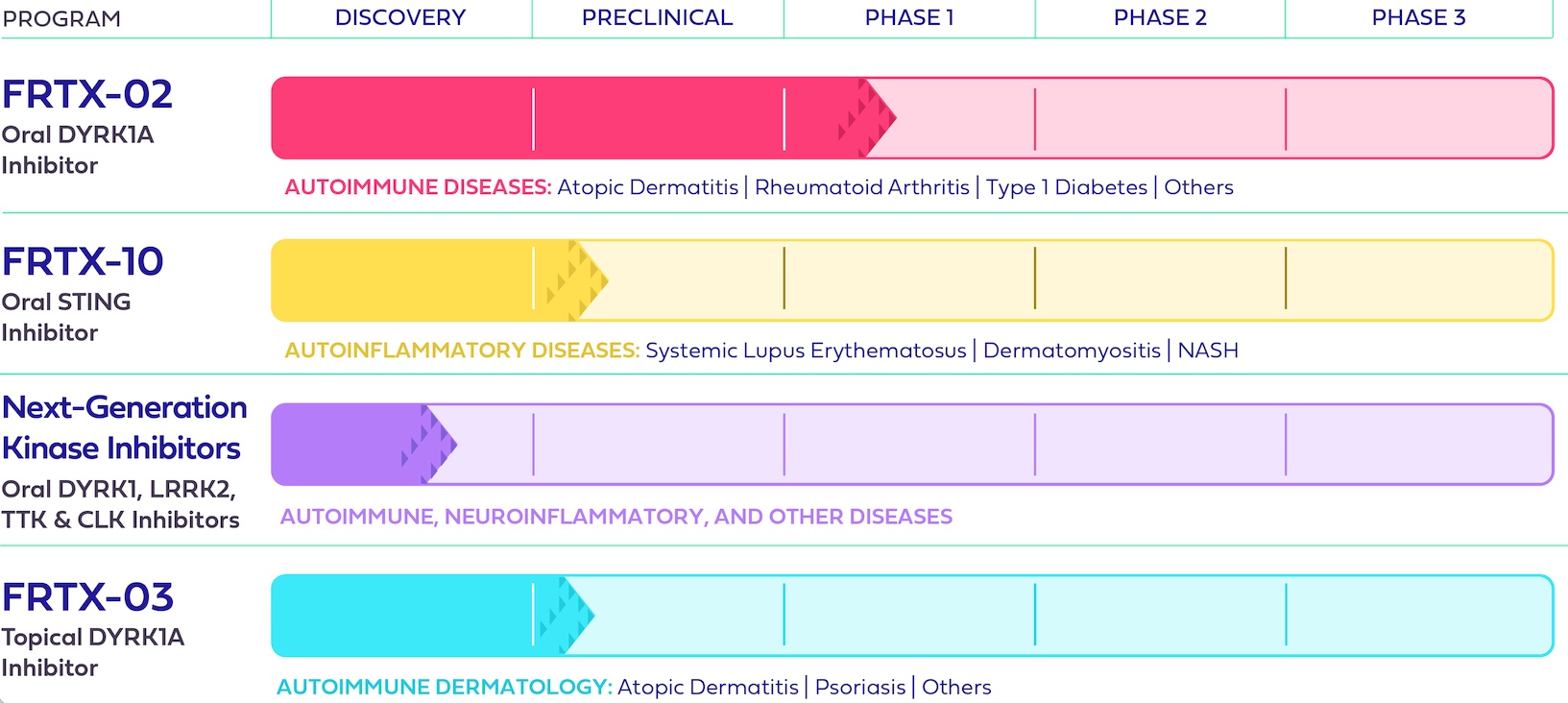

Fresh Tracks Therapeutics, Inc. (the “Company” or “Fresh Tracks”) is a clinical-stage pharmaceutical company striving to transform patient lives through the development of innovative and differentiated prescription therapeutics. The Company’s pipeline aims to disrupt existing treatment paradigms and features several new chemical entities that inhibit novel targets with first-in-class potential for autoimmune, inflammatory, and other debilitating diseases. This includes FRTX-02, a DYRK1A inhibitor for the treatment of certain autoimmune and inflammatory diseases; FRTX-10, a preclinical-stage Stimulator of Interferon Genes (“STING”) inhibitor candidate for the potential treatment of autoimmune, inflammatory, and rare genetic diseases; and a platform of next-generation kinase inhibitors with the potential to produce treatments for autoimmune, inflammatory, and other debilitating diseases.

Reverse Stock Split

On July 5, 2022, the Company effected a 1-for-45 reverse stock split of outstanding shares of its common stock. All common stock shares, per-share amounts, and other related balances and computations reported as of and for all periods presented in the condensed consolidated financial statements and notes reflect the adjusted common stock share, per-share amounts, and other related balances and computations that were effective on and after July 5, 2022.

Liquidity and Capital Resources

The Company has incurred significant operating losses and has an accumulated deficit as a result of ongoing efforts to in-license and develop product candidates, including conducting preclinical and clinical trials and providing general and administrative support for these operations. For the three months ended March 31, 2023, the Company had a net loss of $4.3 million and net cash used in operating activities of $4.5 million. As of March 31, 2023, the Company had cash and cash equivalents of $10.8 million and an accumulated deficit of $170.7 million. The Company believes that its cash and cash equivalents as of March 31, 2023 will be sufficient to fund its operations for at least the next 12 months.

