UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

o | | Preliminary Proxy Statement |

o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement |

o | | Definitive Additional Materials |

o | | Soliciting Material Pursuant to §240.14a-12 |

| | |

Brickell Biotech, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

x | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| 1) | Title of each class of securities to which transaction applies: |

| | |

| 2) | Aggregate number of securities to which transaction applies: |

| | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| 4) | Proposed maximum aggregate value of transaction: |

| | |

| 5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials: | |

| | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| | |

| 1) | Amount Previously Paid: |

| | |

| 2) | Form, Schedule or Registration Statement No.: |

| | |

| 3) | Filing Party: |

| | |

| 4) | Date Filed: |

BRICKELL BIOTECH, INC.

5777 Central Avenue, Suite 102

Boulder, CO 80301

(720) 505-4755

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 31, 2020

TO THE STOCKHOLDERS OF BRICKELL BIOTECH, INC.:

NOTICE IS HEREBY GIVEN that a Special Meeting of Stockholders of Brickell Biotech, Inc., a Delaware corporation (the “Company”), will be held on August 31, 2020, at 10 a.m. (Mountain Time) at the offices of Brickell Biotech, Inc., 5777 Central Avenue, Suite 102, Boulder, Colorado 80301 (the “Special Meeting”), for the following purposes:

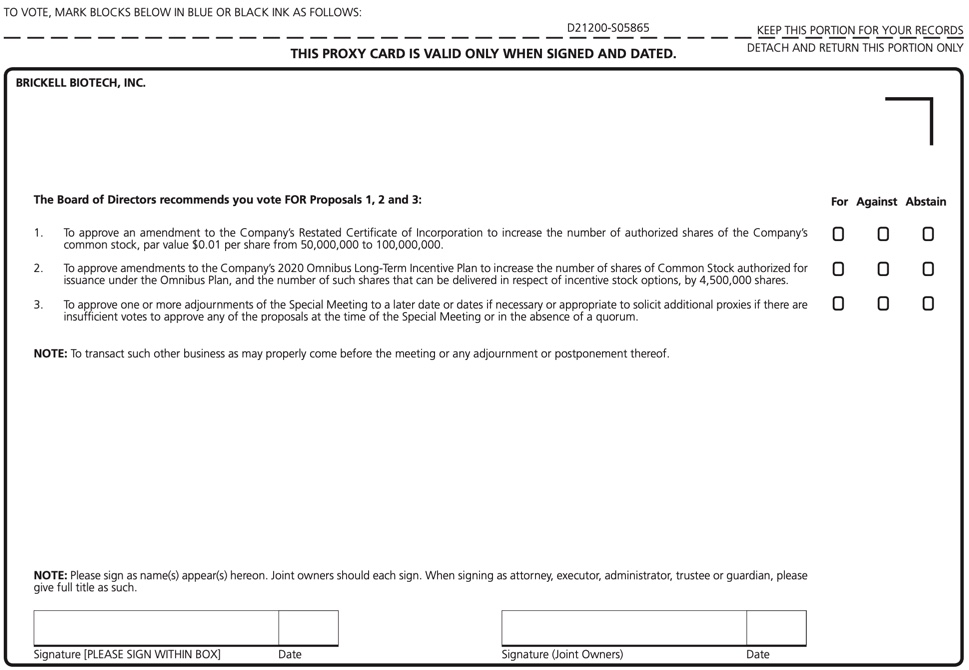

1.To approve an amendment to the Company’s Restated Certificate of Incorporation to increase the number of authorized shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”) from 50,000,000 to 100,000,000;

2.To approve amendments to the Company’s 2020 Omnibus Long-Term Incentive Plan (the “Omnibus Plan”) to increase the number of shares of Common Stock authorized for issuance under the Omnibus Plan, and the number of such shares that can be delivered in respect of incentive stock options, by 4,500,000 shares; and

3.To approve one or more adjournments of the Special Meeting to a later date or dates if necessary or appropriate to solicit additional proxies if there are insufficient votes to approve any of the proposals at the time of the Special Meeting or in the absence of a quorum.

The foregoing items of business are more fully described in the proxy statement accompanying this Notice.

The Board of Directors has fixed the close of business on July 24, 2020, as the record date for the Special Meeting. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

| | | | | |

| By Order of the Board of Directors |

| |

| |

| /s/ ROBERT B. BROWN |

| Robert B. Brown |

| Chief Executive Officer |

| |

| Boulder, Colorado | |

| July 27, 2020 | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON AUGUST 31, 2020.

This Notice of Special Meeting and the Proxy Statement are available at www.proxyvote.com.

TABLE OF CONTENTS

| | | | | | | | |

PROXY STATEMENT | | |

| QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING | | |

PROPOSAL 1 - APPROVAL OF AN AMENDMENT TO THE RESTATED CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK | | |

PROPOSAL 2 - APPROVAL OF AMENDMENTS TO THE BRICKELL BIOTECH, INC. 2020 OMNIBUS LONG-TERM INCENTIVE PLAN | | |

PROPOSAL 3 - APPROVAL OF ONE OR MORE ADJOURNMENTS OF THE MEETING TO SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT VOTES TO APPROVE ANY OF THE PROPOSALS AT THE TIME OF MEETING OR IN THE ABSENCE OF A QUORUM | | |

| | |

| | |

| | |

EXECUTIVE COMPENSATION | | |

DIRECTOR COMPENSATION | | |

EQUITY COMPENSATION PLAN INFORMATION | | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | |

SOLICITATION OF PROXIES | | |

HOUSEHOLDING OF PROXY MATERIALS | | |

OTHER MATTERS | | |

APPENDIX A– PROPOSED AMENDMENT TO THE RESTATED CERTIFICATE OF INCORPORATION | | |

APPENDIX B– BRICKELL BIOTECH, INC. 2020 OMNIBUS LONG-TERM INCENTIVE PLAN, AS PROPOSED TO BE AMENDED | | |

BRICKELL BIOTECH, INC.

5777 Central Avenue, Suite 102

Boulder, CO 80301

(720) 505-4755

PROXY STATEMENT FOR THE

SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 31, 2020

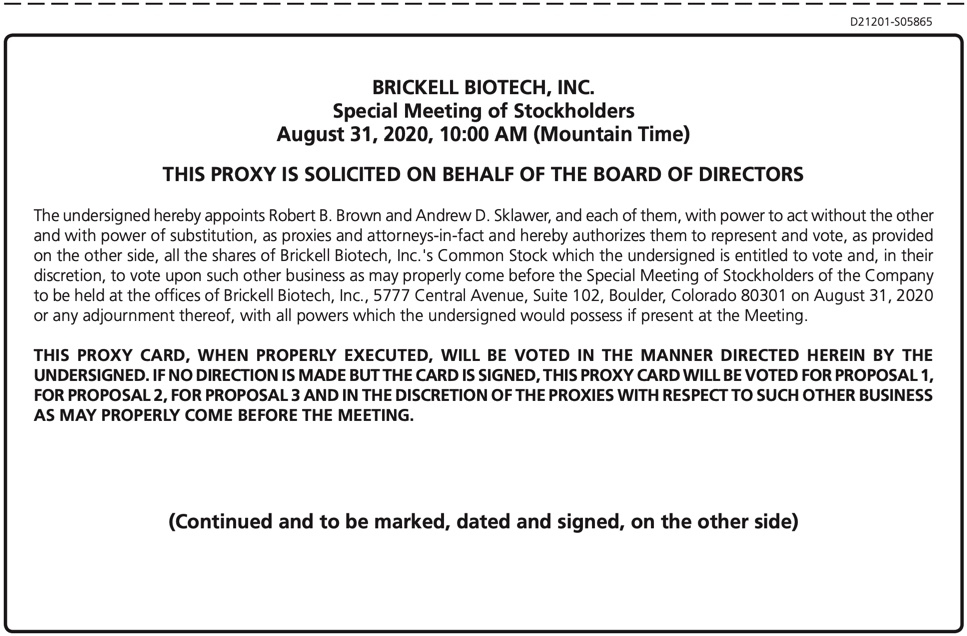

This proxy statement and the accompanying proxy card are being furnished to holders of shares of common stock of Brickell Biotech, Inc., a Delaware corporation (the “Company,” “we,” “us” or “our”), in connection with the solicitation of proxies by our Board of Directors (the “Board”) for use in connection with a Special Meeting of Stockholders (the “Special Meeting”) to be held on August 31 , 2020 at 10 a.m., Mountain Time, or at any adjournments or postponements thereof, for the purposes set forth herein. The Special Meeting will be held at the offices of Brickell Biotech, Inc., 5777 Central Avenue, Suite 102, Boulder, Colorado 80301.