The Company expects to continue to incur additional substantial losses in the foreseeable future as a result of the Company’s research and development activities. The Company’s board of directors (“Board”) and executive management team are conducting a comprehensive process to explore and evaluate strategic options to progress the development of its novel pipeline of potential treatments for autoimmune, inflammatory, and other diseases. Potential strategic options to be explored or evaluated as part of this process may include, but are not limited to, a financing, sale or licensing of assets, acquisition, merger, business combination, and/or other strategic transaction or series of related transactions involving the Company. To continue developing FRTX-02 and the rest of the Company's pipeline, it needs to raise additional funds. If such financing or a strategic partnership is not forthcoming in a timely manner, the Company will be unable to conduct certain additional research and development activities. To the extent that additional funds are raised through the sale of equity, the issuance of securities will result in dilution to the Company’s stockholders.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary, Brickell Subsidiary, Inc. (“Brickell Subsidiary”), and are presented in United States

(“U.S.”) dollars and have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and applicable rules and regulations of the SEC for interim reporting. As permitted under those rules and regulations, certain footnotes or other financial information normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted. These condensed consolidated financial statements have been prepared on the same basis as the annual financial statements and, in the opinion of management, reflect all adjustments, consisting only of normal recurring adjustments, which are necessary for a fair presentation of the Company’s financial information. The results of operations for the three months ended March 31, 2023 are not necessarily indicative of the results to be expected for the full year ending December 31, 2023, for any other interim period, or for any other future period. The condensed consolidated balance sheet as of December 31, 2022 has been derived from audited financial statements at that date but does not include all of the information required by U.S. GAAP for complete financial statements. All intercompany balances and transactions have been eliminated in consolidation. The Company operates in one operating segment and, accordingly, no segment disclosures have been presented herein.

Significant Accounting Policies

The Company’s significant accounting policies are described in Note 2. “Summary of Significant Accounting Policies” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022. During the three months ended March 31, 2023, the Company did not adopt any additional significant accounting policies.

Reclassifications

Certain comparative figures in the prior year condensed consolidated statement of cash flows within operating activities have been reclassified to conform to the current period presentation. These reclassifications did not impact total net cash used in operating activities.

Use of Estimates

The Company’s condensed consolidated financial statements are prepared in accordance with U.S. GAAP, which requires it to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Although these estimates are based on the Company’s knowledge of current events and actions it may take in the future, actual results may ultimately differ from these estimates and assumptions.

Risks and Uncertainties

The Company’s business is subject to significant risks common to early-stage companies in the pharmaceutical industry including, but not limited to, the ability to develop appropriate formulations, scale up and produce the compounds; dependence on collaborative parties; uncertainties associated with obtaining and enforcing patents and other intellectual property rights; clinical implementation and success; the lengthy and expensive regulatory approval process; compliance with regulatory and other legal requirements; competition from other products; uncertainty of broad adoption of its approved products, if any, by physicians and patients; significant competition; ability to manage third-party manufacturers, suppliers, contract research organizations, business partners and other alliances; and obtaining additional financing to fund the Company’s efforts.

The Company expects to incur substantial operating losses for the next several years and will need to obtain additional financing in order to develop its product candidates. There can be no assurance that such financing will be available or will be at terms acceptable to the Company.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less from date of purchase to be cash equivalents. Cash equivalents consist primarily of amounts held in short-term money market accounts with highly rated financial institutions.

Concentrations of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash and cash equivalents, accounts receivable, and contract asset. The Company maintains cash and cash equivalents balances in several accounts with two financial institutions which, from time to time, are in excess of federally insured limits.

One third party individually accounted for all of the Company’s revenue for the three months ended March 31, 2023 and 2022, as well as associated accounts receivable and contract asset balances as of March 31, 2023 and December 31, 2022. Refer to Note 3. “Strategic Agreements” for a detailed discussion of agreements with Botanix SB Inc. and Botanix Pharmaceuticals Limited (“Botanix”).

Fair Value Measurements

Fair value is the price that the Company would receive to sell an asset or pay to transfer a liability in a timely transaction with an independent counterparty in the principal market, or in the absence of a principal market, the most advantageous market for the asset or liability. A three-tier hierarchy distinguishes between (1) inputs that reflect the assumptions market participants would use in pricing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs) and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing an asset or liability developed based on the best information available in the circumstances (unobservable inputs). The hierarchy is summarized in the three broad levels listed below:

Level 1—quoted prices in active markets for identical assets and liabilities

Level 2—other significant observable inputs (including quoted prices for similar assets and liabilities, interest rates, credit risk, etc.)

Level 3—significant unobservable inputs (including the Company’s own assumptions in determining the fair value of assets and liabilities)

The following table sets forth the fair value of the Company’s financial assets measured at fair value on a recurring basis based on the three-tier fair value hierarchy (in thousands):

| | | | | | | | | | | | | | | |

| Level 1 | | | | |

| | | | | |

| | | | | | | |

| March 31,

2023 | | December 31,

2022 | |

Assets: | | | | | | | |

| Money market funds | $ | 7,946 | | | $ | 7,680 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Fair Value of Financial Instruments

The following methods and assumptions were used by the Company in estimating the fair values of each class of financial instrument disclosed herein:

Money Market Funds—The carrying amounts reported as cash and cash equivalents in the condensed consolidated balance sheets approximate their fair values due to their short-term nature and market rates of interest.

The carrying values of cash equivalents, accounts receivable, accounts payable, and accrued liabilities approximate fair value due to the short-term maturity of those items.

Revenue Recognition

The Company has historically recognized revenue primarily from upfront fees, research and development milestones, research reimbursements, and consulting services fees related to the development of previously owned or sublicensed assets associated with the proprietary compound sofpironium bromide, as well as sublicense income and royalty fees on sales of sofpironium bromide gel, 5% (ECCLOCK®) in Japan.

The Company recognizes revenue upon the transfer of promised goods or services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods or services. In determining the appropriate amount of revenue to be recognized, the Company performs the following five steps: (i) identify the contract(s) with a customer; (ii) identify the performance obligations in the contract; (iii) determine the transaction price, including the constraint on variable consideration; (iv) allocate the transaction price to the performance obligations in the contract; and (v) recognize revenue when (or as) the Company satisfies the performance obligations. At contract inception, the Company assesses the goods or services promised within each contract and assesses whether each promised good or service is distinct and determines those that are performance obligations. The Company then recognizes as revenue the amount of the transaction price that is allocated to the respective performance obligation when (or as) the performance obligation is satisfied.

The Company utilizes judgment to assess the nature of the performance obligation to determine whether the performance obligation is satisfied over time or at a point in time and, if over time, the appropriate method of measuring progress. The Company evaluates the measure of progress each reporting period and, if necessary, adjusts the measure of performance and related revenue recognition.

Contract Revenue

The Company evaluates its contracts, including asset sale arrangements that involve the Company’s rights to intellectual property, to determine whether they are outputs of the Company’s ordinary activities and whether the counterparty meets the definition of a customer. If the arrangement is determined to be a contract with a customer and the goods or services sold are determined to be distinct from other performance obligations identified in the arrangement, the Company recognizes revenue primarily from non-refundable upfront fees, milestone payments, sales-based payments, and fees for consulting services allocated to the goods or services when (or as) control is transferred to the customer, and the customer can use and benefit from the goods or services.

Licenses of Intellectual Property

If a license for the Company’s intellectual property is determined to be distinct from the other performance obligations identified in the arrangement, the Company recognizes revenue when the functional license is transferred to the customer, and the customer can use and benefit from the license.

Milestones

At the inception of each arrangement that includes milestone payments (variable consideration), excluding sales-based milestone payments discussed below, the Company evaluates whether the milestones are considered probable of being reached and estimates the amount to be included in the transaction price using the most likely amount method. The most likely amount method is generally utilized when there are only two possible outcomes and represents the Company’s best estimate of the single most likely outcome to be achieved. If it is probable that a significant revenue reversal would not occur, the variable consideration for the associated milestone is included in the transaction price. Milestone payments contingent on regulatory approvals that are not within the Company or the Company’s collaboration partner’s control, as applicable, are generally not considered probable of being achieved until those approvals are received. At the end of each subsequent reporting period, the Company re-evaluates the probability of achievement of milestones and any related constraint, and if necessary, adjusts the Company’s estimate of the variable consideration. Any such adjustments are recorded on a cumulative catch-up basis, which would affect revenue in the period of adjustment.

Sales-Based Payments

For license arrangements that include sales-based payments such as royalties or milestone payments based on the level of sales, and for which the license is deemed to be the predominant item to which the sales-based payments relate, the Company recognizes revenue at the later of (i) when the related sales occur or (ii) when the performance obligation to which some or all of the sales-based payment has been allocated has been satisfied (or partially satisfied). Sales-based payments received under license arrangements are recorded as royalty revenue in the Company’s condensed consolidated statements of operations.

For non-license arrangements that include sales-based payments, including earnout payments and milestone payments based on the level of sales, the Company estimates the sales-based payments (variable consideration) to be achieved and recognizes revenue to the extent it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur. The Company may use either the most likely amount, as described above, or the expected value method, in making such estimates based on the nature of the payment to be received and whether there is a wide range of outcomes or only two possible outcomes. The expected value method represents the sum of probability-weighted amounts in a range of possible consideration amounts. The Company bases its estimates using the applicable method described above on factors such as, but not limited to, required regulatory approvals, historical sales levels, market events and projections, and other factors as appropriate. The Company updates its estimates at each reporting period based on actual results and future expectations as necessary.

Contract Asset

For non-license arrangements involving the sale and transfer of the Company’s intellectual property rights, the Company recognizes estimated variable consideration as revenue as discussed above before the customer pays consideration or before payment is due. The estimated revenue recognized is presented as a contract asset on the Company’s condensed consolidated balance sheets. The current portion of the contract asset is presented in prepaid expenses and other current assets on the Company’s condensed consolidated balance sheets. Actual amounts paid or due by the customer are recorded as a reduction to the contract asset. Any revisions to the Company’s estimated revenue based on actual results and future expectations are recognized as an adjustment to the contract asset.

Research and Development

Research and development costs are charged to expense when incurred and consist of costs incurred for independent and collaboration research and development activities. The major components of research and

development costs include formulation development, nonclinical studies, clinical studies, clinical manufacturing costs, in-licensing fees for development-stage assets, salaries and employee benefits, and allocations of various overhead and occupancy costs. Research costs typically consist of applied research, preclinical, and toxicology work. Pharmaceutical manufacturing development costs consist of product formulation, chemical analysis, and the transfer and scale-up of manufacturing at contract manufacturers. Assets acquired (or in-licensed) that are utilized in research and development that have no alternative future use are expensed as incurred. Milestone payments related to the Company’s acquired (or in-licensed) assets are recorded as research and development expenses when probable and reasonably estimable.

Costs for certain research and development activities, such as clinical trial expenses, are recognized based on an evaluation of the progress to completion of specific tasks using data such as patient enrollment, clinical site activations, and information provided to the Company by its vendor on their actual costs incurred or level of effort expended. Payments for these activities are based on the terms of the individual arrangements, which may differ from the pattern of costs incurred, and are reflected on the condensed consolidated balance sheets as prepaid expenses and other current assets or accrued expenses.

The Company has entered into and may continue to enter into licensing or subscription arrangements to access and utilize certain technology. In each case, the Company evaluates if the license agreement results in the acquisition of an asset or a business. To date, none of the Company’s license agreements have been considered an acquisition of a business. For asset acquisitions, the upfront payments to acquire such licenses, as well as any future milestone payments made before product approval that do not meet the definition of a derivative, are immediately recognized as research and development expenses when they are paid or become payable, provided there is no alternative future use of the rights in other research and development projects.