This proxy statement and the proxy card are first being sent to stockholders commencing on or about July 27, 2020. We will pay for the cost of soliciting proxies to vote at the Special Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON AUGUST 31, 2020.

This Notice of Special Meeting and the Proxy Statement are available at www.proxyvote.com.

In accordance with the rules of the Securities and Exchange Commission, we are advising our stockholders of the availability on the Internet of our proxy materials related to the Special Meeting. These rules allow companies to provide access to proxy materials in one of two ways. Because we have elected to utilize the “full set delivery” option, we are delivering to all stockholders paper copies of all of the proxy materials, as well as providing access to those proxy materials on a publicly accessible website.

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

What am I voting on?

The following proposals are scheduled for a vote at the Special Meeting:

•To approve an amendment to the Company’s Restated Certificate of Incorporation to increase the number of authorized shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”) from 50,000,000 to 100,000,000;

•To approve amendments to the Company’s 2020 Omnibus Long-Term Incentive Plan (the “Omnibus Plan”) to increase the number of shares of Common Stock authorized for issuance under the Omnibus Plan, and the number of such shares that can be delivered in respect of incentive stock options, by 4,500,000 shares; and

•To approve one or more adjournments of the Special Meeting to a later date or dates if necessary or appropriate to solicit additional proxies if there are insufficient votes to approve any of the proposals at the time of the Special Meeting or in the absence of a quorum.

Who can vote at the Special Meeting?

Only stockholders of record at the close of business on July 24, 2020 (the “Record Date”), will be entitled to vote at the Special Meeting. On this record date, there were 27,271,573 shares of the Company’s Common Stock outstanding and entitled to vote.

Am I a stockholder of record?

If at the close of business on the Record Date, your shares were registered directly in your name with the Company’s transfer agent, then you are a stockholder of record.

What if my shares are not registered directly in my name but are held in street name?

If at the close of business on the Record Date, your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and the proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares in your account.

If I am a stockholder of record of the Company’s shares, how do I cast my vote?

If you are a stockholder of record, you may vote in person at the Special Meeting. We will give you a ballot when you arrive.

If you do not wish to vote in person or you will not be attending the Special Meeting, you may vote by proxy. You may vote by proxy over the telephone, on the Internet, or using a proxy card.

The procedures for voting by proxy are as follows:

•To vote by proxy on the Internet, go to http://www.proxyvote.com to complete an electronic proxy card.

•To vote by proxy using a proxy card, complete, sign and date your proxy card and return it promptly in the envelope provided.

•To vote by proxy over the telephone, dial the toll-free phone number listed on the proxy card under the heading “Vote by Phone” and follow the recorded instructions.

If you vote by proxy, your vote must be received by 11:59 p.m. Eastern Time on August 30, 2020, to be counted.

We provide Internet proxy voting to allow you to vote your shares on-line, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

If I am a beneficial owner of the Company’s shares, how do I vote?

If you are a beneficial owner of shares held in street name through a brokerage firm, bank, dealer, or other similar organization, you will receive instructions from that organization, which you must follow to vote your shares. Beneficial owners who wish to vote in person at the Special Meeting must obtain a valid legal proxy from the record owner. To request the requisite proxy form, follow the instructions provided by your broker or contact your broker.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least one-third (1/3) of the outstanding shares are present in person or represented by proxy at the Special Meeting. Abstentions and broker non-votes will be treated as shares present for purposes of determining the presence of a quorum. At the close of business on the Record Date, there were 27,271,573 shares outstanding and entitled to vote.

Therefore, 9,090,525 shares must be present at the Special Meeting or represented by proxy to have a quorum. If there is no quorum, a majority of the votes present at the Special Meeting or represented by proxy may adjourn the Special Meeting to another date.

How many votes are needed to approve each proposal?

•Proposal 1, the approval of an amendment to the Company's Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock, requires the affirmative vote of the holders of a majority of the outstanding shares of Common Stock of the Company entitled to vote.

•Proposal 2, the approval of amendments to the Company’s Omnibus Plan, requires the affirmative vote of the holders of a majority of shares either present in person or represented by proxy and entitled to vote.

•Proposal 3, the approval of one or more adjournments of the Special Meeting to a later date or dates if necessary or appropriate to solicit additional proxies if there are insufficient votes to approve any of the proposals at the time of the Special Meeting or in the absence of a quorum, requires the approval of a majority of the stockholders present in person or represented by proxy at the Special Meeting and entitled to vote, even if less than a quorum.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count votes “For” and “Against,” abstentions and, if applicable, broker non-votes. Abstentions will be counted toward the vote total for each proposal and will have the same effect as “Against” votes. A “broker non-vote” occurs when a stockholder of record, such as a broker, holding shares for a beneficial owner does not vote on a particular item because the stockholder of record does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

Proposals 1 and 3 are considered “routine” proposals under New York Stock Exchange rules. If you are a beneficial owner and your shares are held in the name of a broker or other nominee, the broker or other nominee is permitted to vote your shares on Proposals 1 and 3, even if the broker or other nominee does not receive voting instructions from you.

As a result, we do not anticipate any broker non-votes with respect to Proposals 1 and 3. Broker non-votes will be counted toward the presence of a quorum but, with respect to Proposal 2, will not be counted toward the vote total for, and will not have an effect on the outcome of, Proposal 2.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of the Company’s Common Stock you owned as of the close of business on July 24, 2020.

What does it mean if I receive more than one proxy card or voting instruction form?

If you received more than one proxy card or voting instruction form, your shares are registered in more than one name or are registered in different accounts. Please follow the voting instructions included in each proxy card and voting instruction form to ensure that all of your shares are voted.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “For” Proposal 1, the approval of an amendment to the Company's Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock, “For” Proposal 2, the approval of amendments to the Company’s Omnibus Plan, and “For” Proposal 3, the approval of one or more adjournments of the Special Meeting to a later date or dates if necessary or appropriate to solicit additional proxies if there are insufficient votes to approve any of the proposals at the time of the Special Meeting or in the absence of a quorum.

What are the costs of soliciting these proxies?

We will pay all of the costs of soliciting these proxies. Our officers, directors, employees and consultants may solicit proxies in person or by telephone, fax or email. We will pay these officers, directors, employees and consultants no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses. We have engaged Alliance Advisors, LLC (“Alliance”) to assist us in soliciting proxies for the Special Meeting. We will pay Alliance a base fee of $10,000, plus reasonable out-of-pocket expenses, plus an additional fee based upon the number of contacts with stockholders made and work performed. We estimate the total amount payable to Alliance will be approximately $15,000.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Special Meeting. You may revoke your proxy in any one of three ways:

•You may timely submit a later-dated proxy via the Internet, by telephone or by mail;

•You may send a written notice that you are revoking your proxy to the Company’s Corporate Secretary at 5777 Central Avenue, Suite 102, Boulder, CO 80301; or

•You may attend the Special Meeting and vote in person. Simply attending the Special Meeting will not, by itself, revoke your proxy.