Net Loss per Share

Basic and diluted net loss per share is computed by dividing net loss by the weighted-average number of common shares outstanding. When the effects are not anti-dilutive, diluted earnings per share is computed by dividing the Company’s net income by the weighted-average number of common shares outstanding and the impact of all potentially dilutive common shares. Diluted net loss per share is the same as basic net loss per share, as the effects of potentially dilutive securities are anti-dilutive for all periods presented.

The following table sets forth the potential common shares excluded from the calculation of diluted net loss per share because their inclusion would be anti-dilutive:

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2023 | | 2022 |

| Outstanding warrants | | | | | 621,063 | | | 621,063 | |

| Outstanding options | | | | | 197,055 | | | 153,656 | |

| Unvested restricted stock units | | | | | 141,250 | | | — | |

| | | | | | | |

| | | | | | | |

| Total | | | | | 959,368 | | | 774,719 | |

Leases

The Company determines if an arrangement is a lease at inception. Operating leases with a term greater than one year are recognized on the condensed consolidated balance sheets as right-of-use assets and lease liabilities. The Company does not currently hold any finance leases. The Company has elected the practical expedient not to recognize on the condensed consolidated balance sheets leases with terms of one year or less and not to separate lease components and non-lease components for real estate leases. Lease liabilities and their corresponding right-of-use assets are recorded based on the present value of lease payments over the expected lease term. The interest rate implicit in lease contracts is typically not readily determinable. As such, the

Company estimates the incremental borrowing rate in determining the present value of lease payments. Lease expense is recognized on a straight-line basis over the lease term.

New Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board or other standard setting bodies that the Company adopts as of the specified effective date. The Company does not believe that the adoption of recently issued standards has had or will have a material impact on the Company's condensed consolidated financial statements or disclosures.

NOTE 3. STRATEGIC AGREEMENTS

License and Development Agreement with Voronoi

On August 27, 2021, the Company entered into a License and Development Agreement (the “Voronoi License Agreement”) with Voronoi Inc. (“Voronoi”), pursuant to which the Company acquired exclusive, worldwide rights to research, develop, and commercialize FRTX-02 and other next-generation kinase inhibitors.

With respect to FRTX-02, the Voronoi License Agreement provides that the Company will make payments to Voronoi of up to $211.0 million in the aggregate contingent upon achievement of specified development, regulatory, and commercial milestones. With respect to the compounds arising from the next-generation kinase inhibitor platform, the Company will make payments to Voronoi of up to $107.5 million in the aggregate contingent upon achievement of specified development, regulatory, and commercial milestones. Further, the Voronoi License Agreement provides that the Company will pay Voronoi tiered royalty payments ranging from low-single digits up to 10% of net sales of products arising from the DYRK1A inhibitor programs and next-generation kinase inhibitor platform. All of the contingent payments and royalties are payable in cash in U.S. Dollars, except for $1.0 million of the development and regulatory milestone payments, which amount is payable in equivalent shares of the Company’s common stock. Under the terms of the Voronoi License Agreement, the Company is responsible for, and bears the future costs of, all development and commercialization activities, including patenting, related to all the licensed compounds. As of March 31, 2023 and through the date of this Quarterly Report, the Company has not yet made any payments or recorded any liabilities related to the specified development, regulatory, and commercial milestones or royalties on net sales pursuant to the Voronoi License Agreement.

Exclusive License and Development Agreement with Carna

On February 2, 2022, the Company entered into an Exclusive License Agreement (the “Carna License Agreement”) with Carna Biosciences, Inc. (“Carna”), pursuant to which the Company acquired exclusive, worldwide rights to research, develop, and commercialize Carna’s portfolio of novel STING inhibitors. In accordance with the terms of the Carna License Agreement, in exchange for the licensed rights, the Company made a one-time cash payment of $2.0 million, which was recorded as research and development expenses in the condensed consolidated statements of operations during the three months ended March 31, 2022.

The Carna License Agreement provides that the Company will make success-based payments to Carna of up to $258.0 million in the aggregate contingent upon achievement of specified development, regulatory, and commercial milestones. Further, the Carna License Agreement provides that the Company will pay Carna tiered royalty payments ranging from mid-single digits up to 10% of net sales. All of the contingent payments and royalties are payable in cash in U.S. Dollars. Under the terms of the Carna License Agreement, the Company is responsible for, and bears the future costs of, all development and commercialization activities, including patenting, related to all the licensed compounds. As of March 31, 2023 and through the date of this Quarterly Report, the Company has not yet made any payments or recorded any liabilities related to the specified

development, regulatory, and commercial milestones or royalties on net sales pursuant to the Carna License Agreement.

Asset Purchase Agreement with Botanix

On May 3, 2022 (the “Effective Date”), the Company and Brickell Subsidiary entered into an asset purchase agreement with Botanix (the “Asset Purchase Agreement”), pursuant to which Botanix acquired and assumed control of all rights, title, and interests to assets primarily related to the proprietary compound sofpironium bromide that were owned and/or licensed by the Company or Brickell Subsidiary (the “Assets”). Prior to the sale of the Assets, the Company had previously entered into a License Agreement with Bodor Laboratories, Inc. (“Bodor”), dated December 15, 2012 (last amended in February 2020) that provided the Company with a worldwide exclusive license to develop, manufacture, market, sell, and sublicense products containing sofpironium bromide through which the Assets were developed (the “Amended and Restated License Agreement”). As a result of the Asset Purchase Agreement, Botanix is now responsible for all further research, development, and commercialization of sofpironium bromide globally and replaced the Company as the exclusive licensee under the Amended and Restated License Agreement.