What is the deadline to submit a proposal for inclusion in the proxy materials for the 2021 Annual Meeting?

To be eligible for inclusion in the proxy materials for the 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting”), a stockholder proposal must be received by our Corporate Secretary by November 30, 2020. Stockholder proposals should be addressed to Brickell Biotech, Inc., Attn: Corporate Secretary, 5777 Central Avenue, Suite 102, Boulder, CO 80301. Such proposals need to comply with SEC regulations regarding the inclusion of stockholder proposals in our sponsored proxy materials.

What procedure should I follow if I intend to present a proposal or nominate a director from the floor at the 2021 Annual Meeting?

If you wish to present a proposal from the floor at the 2021 Annual Meeting, the proposal must be received by our Corporate Secretary not less than 90 calendar days nor more than 120 calendar days prior to the date of the meeting in order for the proposal to be considered. If we provide less than 45 calendar days’ notice or public disclosure of the date of the 2021 Annual Meeting, a stockholder proposal must be received by our Corporate Secretary not later than the close of business on the 10th business day following the date on which such notice is mailed or such public disclosure is made.

If you wish to present a director nomination from the floor at the 2021 Annual Meeting, your written recommendation to the Nominating and Corporate Governance Committee must be received by our Corporate Secretary at least 120 days prior to the date of the meeting in order for the nomination to be considered. If we provide less than 90 calendar days’ notice of the 2021 Annual Meeting, your written recommendation must be received by our Corporate Secretary not later than the close of business on the seventh calendar day following the date on which the notice of meeting was mailed. All proposals and nominations must be submitted in writing to Brickell Biotech, Inc., Attn: Corporate Secretary, 5777 Central Avenue, Suite 102, Boulder, CO 80301. You are also advised to review the Company’s Bylaws, which you may request in writing from the Company’s Corporate Secretary at the address above and which contain additional requirements about advance notice of stockholder proposals and director nominations.

PROPOSAL 1

APPROVAL OF AN AMENDMENT TO THE COMPANY'S

RESTATED CERTIFICATE OF INCORPORATION

TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

On July 14, 2020, the Board adopted, subject to stockholder approval, an amendment to Article IV, Section A of our Restated Certificate of Incorporation (the “Charter Amendment”) to increase the number of authorized shares of Common Stock by 50,000,000 shares, or from 50,000,000 shares to 100,000,000 shares. The following discussion is qualified by the text of the Charter Amendment, which is set forth in Appendix A attached to this proxy statement. The Board believes that the Charter Amendment is necessary to maintain flexibility to issue shares of Common Stock for future corporate needs.

The additional authorized shares of Common Stock to be authorized by the Charter Amendment would have rights identical to our current issued and outstanding shares of Common Stock. Issuance of the additional shares of Common Stock would not affect the rights of the holders of our issued and outstanding shares of Common Stock, except for effects incidental to any increase in the number of shares of Common Stock issued and outstanding, such as dilution of earnings per share and voting rights.

If the Charter Amendment is approved by stockholders at the Special Meeting, then it will become effective upon filing of a Certificate of Amendment to our Restated Certificate of Incorporation with the Delaware Secretary of State, which filing is expected to occur promptly following the Special Meeting. The Board reserves the right, notwithstanding stockholder approval of the Charter Amendment and without further action by our stockholders, not to proceed with the Charter Amendment at any time before it becomes effective.

Capitalization

Our Restated Certificate of Incorporation currently authorizes up to 55,000,000 shares of capital stock, of which 50,000,000 are shares of Common Stock and 5,000,000 are shares of preferred stock, par value $0.01 per share. As of July 14, 2020, we had no shares of preferred stock issued and outstanding and the Charter Amendment does not affect the number of authorized shares of preferred stock.

On June 22, 2020, we completed a registered public offering (the “June 2020 Offering”) and sold 14,790,133 shares of our Common Stock, pre-funded warrants to purchase 2,709,867 shares of our Common Stock, and accompanying common warrants to purchase up to an aggregate of 17,500,000 shares of our Common Stock. As a result, and in addition to shares of our Common Stock previously issued or reserved for issuance, as of July 14, 2020, we estimate that the following shares of Common Stock were issued or reserved for future issuance:

•26,671,573 shares were issued and outstanding;

•1,578,231 shares were reserved for issuance upon the exercise of outstanding stock options;

•253,045 shares were reserved for issuance upon the settlement of outstanding restricted stock units; and

•20,669,533 shares were reserved for issuance upon the exercise of outstanding warrants.

Under the terms of the Omnibus Plan approved by our stockholders at our 2020 Annual Meeting of Stockholders held on April 20, 2020 (the “2020 Annual Meeting”), 679,389 shares of Common Stock were authorized for issuance under the Omnibus Plan. As a result of the June 2020 Offering, if the Charter Amendment is not approved by our stockholders, we will be severely limited in our ability to grant additional awards under the Omnibus Plan, which in turn will severely limit our ability to attract and retain employees. In addition, the Board has determined that it is in the best interests of our company and stockholders to provide for

additional shares to be used for equity compensation awards under the Omnibus Plan, and therefore, pursuant to this proxy statement, we are also seeking the approval of our stockholders to increase the number of shares of our Common Stock available for issuance under the Omnibus Plan by 4,500,000. See “Proposal 2 – Approval of Amendments to the Brickell Biotech, Inc. 2020 Omnibus Long-Term Incentive Plan.”

Further, the Board had previously reserved 10,000,000 shares of Common Stock for issuance pursuant to a purchase agreement (the “Lincoln Park Purchase Agreement”) with Lincoln Park Capital Fund, LLC (“Lincoln Park”), pursuant to which Lincoln Park agreed to purchase from us up to an aggregate of $28.0 million of our Common Stock (subject to certain limitations) from time to time over the 36-month term of the Lincoln Park Purchase Agreement. As a result of the June 2020 Offering, the Board re-allocated 10,000,000 shares previously reserved for issuance related to the Lincoln Park Purchase Agreement, to instead be reserved for issuance under the warrants issued in the June 2020 Offering. As a result, if the Charter Amendment is not approved by stockholders, we will be significantly limited in our ability to utilize the Lincoln Park Purchase Agreement as a source of capital.

Accordingly, at July 14, 2020, 827,618 shares of Common Stock remained unreserved and available for future issuance. In consideration of the foregoing, the Board approved the Charter Amendment in substantially the form set forth in Appendix A and has recommended that our stockholders do the same.

Reasons for the Charter Amendment

We believe that the additional shares of authorized Common Stock under the Charter Amendment are necessary to provide us with appropriate flexibility to utilize equity for business and financial purposes that the Board determines to be in our company’s best interests on a timely basis without the expense and delay of a stockholders’ meeting. The Board believes that the currently remaining authorized Common Stock is not likely to be sufficient to permit us to respond to potential business opportunities or to pursue important objectives designed to enhance stockholder value, or to recruit and retain employees, directors, officers and consultants. In particular, without additional authorized shares of Common Stock, we will be severely restricted in our ability to pursue the additional financing required to complete our U.S. Phase 3 clinical trials of sofpironium bromide and conduct the necessary research and development activities related to regulatory submissions for sofpironium bromide. In addition, the number of currently remaining authorized shares of Common Stock will significantly limit our ability to issue shares under the Lincoln Park Purchase Agreement or to grant new equity awards under the Omnibus Plan up to the full amount authorized under the Omnibus Plan, either before or after the proposed increase in such amount as described further under “Proposal 2 – Approval of Amendments to the Brickell Biotech, Inc. 2020 Omnibus Long-Term Incentive Plan.”

The additional authorized shares of Common Stock under the Charter Amendment will provide us with flexibility to use our Common Stock, without further stockholder approval (except to the extent such approval may be required by law or by applicable exchange listing standards) for any proper corporate purposes, including, without limitation, raising capital through one or more future public offerings or private placements of equity securities, issuing shares under the Lincoln Park Purchase Agreement, expanding our business, acquisition transactions, entering into strategic relationships, providing equity-based compensation and/or incentives to employees, consultants, officers and directors, effecting stock dividends or for other general corporate purposes. For example, we will require substantial additional funding in order to complete our U.S. Phase 3 clinical trials of sofpironium bromide, our primary product candidate, and the additional authorized shares of Common Stock under the Charter Amendment could be utilized for a financing if we have an appropriate opportunity. Having an increased number of authorized but unissued shares of Common Stock would allow us to take prompt action with respect to corporate opportunities that develop, without the delay and expense of convening a special meeting of stockholders for the purpose of approving an increase in our capitalization. The Board will determine whether, when and on what terms the issuance of shares of Common Stock may be warranted in connection with any of the foregoing purposes.

If the Charter Amendment is not approved by our stockholders, our business development and financing alternatives may be limited by the lack of sufficient unissued and unreserved authorized shares of Common Stock, and stockholder value may be harmed, perhaps severely, by this limitation. In addition, our success depends in part on our continued ability to attract, retain and motivate highly qualified management and clinical and scientific personnel, and if the Charter Amendment is not approved by our stockholders, the lack of sufficient unissued and unreserved authorized shares of Common Stock to provide future equity incentive opportunities that our Compensation Committee deems appropriate could adversely impact our ability to achieve these goals. In summary, if our stockholders do not approve the Charter Amendment, we may not be able to access the capital markets, initiate or complete pivotal clinical trials and other key development activities, complete corporate collaborations or partnerships, attract, retain and motivate employees and others required to make our business successful, and pursue other business opportunities integral to our growth and success, all of which could severely harm our company and our prospects.

Other than shares related to future awards under the Omnibus Plan, outstanding awards issued pursuant to the Omnibus Plan or prior equity compensation plans, the Lincoln Park Purchase Agreement, our amended and restated license agreement with Bodor Laboratories, Inc. and Dr. Nicholas S. Bodor, and outstanding warrants, we do not currently have any other arrangements, agreements or understandings that would require the issuance of additional shares of our Common Stock. Because it is anticipated that our directors and executive officers will be granted additional equity awards under the Omnibus Plan, they may be deemed to have an indirect interest in the Charter Amendment, because absent the Charter Amendment, we would not have sufficient authorized shares to grant such awards.

Possible Effects of the Amendment

The increase in authorized shares of our Common Stock under the Charter Amendment will not have any immediate effect on the rights of existing stockholders. However, because the holders of our Common Stock do not have any preemptive rights, future issuance of shares of Common Stock or securities exercisable for or convertible into shares of Common Stock could have a dilutive effect on our earnings per share, book value per share, voting rights of stockholders and could have a negative effect on the price of our Common Stock.

The Board has not proposed the increase in the number of authorized shares of Common Stock with the intent of using the additional shares to prevent or discourage any actual or threatened takeover of our company. Under certain circumstances, however, the additional authorized shares could be used in a manner that has an anti-takeover effect. For example, the additional shares could be used to dilute the stock ownership or voting rights of persons seeking to obtain control of our company or could be issued to persons allied with the Board or management and thereby have the effect of making it more difficult to remove directors or members of management by diluting the stock ownership or voting rights of persons seeking to effect such a removal. Accordingly, if the Charter Amendment is approved by stockholders, the additional shares of authorized Common Stock may render more difficult or discourage a merger, tender offer or proxy contest, the assumption of control by a holder or group of holders of a large block of Common Stock, or the replacement or removal of one or more directors or members of management.

The following other provisions of our Restated Certificate of Incorporation and Amended and Restated Bylaws, in combination with the additional authorized shares, may also have an anti-takeover effect of preventing or discouraging a change in control of our company: (i) a Board comprised of three classes of directors with each class serving a staggered three-year term; (ii) authorizing the Board to issue preferred stock from time to time, in one or more classes or series, without stockholder approval; (iii) requiring the approval of at least two-thirds of our outstanding voting stock to amend specified provisions of our Restated Certificate of Incorporation; (iv) requiring the approval of at least two-thirds of our total number of authorized directors, or two-thirds of our outstanding voting stock, to amend our Amended and Restated Bylaws; (v) providing that special meetings of our stockholders may be called only by our Chief Executive Officer, or by the Board pursuant to a resolution adopted by a majority of the total number of authorized directors; (vi) providing that vacancies on the Board

and newly created directorships may be filled only by a majority of the directors then in office, though less than a quorum, or by a sole remaining director; and (vii) the absence of cumulative voting rights in the election of directors.

The Board of Directors recommends a vote “FOR” approval of the amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock.

PROPOSAL 2

APPROVAL OF AMENDMENTS TO THE

BRICKELL BIOTECH, INC. 2020 OMNIBUS LONG-TERM INCENTIVE PLAN

On March 16, 2020, the Board approved, and on April 20, 2020, our stockholders approved, the Omnibus Plan. On July 14, 2020, the Board, based on the recommendation of the Compensation Committee, approved the following amendments to the Omnibus Plan, subject to stockholder approval:

•an increase in the maximum number of shares that may be delivered under the Omnibus Plan by an additional 4,500,000 shares, from 679,389 shares to 5,179,389 shares (which amount is in addition to any shares granted previously under the Company’s 2009 Equity Incentive Plan, as amended, and the Amended and Restated Stock Incentive Plan of Vical Incorporated (the “Prior Plans”) that are forfeited, expire or are canceled after the effective date of the Omnibus Plan without delivery of shares or which result in the forfeiture of the shares back to us to the extent that such shares would have been added back to the reserve under the terms of the Prior Plans); and

•a corresponding increase in the maximum number of shares that may be delivered with respect to incentive stock options granted under the Omnibus Plan by an additional 4,500,000 shares, from 679,389 shares to 5,179,389 shares;

(collectively, the “Plan Amendments”). A copy of the Omnibus Plan, as proposed to be amended, is attached to this proxy statement as Appendix B and is marked to show the proposed Plan Amendments.

Purpose

Equity compensation is an important component of our executive, employee, consultant and director compensation programs. We believe it best aligns employee, consultant and director compensation with stockholder interests and motivates participants to achieve long-range goals tied to the success of the company. The Omnibus Plan permits shares of our Common Stock to be awarded as employee incentive compensation, allowing the Board to attract and retain key employees, provide them competitive compensation, adapt to evolving compensation practices and account for our growth.

Key Reasons to Vote for this Proposal:

•Equity awards are a key part of our compensation program. We believe that equity compensation has been, and will continue to be, a critical component of our compensation package because it (i) contributes to a culture of ownership among our employees and other service providers, (ii) aligns our employees’ interests with the interests of our other stockholders, and (iii) preserves our cash resources. It has been our practice to grant equity broadly throughout the organization, not just to executive officers and directors. We compete for talent in an extremely competitive industry, often with larger companies with greater resources. We believe that our ability to compensate with equity awards is essential to our efforts to attract and retain top talent. Equity awards are an essential part of our compensation package, are central to our employment value proposition, and are necessary for us to continue competing for top talent as we grow.

•Equity awards incentivize the achievement of key business objectives and increases in stockholder value. Our equity program primarily consists of stock options and restricted stock units. Stock options are performance-based because no value is realized unless our stock price increases from the date of grant. We believe that equity awards have been and will continue to be critical to our success and that they play an important role in incentivizing employees across our company to achieve our key business objectives and drive increases in stockholder value. The Omnibus Plan promotes the long-term

financial interest of our company, including the growth in value of our company’s equity and enhancement of long-term stockholder return.