In accordance with the sublicense rights provided to the Company under the Amended and Restated License Agreement, the Company also had previously entered into a License, Development, and Commercialization Agreement with Kaken Pharmaceutical Co., Ltd. (“Kaken”), dated as of March 31, 2015 (as amended in May 2018, the “Kaken Agreement”), under which the Company granted to Kaken an exclusive right to develop, manufacture, and commercialize the sofpironium bromide compound in Japan and certain other Asian countries (the “Territory”). In exchange for the sublicense, the Company was entitled to receive aggregate payments of up to $10.0 million upon the achievement of specified development milestones, which were earned and received in 2017 and 2018, and up to $19.0 million upon the achievement of sales-based milestones, as well as tiered royalties based on a percentage of net sales of licensed products in the Territory. In September 2020, Kaken received regulatory approval in Japan to manufacture and market ECCLOCK for the treatment of primary axillary hyperhidrosis, and as a result, the Company began recognizing royalty revenue earned on a percentage of net sales of ECCLOCK in Japan. Pursuant to the Asset Purchase Agreement, the Kaken Agreement was assigned to Botanix, which replaced the Company as the exclusive sub-licensor to Kaken. During the three months ended March 31, 2022, prior to entering into the Asset Purchase Agreement, the Company recognized royalty revenue of $0.1 million under the Kaken Agreement.

The Company determined that the development of and ultimate sale and assignment of rights to the Assets is an output of the Company’s ordinary activities and Botanix is a customer as it relates to the sale of the Assets and related activities.

In accordance with the terms of the Asset Purchase Agreement, in exchange for the Assets, the Company (i) received an upfront payment at closing in the amount of $3.0 million, (ii) was reimbursed for certain recent development expenditures in advancement of the Assets, (iii) received a milestone payment of $2.0 million upon the acceptance by the U.S. Food and Drug Administration (“FDA”) in December 2022 of the filing of a new drug application (“NDA”) for sofpironium bromide gel, 15%, and (iv) will receive a contingent milestone payment of $4.0 million if marketing approval in the U.S. for sofpironium bromide gel, 15%, is received on or before September 30, 2023, or $2.5 million if such marketing approval is received after September 30, 2023 but on or before February 17, 2024. Botanix submitted an NDA for sofpironium bromide gel, 15%, to the FDA in September 2022, which was accepted by the FDA in December 2022. Under the Asset Purchase Agreement, the Company also is eligible to receive additional success-based regulatory and sales milestone payments of up to $168.0 million. Further, the Company will receive tiered earnout payments ranging from high-single digits to mid-teen digits on net sales of sofpironium bromide gel (the “Earnout Payments”).

The Asset Purchase Agreement also provides that Botanix will pay to the Company a portion of the sales-based milestone payments and royalties that Botanix receives from Kaken under the assigned Kaken Agreement

(together, the “Sublicense Income”). Sublicense Income represents the Company’s estimate of payments that will be earned by the Company in the applicable period from sales-based milestone payments and royalties Botanix will receive from Kaken to the extent it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur. Royalties vary based on net sales that are impacted by a wide variety of market and other factors and, as such, the Company utilized the expected value approach, which the Company believes will best predict the amount of consideration to which it will be entitled. In relation to the sales-based milestone payments that Botanix may receive from Kaken in the future, the Company utilized the most likely amount method and determined it is not yet probable that the Company will receive any payments from Botanix in relation to such milestone payments. Therefore, the Company determined that such milestone payments are fully constrained as of March 31, 2023, and, as such, have not yet been recognized as contract revenue. With respect to the recognition of contract revenue for the Sublicense Income based on future royalties that will be due to Botanix from Kaken, certain amounts are not yet due from Botanix. Therefore, the Company has recorded a contract asset equal to the amount of revenue recognized related to the Sublicense Income, less the amount of payments received from or due by Botanix in relation to the Sublicense Income.

All other consideration due under the Asset Purchase Agreement is contingent upon certain regulatory approvals and future sales subsequent to such regulatory approvals, or is based upon future sales that the Company determined are not yet probable due to such revenues being highly susceptible to factors outside of the Company’s influence and uncertainty about the amount of such consideration that will not be resolved for an extended period of time. Therefore, the Company determined that such variable consideration amounts are fully constrained as of March 31, 2023, and as such, did not recognize such amounts as contract revenue.

Transition Services Agreement with Botanix

In connection with the sale of the Assets, on the Effective Date, the Company and Botanix entered into a transition services agreement (the “TSA”) whereby the Company is providing consulting services as an independent contractor to Botanix in support of and through filing and potential approval of the U.S. NDA for sofpironium bromide gel, 15%. In accordance with the terms of the TSA, in exchange for providing these services (i) prior to the acceptance of the filing by the FDA of such NDA in December 2022, the Company received from Botanix a fixed monthly amount of $71 thousand, and (ii) after the acceptance of the filing in December 2022, the Company will receive from Botanix a variable amount based upon actual hours worked, in each case plus related fees and expenses of the Company’s advisors (plus a 5% administrative fee) and the Company’s out-of-pocket expenses. During the three months ended March 31, 2023, the Company recognized $9 thousand of contract revenue associated with consulting services provided under the TSA.

Contract Assets under the Botanix Agreements

The following table presents changes in the value of the Company’s contract asset related to Sublicense Income for the three months ended March 31, 2023 (in thousands):

| | | | | |

| Contract asset as of January 1, 2023 | $ | 318 | |

| |

| Amounts received or receivable | (34) | |

| Contract asset as of March 31, 2023 | $ | 284 | |

Contract asset, included in prepaid expenses and other current assets | $ | 220 | |

Contract asset, net of current portion | $ | 64 | |

Agreements with Bodor

In connection with the sale of the Assets, on the Effective Date, the Company, Brickell Subsidiary, and Bodor entered into an agreement (the “Rights Agreement”) to clarify that the Company and Brickell Subsidiary have

the power and authority under the Amended and Restated License Agreement to enter into the Asset Purchase Agreement and the TSA, and that Botanix would assume the Amended and Restated License Agreement pursuant to the Asset Purchase Agreement. The Rights Agreement includes a general release of claims and no admission of liability between the parties. Pursuant to such Rights Agreement, as subsequently amended on November 10, 2022, the Company agreed to pay Bodor (i) 20% of the amount of each payment due to the Company from Botanix for upfront and milestone payments, subject to deductions, credits, or offsets applied under the Asset Purchase Agreement, as well as (ii) certain tiered payments, set as a percentage ranging from mid-single digits to mid-teen digits, of the amount of each of the applicable Earnout Payments due to the Company from Botanix after deductions, credits or offsets applied under the Asset Purchase Agreement.