•The Omnibus Plan provides necessary flexibility to the Board. Specifically, the Omnibus Plan provides for the grant of non-qualified and incentive stock options, full value awards, and cash incentive awards. The flexibility inherent in the plan permits the Board to change the type, terms and conditions of awards as circumstances may change. We believe that this flexibility and the resulting ability to more affirmatively adjust the nature and amounts of executive compensation are particularly important for a public company such as ours, given the volatility of the public markets and reactions to economic and world events especially given the current pandemic. Equity compensation, which aligns the long-term interests of both executives and our stockholders, is an important tool for the Board which without the stockholder approval of this Proposal 2 will not be available to our Board in any meaningful way.

Historic Use of Equity and Need for Additional Shares

Under the terms of the Omnibus Plan approved by our stockholders at the 2020 Annual Meeting, 679,389 shares of Common Stock were authorized for issuance under the Omnibus Plan. As a result of the June 2020 Offering, the Board utilized authorized shares that were previously reserved for issuance under the Omnibus Plan and not subject to outstanding awards under the Omnibus Plan, to instead be reserved for issuance under the warrants issued in the June 2020 Offering. As a result, if the Charter Amendment is not approved by our stockholders, we will be severely limited in our ability to grant additional awards under the Omnibus Plan, severely limiting our ability to attract and retain employees, including current employees. In addition, regardless of whether the Charter Amendment is approved by stockholders, although the Omnibus Plan was adopted in April 2020 and awards representing 92,436 shares have been granted under the Omnibus Plan through July 14, 2020, the Compensation Committee of the Board has recently reviewed the number of shares available for issuance under the Omnibus Plan, which was approximately 694,162 shares as of July 14, 2020, and determined that such number would likely be insufficient to meet our anticipated retention and recruiting needs. The Compensation Committee also considered the amount of outstanding stock options that are underwater. All of our outstanding stock options are “underwater,” meaning the exercise price of each of those options is greater than our current stock price as of July 14, 2020.

In setting the number of additional shares to be available for issuance under the Plan Amendments, we considered the significant number of additional shares and warrants issued in the June 2020 Offering, in addition to our estimated going forward competitive usage needs for existing employees and potential new hires for approximately the next one to three years, with such timing dependent on a variety of factors, including the price of our shares and hiring activity during the next few years, forfeitures of outstanding awards, and noting that future circumstances may require us to change our current equity grant practices. We cannot predict our future equity grant practices, the future price of our shares or future hiring activity with any degree of certainty at this time, and the share reserve under the Omnibus Plan could last for a shorter or longer time.

Based on these considerations, an additional 4,500,000 shares are being proposed to be made available for issuance under the Omnibus Plan, which the Compensation Committee believes represents an appropriate increase at this time.

As of July 14, 2020, our dilution (calculated as the number of shares available for grant under the Omnibus Plan divided by the total number of fully diluted shares outstanding) was approximately 1.4%. If the Plan Amendments are approved, and if the Charter Amendment is approved, the potential dilution from issuances authorized under the Omnibus Plan as of July 14, 2020 would increase to approximately 9.6%. While we acknowledge the potential dilutive effect of stock-based compensatory awards, the Board and the Compensation Committee believe that the performance and motivational benefits that can be achieved from offering such awards outweigh this potential dilutive effect.

The Compensation Committee believes that the ability to provide equity compensation to our executives and other employees and consultants has been, and will continue to be, essential to our ability to continue to attract, retain and motivate talented employees. The Compensation Committee believes that equity-based compensation is a key feature of a competitive compensation program. Further, equity-based compensation awards help align our employees’ and consultants’ interests with those of our stockholders.

Key Compensation Practices Reflected in the Omnibus Plan

The Omnibus Plan contains a number of provisions that we believe are consistent with the interests of our stockholders and sound corporate governance practices, including:

•No repricing of stock options. The Omnibus Plan prohibits the repricing of stock options without stockholder approval. This prohibition includes decreasing the exercise price of a stock option after the date of grant or replacing a stock option for cash or another award if the exercise price is greater than the then-current fair market value of the underlying stock.

•No discounted stock options. The exercise price for a stock option may not be less than the fair market value of the underlying stock at the time the option is granted.

•No liberal share recycling. The following shares will not become available again for issuance under the Omnibus Plan: (i) shares used to satisfy the applicable tax withholding obligation or payment of the exercise price; (ii) shares tendered to satisfy the payment of the exercise price of a stock option; or (iii) shares repurchased by us with proceeds received from the exercise of a stock option.

•No liberal definition of “change in control.” No change in control would be triggered on mere stockholder approval of a transaction.

•Limits on dividends and dividend equivalents. The Omnibus Plan prohibits the payment of dividends or dividend equivalents on stock options, and provides that no dividends or dividend equivalents granted in relation to full value awards that are subject to vesting shall be settled prior to the date that such full value award (or applicable portion thereof) becomes vested and is settled.

•Minimum vesting or performance period for all awards. Subject to certain limited exceptions, a minimum vesting or performance period of one year is prescribed for all awards.

General Terms of the Omnibus Plan

The following summary of the Omnibus Plan is not a comprehensive description of all provisions of the Omnibus Plan and should be read in conjunction with, and is qualified in its entirety by reference to, the complete text of the Omnibus Plan, which is attached as Appendix B to this proxy statement and is marked to show the proposed Plan Amendments.

The Omnibus Plan is administered by the Compensation Committee of the Board unless otherwise provided by the Board. The Compensation Committee selects the Participants, the time or times of receipt of awards, the types of awards to be granted and the applicable terms, conditions, performance targets, restrictions and other provisions of such awards, to cancel or suspend awards, and to accelerate the exercisability or vesting of any award under circumstances designated by it. The Compensation Committee may delegate all or any portion of its responsibilities or powers under the Omnibus Plan to persons selected by it. If the Compensation Committee does not exist or for any other reason determined by the Board, and to the extent not prohibited by applicable law or the applicable rules of any stock exchange, the Board may take any action under the Omnibus Plan that would otherwise be the responsibility of the Compensation Committee.

If an award of Common Stock is forfeited without the delivery of shares, the total number of shares with respect to which such payment is made shall not be considered to have been delivered. However, (i) if shares covered by an award are used to satisfy the applicable tax withholding obligation, the number of shares held back by us to satisfy such withholding obligation shall be considered to have been delivered; (ii) if the exercise price of any option granted under the Omnibus Plan is satisfied by tendering Company shares to us (including Company shares that would otherwise be distributable upon the exercise of the option), the number of Company shares tendered to satisfy such exercise price shall be considered to have been delivered; and (iii) if we repurchase Company shares with proceeds received from the exercise of an option issued under the Omnibus Plan, the total number of shares repurchased shall be deemed delivered.

Notwithstanding the minimum vesting limitations described below with respect to options and full value awards, the Compensation Committee may grant options and full value awards that are not subject to such minimum vesting provisions. The total aggregate number of Company shares subject to options and full value awards granted pursuant to the Omnibus Plan that are not subject to such minimum vesting limitations may not exceed five percent of the limit of the total number of Company shares that may be delivered under the Omnibus Plan.

The Company shares with respect to which awards may be made under the Omnibus Plan shall be:

•shares currently authorized but unissued;

•to the extent permitted by applicable law, currently held or acquired by us as treasury shares, including shares purchased in the open market or in private transactions; or

•shares purchased in the open market by a direct or indirect wholly-owned subsidiary of Company, and we may contribute to the subsidiary an amount sufficient to accomplish the purchase of the shares to be so acquired.

At the discretion of the Compensation Committee, an award under the Omnibus Plan may be settled in cash, Company shares, the granting of replacement awards, or a combination thereof; provided, however, that if a cash incentive award is settled in Company shares, it must satisfy the minimum vesting requirements related to full value awards.

The Compensation Committee may use Company shares available under the Omnibus Plan as the form of payment for compensation, grants or rights earned or due under any other compensation plans or arrangements of our company or a subsidiary, including the plans and arrangements of our company or a subsidiary assumed in business combinations.

In the event of a corporate transaction involving us (including, without limitation, any share dividend, share split, extraordinary cash dividend, recapitalization, reorganization, merger, amalgamation, consolidation, share exchange, split-up, spin-off, sale of assets or subsidiaries, combination or exchange of shares), the Compensation Committee shall adjust outstanding awards to preserve the benefits or potential benefits of the awards. Action by the Compensation Committee may include:

•adjustment of the number and kind of shares which may be delivered under the Omnibus Plan;

•adjustment of the number and kind of shares subject to outstanding awards;

•adjustment of the exercise price of outstanding options; and

•any other adjustments that the Compensation Committee determines to be equitable, which may include, without limitation:

•replacement of awards with other awards which the Compensation Committee determines have comparable value and which are based on stock of a company resulting from the transaction; and

•cancellation of the award in return for cash payment of the current value of the award, determined as though the award is fully vested at the time of payment, provided that in the case of an option, the amount of such payment will be the excess of value of the Company shares subject to the option at the time of the transaction over the exercise price.

Except as otherwise provided by the Compensation Committee, awards under the Omnibus Plan are not transferable except as designated by the Participant by will or by the laws of descent and distribution.

Eligibility and Shares Subject to the Omnibus Plan

All employees and directors of, and consultants and other persons providing services to, our company or any of its subsidiaries (or any parent or other related company, as determined by the Compensation Committee) are eligible to become Participants in the Omnibus Plan, except that non-employees may not be granted incentive stock options.

As of July 14, 2020, we had 12 employees and four non-employee directors eligible to participate in the Omnibus Plan.

As of April 20, 2020, the effective date of the Omnibus Plan, the maximum number of shares of Common Stock that could be delivered to Participants and their beneficiaries under the Omnibus Plan was (i) 679,389 shares; and (ii) any shares granted previously under the Prior Plans that are forfeited, expire or are canceled after April 20, 2020 without delivery of shares or which result in the forfeiture of the shares back to us to the extent that such shares would have been added back to the reserve under the terms of the Prior Plans, but not including shares that remained available for grant pursuant to the Prior Plans that were not previously granted. Since April 20, 2020 and through July 14, 2020, a total of 92,436 shares of Common Stock have been issued pursuant to or are subject to awards under the Omnibus Plan.

The Plan Amendments would increase the total number of shares of Common Stock available for the grant of awards under the Omnibus Plan by an additional 4,500,000 shares, from 679,389 shares to 5,179,389 shares, plus the number of shares granted previously under the Prior Plans that are forfeited, expire or are canceled after April 20, 2020. If an award granted under the Omnibus Plan is forfeited or canceled, or is settled in cash, the undelivered shares of Common Stock that were subject to the award will be available for future awards under the Omnibus Plan. The following shares of Common Stock may not again be made available for issuance as awards under the Omnibus Plan: (i) shares of Common Stock tendered or withheld to pay the exercise price or withholding taxes related to an outstanding award, or (ii) shares repurchased by us with proceeds received from the exercise of an option issued under the Omnibus Plan.

The allocation of the additional 4,500,000 shares of stock which the stockholders are being asked to approve has not been determined. Pursuant to the terms of the Omnibus Plan, the Compensation Committee and/or committees appointed by the Board will determine the number of options and restricted stock units (“RSUs”) (and any other awards) to be allocated to our employees, consultants and non-employee directors under the Omnibus Plan in the future, and such allocations may only be made in accordance with the provisions of the Omnibus Plan as described herein.

Options

The Compensation Committee may grant an incentive stock option or non-qualified stock option to purchase Company shares at an exercise price determined by the Compensation Committee. Each option shall be designated as an incentive stock option or non-qualified stock option when granted. An incentive stock option is

a stock option intended to satisfy additional requirements required by federal tax rules in the United States as specified in the Omnibus Plan (and any incentive stock option granted that does not satisfy such requirements shall be treated as a non-qualified stock option).

The maximum number of shares of Common Stock that may be delivered to Participants and their beneficiaries with respect to incentive stock options granted under the Omnibus Plan currently is 679,389 shares of Common Stock. If the Plan Amendments are approved by stockholders, the maximum number of shares of Common Stock that may be delivered to Participants and their beneficiaries with respect to incentive stock options granted under the Omnibus Plan would be increased to 5,179,389 shares of Common Stock.

Except as described below, the exercise price for an option shall not be less than the fair market value of a Company share at the time the option is granted; provided, that the exercise price of an incentive stock option granted to any employee who owns more than 10 percent of the voting power of all classes of stock in our company or a subsidiary shall not be less than 110 percent of the fair market value of a Company share at the time of grant. The exercise price of an option may not be decreased after the date of grant nor may an option be surrendered to us as consideration for the grant of a replacement option with a lower exercise price, except as approved by our stockholders or as adjusted for the corporate transactions described above. On July 14, 2020, the closing price for our Common Stock on the Nasdaq Stock Market was $0.84 per share.

No option shall be surrendered to us in consideration for a cash payment or grant of any other award if at the time of such surrender the exercise price of such option is greater than the then current fair market value of a share of Common Stock, except as approved by our stockholders. In addition, the Compensation Committee may grant options with an exercise price less than the fair market value of the Company shares at the time of grant in replacement for awards under other plans assumed in connection with business combinations if the Compensation Committee determines that doing so is appropriate to preserve the benefit of the awards being replaced. No dividend equivalents may be granted under the Omnibus Plan with respect to any option.

The option shall be exercisable in accordance with the terms established by the Compensation Committee, but in no event shall an option become exercisable or vested prior to the earlier of (i) the first anniversary of the date of grant or (ii) the date on which the Participant’s termination occurs by reason of death or disability, change in control or involuntary termination.

The full purchase price of each Company share purchased upon the exercise of any option shall be paid at the time of exercise of an option. Except as otherwise determined by the Compensation Committee, the purchase price of an option shall be payable in cash, by promissory note, or by Company shares (valued at fair market value as of the day of exercise), including shares of stock otherwise distributable on the exercise of the option, or a combination thereof. If the shares remain publicly traded, the Compensation Committee may permit a Participant to pay the exercise price by irrevocably authorizing a third party to sell Company shares (or a sufficient portion of the Company shares) acquired upon exercise of the option and remit to us a sufficient portion of the sale proceeds to pay the entire exercise price and any tax withholding resulting from such exercise. The Compensation Committee, in its discretion, may impose such conditions, restrictions, and contingencies on Company shares acquired pursuant to the exercise of an option as the Compensation Committee determines to be desirable. In no event will an option expire more than ten years after the grant date; provided, that an incentive stock option granted to any employee who owns more than 10 percent of the voting power of all classes of stock in our company or a subsidiary shall not be more than 5 years.

Full Value Awards

The following types of “full value awards” may be granted, as determined by the Compensation Committee:

•the Compensation Committee may grant awards in return for previously performed services or in return for the Participant surrendering other compensation that may be due;

•the Compensation Committee may grant awards that are contingent on the achievement of performance or other objectives during a specified period; and

•the Compensation Committee may grant awards subject to a risk of forfeiture or other restrictions that lapse upon the achievement of one or more goals relating to completion of service by the Participant, or achievement of performance or other objectives.