Pursuant to the terms of the Asset Purchase Agreement, the Company retained its obligation under the Amended and Restated License Agreement to issue $1.0 million in shares of its common stock to Bodor upon the FDA’s acceptance of an NDA filing for sofpironium bromide gel, 15%. On November 10, 2022, the Company entered into an Acknowledgment and Agreement Related to Asset Purchase Agreement and Amended and Restated License Agreement (the “Acknowledgment”) with Brickell Subsidiary, Botanix, and Bodor. Pursuant to the Acknowledgment, the Company paid $1.0 million in cash to Bodor in full satisfaction of the Company’s obligation to issue shares upon the FDA’s acceptance of the NDA.

During the three months ended March 31, 2023 and 2022, no expense was incurred or reported as general and administrative expenses in the condensed consolidated statements of operations associated with achieved milestones related to sofpironium bromide gel, 15%. Prior to the execution of the Rights Agreement, the Company paid Bodor immaterial amounts with respect to the royalties the Company received from Kaken for sales of ECCLOCK in Japan during those periods.

NOTE 4. DETAILED ACCOUNT BALANCES

Prepaid expenses and other current assets consisted of the following (in thousands):

| | | | | | | | | | | |

| |

| | | |

| March 31,

2023 | | December 31,

2022 |

| Prepaid insurance | $ | 496 | | | $ | 521 | |

| Contract asset | 220 | | | 254 | |

| Prepaid research and development expenses | 159 | | | 254 | |

| Other prepaid expenses | 122 | | | 117 | |

| Accounts receivable | 45 | | | 250 | |

| Other current assets | 7 | | | 7 | |

| Total | $ | 1,049 | | | $ | 1,403 | |

Accrued liabilities consisted of the following (in thousands):

| | | | | | | | | | | |

| |

| | | |

| March 31,

2023 | | December 31,

2022 |

| Accrued compensation | $ | 731 | | | $ | 1,320 | |

| Accrued professional fees | 404 | | | 705 | |

| Accrued research and development expenses | 303 | | | 432 | |

| | | |

| | | |

| | | |

| | | |

| Total | $ | 1,438 | | | $ | 2,457 | |

NOTE 5. COMMITMENTS AND CONTINGENCIES

Operating Lease

In August 2016, the Company entered into a multi-year, noncancelable lease for its Colorado-based office space, which was amended on December 29, 2022 to, among other things, extend the lease term to December 31, 2025, eliminate options previously available to the Company to extend the lease, and provide that the Company may terminate the lease effective June 30, 2023 if notice is provided by April 30, 2023 (as amended, the “Boulder Lease”). Minimum base lease payments under the Boulder Lease are recognized on a straight-line basis over the term of the lease. In addition to base rental payments included in the contractual obligations table below, the Company is responsible for its pro rata share of the operating expenses for the building, which includes common area maintenance, utilities, property taxes, and insurance.

Upon modification of the Boulder Lease in December 2022, the Company reassessed classification of the lease and determined that the lease still met the criteria to be classified as an operating lease. Furthermore, the Company remeasured the lease liability as of the effective date by calculating the present value of the new lease payments, discounted at the Company’s incremental borrowing rate of 11.0%, over the lease term of six months. The lease term includes periods covered by an option to terminate the lease that the Company is reasonably certain to exercise. The operating expenses are variable and are not included in the present value determination of the lease liability.

The following is a summary of the contractual obligations related to operating lease commitments as of March 31, 2023 (in thousands):

| | | | | | | | |

| | |

| | |

| | |

| Total maturities, through December 31, 2023 | | $ | 29 | |

| Less imputed interest | | (1) | |

| Present value of lease liability | | $ | 28 | |

On May 4, 2023, the Company entered into an amendment to the Boulder Lease, which will terminate the Boulder Lease, effective August 31, 2023.

Licensing and Other Agreements

Refer to Note 3. “Strategic Agreements” for more information about the Company’s obligations under its licensing and other agreements.

NOTE 6. CAPITAL STOCK

Common Stock

Under the Company’s Restated Certificate of Incorporation, the Company’s Board has the authority to issue up to 300,000,000 shares of common stock with a par value of $0.01 per share. Each share of the Company’s common stock is entitled to one vote, and the holders of the Company’s common stock are entitled to receive

dividends when and as declared or paid by its Board. The Company had reserved authorized shares of common stock for future issuance as of March 31, 2023 as follows:

| | | | | |

| March 31,

2023 |

| Common stock warrants | 621,063 | |

| Common stock options outstanding | 197,055 | |

| Unvested restricted stock units | 141,250 | |

Shares available for grant under the Employee Stock Purchase Plan | 42,728 | |

| Shares available for grant under the 2020 Omnibus Long-Term Incentive Plan | 18,854 | |

| Total | 1,020,950 | |

The Company may be limited in its ability to sell a certain number of shares of its common stock under the Purchase Agreement or ATM Agreements described below, depending on the availability at any given time of authorized and available shares of common stock.

Public Offerings of Common Stock and Warrants

In October 2020, the Company completed a sale of 422,300 shares of its common stock, and, to certain investors, pre-funded warrants to purchase 40,663 shares of its common stock, and accompanying common stock warrants to purchase up to an aggregate of 462,979 shares of its common stock (the “October 2020 Offering”). Each share of common stock and pre-funded warrant to purchase one share of the Company’s common stock was sold together with a common warrant to purchase one share of the Company’s common stock. The shares of common stock and pre-funded warrants, and the accompanying common warrants, were issued separately and were immediately separable upon issuance. The common warrants are exercisable at a price of $32.40 per share of the Company’s common stock and will expire five years from the date of issuance. The pre-funded warrants were exercised in October 2020. No warrants associated with the October 2020 Offering were exercised during the three months ended March 31, 2023 or 2022.

In June 2020, the Company completed a sale of 328,669 shares of its common stock, and, to certain investors, pre-funded warrants to purchase 60,220 shares of its common stock, and accompanying common stock warrants to purchase up to an aggregate of 388,920 shares of its common stock (the “June 2020 Offering”). Each share of common stock and pre-funded warrant to purchase one share of common stock was sold together with a common warrant to purchase one share of common stock. The shares of common stock and pre-funded warrants, and the accompanying common warrants, were issued separately and were immediately separable upon issuance. The pre-funded warrants were exercised in the third quarter of 2020. The common warrants were immediately exercisable at a price of $56.25 per share of common stock and will expire five years from the date of issuance. No warrants associated with the June 2020 Offering were exercised during the three months ended March 31, 2023 or 2022.

At Market Issuance Sales Agreements

In March 2021, the Company entered into an At Market Issuance Sales Agreement (the “2021 ATM Agreement”) with Oppenheimer & Co. Inc. (“Oppenheimer”) and William Blair & Company, L.L.C. as the Company’s sales agents (the “Agents”). Pursuant to the terms of the 2021 ATM Agreement, the Company may sell from time to time through the Agents shares of its common stock having an aggregate offering price of up to $50.0 million. Such shares are issued pursuant to the Company’s shelf registration statement on Form S-3 (Registration No. 333-254037). Sales of the shares are made by means of ordinary brokers’ transactions on The Nasdaq Capital Market at market prices or as otherwise agreed by the Company and the Agents. Under the terms of the 2021 ATM Agreement, the Company may also sell the shares from time to time to an Agent as principal for its own account at a price to be agreed upon at the time of sale. Any sale of the shares to an Agent

as principal would be pursuant to the terms of a separate placement notice between the Company and such Agent. During the three months ended March 31, 2023, the Company sold 2,887,535 shares of common stock under the 2021 ATM Agreement at a weighted-average price of $2.34 per share, for aggregate net proceeds of $6.6 million, after giving effect to a 3% commission to the Agents. During the three months ended March 31, 2022, no sales of common stock under the 2021 ATM Agreement occurred. As of March 31, 2023, approximately $38.0 million of shares of common stock were remaining, but had not yet been sold by the Company under the 2021 ATM Agreement.

In April 2020, the Company entered into an At Market Issuance Sales Agreement (the “2020 ATM Agreement” and, together with the 2021 ATM Agreement, the “ATM Agreements”) with Oppenheimer as the Company’s sales agent. Pursuant to the terms of the 2020 ATM Agreement, the Company may sell from time to time through Oppenheimer shares of its common stock having an aggregate offering price of up to $8.0 million. As of March 31, 2023, approximately $2.6 million of shares of common stock were remaining, but had not yet been sold by the Company under the 2020 ATM Agreement. However, the shares that may be sold pursuant to the 2020 ATM Agreement are not currently registered under the Securities Act of 1933, as amended. During the three months ended March 31, 2023 and 2022, no sales of common stock under the 2020 ATM Agreement occurred.

The Company is subject to the SEC’s “baby shelf rules,” which prohibit companies with a public float of less than $75 million from issuing securities under a shelf registration statement in excess of one-third of such company’s public float in a 12-month period. These rules may limit future issuances of shares by the Company under the ATM Agreements or other common stock offerings.

Private Placement Offerings

In February 2020, the Company and Lincoln Park Capital Fund, LLC (“Lincoln Park”) entered into (i) a securities purchase agreement (the “Securities Purchase Agreement”); (ii) a purchase agreement (the “Purchase Agreement”); and (iii) a registration rights agreement (the “Registration Rights Agreement”). Pursuant to the Securities Purchase Agreement, Lincoln Park purchased, and the Company sold, (i) an aggregate of 21,111 shares of common stock (the “Common Shares”); (ii) a warrant to initially purchase an aggregate of up to 13,476 shares of common stock at an exercise price of $0.45 per share (the “Series A Warrant”); and (iii) a warrant to initially purchase an aggregate of up to 34,588 shares of common stock at an exercise price of $52.20 per share (the “Series B Warrant,” and together with the Series A Warrant, the “Warrants”). No warrants associated with the Securities Purchase Agreement were exercised during the three months ended March 31, 2023 or 2022.

Under the terms and subject to the conditions of the Purchase Agreement, the Company has the right, but not the obligation, to sell to Lincoln Park, and Lincoln Park is obligated to purchase, up to $28.0 million in the aggregate of shares of common stock. In order to retain maximum flexibility to issue and sell up to the maximum of $28.0 million of the Company’s common stock under the Purchase Agreement, the Company sought and, at its annual meeting on April 19, 2021, received, stockholder approval for the sale and issuance of common stock in connection with the Purchase Agreement under Nasdaq Listing Rule 5635(d). Sales of common stock by the Company will be subject to certain limitations, and may occur from time to time, at the Company’s sole discretion, over the 36-month period commencing on August 14, 2020 (the “Commencement Date”).