Any such awards shall be subject to such conditions, restrictions and contingencies as the Compensation Committee determines. If the right to become vested in a full value award is conditioned on the completion of a specified period of service with the Company or its subsidiaries, without achievement of performance targets or other performance objectives being required as a condition of vesting, and without it being granted in lieu of other compensation, then the required period of service shall not end prior to the first anniversary of the date of grant. If the right to become vested in a full value award is conditioned on the achievement of performance targets or performance objectives, and without it being granted in lieu of other compensation, then the required performance period shall not end prior to the first anniversary of the date of grant. In the event the Participant’s termination occurs due to death, disability or involuntary termination without cause, any unvested full value awards shall become vested only as determined by the Compensation Committee in its sole discretion.

Dividends or dividend equivalents settled in cash or Company shares may be granted to a Participant in relation to a full value award with payments made either currently or credited to an account. No dividend or dividend equivalents granted in relation to a full value award that is subject to vesting shall be settled prior to the date such full value award (or applicable portion thereof) becomes vested and is settled.

Change in Control

A change in control shall have such effect on an award as is provided in the applicable award agreement, or, to the extent not prohibited by the Omnibus Plan or the applicable award agreement, as provided by the Compensation Committee. In the event of a change in control, the Compensation Committee may cancel any outstanding awards in return for cash payment of the current value of the award, determined with the award fully vested at the time of payment, provided that in the case of an option, the amount of such payment will be the excess of value of the Company shares subject to the option at the time of the transaction over the exercise price (and the option will be canceled with no payment if the value of the shares at the time of the transaction are equal to or less than the exercise price).

For the purposes of the Omnibus Plan, a “change in control” is generally deemed to occur when:

•any person becomes the beneficial owner of 50 percent or more of our voting stock;

•the consummation of a reorganization, merger, consolidation, acquisition, share exchange or other corporate transaction involving our company where, immediately after the transaction, our stockholders immediately prior to the combination hold, directly or indirectly, 50 percent or less of the voting stock of the combined company;

•the consummation of any plan of liquidation or dissolution providing for the distribution of all or substantially all of the assets of our company and its subsidiaries or the consummation of a sale of substantially all of the assets of our company and its subsidiaries; or

•at any time during any period of two consecutive years, individuals who at the beginning of such period were members of the Board, who we refer to as Incumbent Directors, cease for any reason to constitute at least a majority thereof (unless the election, or the nomination for election by our stockholders, of each new director was approved by a vote of at least two-thirds of the Incumbent Directors.

Amendment and Termination

The Board may amend or terminate the Omnibus Plan at any time, and the Board or the Compensation Committee may amend any award granted under the Omnibus Plan, but no amendment or termination may adversely affect the rights of any Participant without the Participant’s written consent. The Board may not amend the provision of the Omnibus Plan related to re-pricing without approval of stockholders or make any material amendments to the Omnibus Plan without stockholder approval. The Omnibus Plan will remain in effect as long as any awards under the Omnibus Plan remain outstanding, but no new awards may be granted after the tenth anniversary of the date on which the stockholders approve the Omnibus Plan.

United States Income Tax Considerations

The following is a brief description of the U.S. federal income tax treatment that will generally apply to awards under the Omnibus Plan based on current U.S. income taxation with respect to Participants who are U.S. citizens or residents. Participants subject to taxation in other countries should consult their tax advisor (including Participants in Israel).

Non-Qualified Options. The grant of a non-qualified option will not result in taxable income to the Participant. The Participant will realize ordinary income at the time of exercise in an amount equal to the excess of the fair market value of the Company shares acquired over the exercise price for those shares. Gains or losses realized by the Participant upon disposition of such shares will be treated as capital gains and losses, with the basis in such Company shares equal to the fair market value of the shares at the time of exercise and the holding period beginning the day after exercise.

Incentive Stock Options. The grant of an incentive stock option will not result in taxable income to the Participant. The exercise of an incentive stock option will not result in taxable income to the Participant provided that the Participant was, without a break in service, an employee of our company or a subsidiary during the period beginning on the date of the grant of the option and ending on the date three months prior to the date of exercise (one year prior to the date of exercise if the Participant is “disabled,” as that term is defined in the Internal Revenue Code).

The excess of the fair market value of the Company shares at the time of the exercise of an incentive stock option over the exercise price is an adjustment that is included in the calculation of the Participant’s alternative minimum taxable income for the tax year in which the incentive stock option is exercised. For purposes of determining the Participant’s alternative minimum tax liability for the year of disposition of the shares acquired pursuant to the incentive stock option exercise, the Participant will have a basis in those shares equal to the fair market value of the Company shares at the time of exercise.

If the Participant does not sell or otherwise dispose of the Company shares within two years from the date of the grant of the incentive stock option or within one year after the transfer of such Company shares to the Participant, then, upon disposition of such Company shares, any amount realized in excess of the exercise price will be taxed to the Participant as capital gain. A capital loss will be recognized to the extent that the amount realized is less than the exercise price.

If the above holding period requirements are not met, the Participant will generally realize ordinary income at the time of the disposition of the shares, in an amount equal to the lesser of (i) the excess of the fair market value of the Company shares on the date of exercise over the exercise price, or (ii) the excess, if any, of the amount realized upon disposition of the shares over the exercise price. If the amount realized exceeds the value of the shares on the date of exercise, any additional amount will be capital gain. If the amount realized is less than the exercise price, the Participant will recognize no income, and a capital loss will be recognized equal to the excess of the exercise price over the amount realized upon the disposition of the shares.

Full Value Awards. A Participant who has been granted a full value award will not realize taxable income at the time of grant, provided that the Company shares subject to the award are subject to restrictions that constitute a “substantial risk of forfeiture” for U.S. income tax purposes. Upon the vesting of Company shares subject to an award, the holder will realize ordinary income in an amount equal to the then fair market value of those shares. Gains or losses realized by the Participant upon disposition of such shares will be treated as capital gains and losses, with the basis in such shares equal to the fair market value of the shares at the time of vesting, and the holding period beginning at vesting. Dividends paid to the holder during the restriction period, if so provided, will also be compensation income to the Participant.

Withholding of Taxes. We may withhold amounts from Participants to satisfy withholding tax requirements. Except as otherwise provided by the Compensation Committee, Participants may satisfy withholding requirements through cash payment, by having Company shares withheld from awards or by tendering previously owned Company shares to us to satisfy tax withholding requirements.

Change In Control. Any acceleration of the vesting or payment of awards under the Omnibus Plan in the event of a change in control of us may cause part or all of the consideration involved to be treated as an “excess parachute payment” under the Internal Revenue Code, which may subject the Participant to a 20 percent excise tax and preclude deduction by a subsidiary, or may otherwise result in a cut back based on employment arrangements with a Participant.

ERISA. The Omnibus Plan is not subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended, and is not intended to be qualified under Section 401 of the Internal Revenue Code.

Tax Advice

The preceding discussion is based on U.S. federal income tax laws and regulations presently in effect, which are subject to change, and the discussion does not purport to be a complete description of the U.S. federal income tax aspects of the Omnibus Plan. A Participant may also be subject to state and local taxes in connection with the grant of awards under the Omnibus Plan. In addition, a number of Participants reside outside the U.S. and are subject to taxation in other countries or may be subject to U.S. federal income tax in a manner not described above. The actual tax implications for any Participant will depend on the legislation in the relevant tax jurisdiction for that Participant and their personal circumstances.

New Plan Benefits

Because the Compensation Committee, in its discretion, will select the participants who receive awards and the timing, size and types of those awards, we cannot currently determine the awards that will be made to particular individuals or groups under the Omnibus Plan, as amended, other than with respect to non-employee directors. Under the current compensation program for our non-employee directors, each of our non-employee directors receives an annual award of 6,500 stock options, and the non-executive Chairman of the Board receives an additional annual award of 1,500 stock options.

For illustrative purposes only, the following table sets forth the awards received by the individuals and groups listed below under the Prior Plans and the Omnibus Plan between August 31, 2019, the date of our reverse merger transaction, and July 14, 2020:

| | | | | | | | |

Name | | Number of Shares Subject to Awards (#) |

Robert B. Brown | | — |

Andrew D. Sklawer | | 20,000 |

R. Michael Carruthers | | 10,000 |

All current executive officers as a group | | 226,364 |

All non-employee directors as a group | | 157,806 |

All employees, other than executive officers, as a group | | 139,813 |

The Board of Directors recommends a vote “FOR” approval of the Plan Amendments.

PROPOSAL 3

ADJOURNMENT PROPOSAL

We are asking our stockholders to approve a proposal to approve one or more adjournments of the Special Meeting to a later date or dates if necessary or appropriate to solicit additional proxies if there are insufficient votes to approve any of the proposals at the time of the Special Meeting or if we do not have a quorum at the Special Meeting (“Adjournment Proposal”). If our stockholders approve this Adjournment Proposal, we could adjourn the Special Meeting and any reconvened session of the Special Meeting and use the additional time to solicit additional proxies, including the solicitation of proxies from shareholders that have previously returned properly executed proxies voting against approval of any of the proposals. Among other things, approval of the Adjournment Proposal could mean that, even if we had received proxies representing a sufficient number of votes against approval of a proposal such that the proposal would be defeated, we could adjourn the Special Meeting without a vote on the approval of such proposal and seek to convince the holders of those shares to change their votes to votes in favor of approval of such proposal. Additionally, we may seek to adjourn the Special Meeting if a quorum is not present at the Special Meeting.

The Board believes that it is in the best interests of our company and our stockholders to be able to adjourn the Special Meeting to a later date or dates if necessary or appropriate for the purpose of soliciting additional proxies in respect of the approval of any of the proposals if there are insufficient votes to approve such proposal at the time of the Special Meeting or in the absence of a quorum.

The Board unanimously recommends a vote “FOR” Proposal No. 3.

EXECUTIVE COMPENSATION

The primary objectives of the Compensation Committee of our Board of Directors with respect to executive compensation are to attract, retain, and motivate the best possible executive talent. In doing so, the Compensation Committee seeks to tie short and long-term cash and equity incentives to achievement of measurable corporate and individual performance objectives, and to align executives’ incentives with stockholder value creation. To achieve these objectives, the Compensation Committee has maintained, and expects to further implement, compensation plans that tie a substantial portion of executives’ overall compensation to our research, clinical, regulatory, commercial, financial and operational performance.

Determination of Executive Compensation

After performing individual evaluations, the Chief Executive Officer (“CEO”) submits recommendations for approval to the Compensation Committee for salary increases, cash bonuses, and stock-based awards for the other executives. In the case of the CEO, his individual performance evaluation is conducted by the Compensation Committee, which determines his base salary, cash bonus, and stock-based awards. Annual base salary increases, annual stock-based awards, and annual cash bonuses, to the extent granted, will be implemented during the first calendar quarter of the year, beginning in year ending December 31, 2021.

In addition to corporate and individual goal achievement, the Compensation Committee also considers the following factors in determining an executive’s compensation package:

•the executive’s role and performance within the Company and the compensation data for similar persons in peer group companies and subscription compensation survey data;

•the demand for executives with the executive’s specific expertise and experience;

•a comparison to other executives within the Company having similar levels of expertise and experience; and

•uniqueness of the executive’s industry skills.

The Compensation Committee retains ultimate discretion as to whether any salary increases, cash bonuses or stock-based awards will be awarded for any year, including whether to accept or vary from the CEO’s recommendations for other executives.

Compensation Components

The components of our compensation package are as follows:

Base Salary

Base salaries for our executives are established based on the scope of their responsibilities and their prior relevant background, training, and experience, taking into account competitive market compensation paid by the companies represented in the compensation data we review for similar positions and the overall market demand for such executives at the time of hire. As with total executive compensation, we believe that if our executives meet the performance expectations of the Compensation Committee, then their base salaries should be in line with the median range of salaries for executives in similar positions and with similar responsibilities in the companies of similar size to us represented in the compensation data we review. An executive’s base salary is also evaluated together with other components of the executive’s other compensation to ensure that the executive’s total compensation is in line with our overall compensation philosophy.

Base salaries are reviewed annually as part of our annual performance program and increased for merit reasons, based on the executive’s success in meeting or exceeding individual performance objectives and an assessment

of whether significant corporate goals were achieved. If necessary, we also realign base salaries with market levels for the same positions in the companies of similar size to us represented in the compensation data we review, if we identify significant market changes in our data analysis. Additionally, the Compensation Committee adjusts base salaries as warranted throughout the year for promotions or other changes in the scope or breadth of an executive’s role or responsibilities.

Annual Bonus

Our compensation program includes eligibility for an annual performance-based cash bonus in the case of all executives and certain non-executive employees. The amount of the cash bonus depends on the level of achievement of the stated corporate, department, and individual performance goals, with a target bonus generally set as a percentage of base salary and in line with the employee’s employment agreement.

Long-Term Incentives

We believe that long-term performance is achieved through an ownership culture that encourages long-term participation by our executives through equity-based awards. Our Omnibus Plan allows the grant to executives of stock options, restricted stock, and other equity-based awards. We typically make an initial equity award of stock options to new employees and annual stock-based grants as part of our overall compensation program. The cumulative amount of stock options granted as part of our annual performance program is approved by the Compensation Committee. All equity-based awards granted to executives are approved by our Compensation Committee or our Board of Directors.

Retirement Plan

We intend to establish a 401(k) retirement savings plan that will allow eligible employees to defer a portion of their compensation, within limits prescribed by the Internal Revenue Code, on a pre-tax or after-tax basis through contributions to the plan. Our named executive officers will be eligible to participate in the 401(k) plan on the same general terms as other full-time employees.

Other Compensation

We maintain broad-based benefits and perquisites that are offered to all employees, including health insurance, life and disability insurance and dental insurance. In particular circumstances, we may also utilize cash signing bonuses when certain executives join us. Whether a signing bonus is paid and the amount thereof is determined on a case-by-case basis under the specific hiring circumstances. For example, we will consider paying a signing bonus to compensate for amounts forfeited by an executive upon terminating prior employment, to assist with relocation expenses and/or to create additional incentive for an executive to join our Company in a position where there is high market demand. Additionally, the Company provides payment for corporate apartments near the Company’s headquarters to the Chief Executive Officer and General Counsel, in lieu of re-location expenses.

Acceleration of vesting of equity-based awards.

In addition to the severance provisions contained in the employment agreements with our CEO and our other executives, provisions of the Omnibus Plan allow our Board of Directors to grant stock-based awards to employees and executives that provide for the acceleration of vesting in the event of a “change of control” (as defined in the Omnibus Plan). The Compensation Committee believes that these provisions are properly designed to promote stability during a change of control and enable our executives to focus on corporate objectives during a change of control, even if their employment may be subsequently terminated.

Tax and Accounting Implications

Deductibility of executive compensation. As part of its role, the Compensation Committee reviews and considers the deductibility of executive compensation under Section 162(m) of the Internal Revenue Code (the “Code”), which provides that the Company may not deduct compensation of more than $1,000,000 that is paid to certain individuals. The Company believes that compensation paid under the management incentive plans is generally fully deductible for federal income tax purposes. However, in certain situations, the Compensation Committee may approve compensation that will not meet these requirements in order to ensure competitive levels of total compensation for its executives.

Accounting for stock-based compensation.