Following the Commencement Date, under the Purchase Agreement, on any business day selected by the Company, the Company may direct Lincoln Park to purchase up to 2,222 shares of common stock on such business day (each, a “Regular Purchase”), provided, however, that (i) the Regular Purchase may be increased to up to 2,777 shares, provided that the closing sale price of the common stock is not below $3.00 on the purchase date; and (ii) the Regular Purchase may be increased to up to 3,333 shares, provided that the closing sale price of the common stock is not below $5.00 on the purchase date. In each case, Lincoln Park’s maximum

commitment in any single Regular Purchase may not exceed $1,000,000. The purchase price per share for each such Regular Purchase will be based on prevailing market prices of common stock immediately preceding the time of sale. In addition to Regular Purchases, the Company may direct Lincoln Park to purchase other amounts as accelerated purchases or as additional accelerated purchases if the closing sale price of the common stock exceeds certain threshold prices as set forth in the Purchase Agreement. In all instances, the Company may not sell shares of its common stock to Lincoln Park under the Purchase Agreement if it would result in Lincoln Park beneficially owning more than 9.99% of the outstanding shares of common stock. During the three months ended March 31, 2023 and 2022, no sales of common stock under the Purchase Agreement occurred. As of March 31, 2023, approximately $26.9 million of shares of common stock were remaining, but had not yet been sold by the Company under the Purchase Agreement.

On September 9, 2022, a registration statement was declared effective covering the resale of up to 1,750,000 additional shares of the Company’s common stock that the Company has reserved for issuance and sale to Lincoln Park under the Purchase Agreement (Registration Statement No. 333-267254).

The Company has the right to terminate the Purchase Agreement at any time, at no cost or penalty.

The Securities Purchase Agreement, the Purchase Agreement, and the Registration Rights Agreement contain customary representations, warranties, agreements, and conditions to completing future sale transactions, indemnification rights, and obligations of the parties.

Preferred Stock

Under the Company’s Restated Certificate of Incorporation, the Company’s Board has the authority to issue up to 5,000,000 shares of preferred stock with a par value of $0.01 per share, at its discretion, in one or more classes or series and to fix the powers, preferences and rights, and the qualifications, limitations, or restrictions thereof, including dividend rights, conversion rights, voting rights, terms of redemption, and liquidation preferences, without further vote or action by the Company’s stockholders. As of March 31, 2023, there were no shares of preferred stock outstanding.

NOTE 7. STOCK-BASED COMPENSATION

Equity Incentive Plans

On April 20, 2020, the Company’s stockholders approved the 2020 Omnibus Long-Term Incentive Plan (the “Omnibus Plan”), which replaced, with respect to new award grants, the Company’s 2009 Equity Incentive Plan, as amended and restated (the “2009 Plan”), and the Vical Equity Incentive Plan (the “Vical Plan”) (collectively, the “Prior Plans”) that were previously in effect. Following the approval of the Omnibus Plan on April 20, 2020, no further awards were available to be issued under the Prior Plans, but awards outstanding under those plans as of that date remain outstanding in accordance with their terms. As of March 31, 2023, 25,047 and 1,684 shares were subject to outstanding awards under the 2009 Plan and Vical Plan, respectively.

On May 17, 2022, the Company’s stockholders approved an increase in the number of shares of common stock authorized for issuance under the Omnibus Plan by 119,377 shares. As of March 31, 2023, 323,364 shares were authorized, and 338,305 shares were subject to outstanding awards under the Omnibus Plan. As of March 31, 2023, 18,854 shares remained available for grant under the Omnibus Plan.

Employee Stock Purchase Plan

On April 19, 2021, the Company’s stockholders approved the Fresh Tracks Therapeutics, Inc. Employee Stock Purchase Plan (the “ESPP”), which had a first eligible purchase period commencing on July 1, 2021. The ESPP allows qualified employees to purchase shares of the Company’s common stock at a price per share equal to

85% of the lower of: (i) the closing price of the Company’s common stock on the first trading day of the applicable purchase period or (ii) the closing price of the Company’s common stock on the last trading day of the applicable purchase period. New six-month purchase periods begin each January 1 and July 1. As of March 31, 2023, the Company had 42,728 shares available for issuance and 15,049 cumulative shares had been issued under the ESPP.

Stock-Based Compensation Expense

Total stock-based compensation expense reported in the condensed consolidated statements of operations was allocated as follows (in thousands):

| | | | | | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| | | | | 2023 | | 2022 |

| Research and development | | | | | $ | 92 | | | $ | 103 | |

| General and administrative | | | | | 287 | | | 448 | |

| Total stock-based compensation expense | | | | | $ | 379 | | | $ | 551 | |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

We are a clinical-stage pharmaceutical company striving to transform patient lives through the development of innovative and differentiated prescription therapeutics. Our pipeline aims to disrupt existing treatment paradigms and features several new chemical entities that inhibit novel targets with first-in-class potential for autoimmune, inflammatory, and other debilitating diseases. Our executive management team and board of directors (our “Board”) have a proven track record of leadership across early-stage research, product development, and global commercialization, having served in leadership roles at large global pharmaceutical and biotech companies that successfully developed and/or launched first-in-class products, some of which have achieved iconic status, including Cialis®, Taltz®, Gemzar®, Prozac®, Cymbalta®, Juvederm®, Pluvicto®, and sofpironium bromide. Our strategy is to align this experience and clear vision to explore beyond the limitations of current therapies by identifying, pursuing, and developing next-generation therapeutics that can be groundbreaking in their ability to help millions of people struggling with autoimmune, inflammatory, and other debilitating diseases.

Exploration of Strategic Options

Our Board and executive management team are conducting a comprehensive process to explore and evaluate strategic options to progress the development of our novel pipeline of potential treatments for autoimmune, inflammatory, and other diseases. Potential strategic options to be explored or evaluated as part of this process may include, but are not limited to, a financing, sale or licensing of assets, acquisition, merger, business combination, and/or other strategic transaction or series of related transactions involving our Company. MTS Health Partners, LP has been retained as our exclusive financial advisor to assist in this review process.

Research and Development Programs