UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

Brickell Biotech, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

1) | Title of each class of securities to which transaction applies: | |

2) | Aggregate number of securities to which transaction applies: | |

3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

4) | Proposed maximum aggregate value of transaction: | |

5) | Total fee paid: | |

o | Fee paid previously with preliminary materials: | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

1) | Amount Previously Paid: | |

2) | Form, Schedule or Registration Statement No.: | |

3) | Filing Party: | |

4) | Date Filed: | |

BRICKELL BIOTECH, INC.

5777 Central Avenue, Suite 102

Boulder, CO 80301

(720) 505-4755

5777 Central Avenue, Suite 102

Boulder, CO 80301

(720) 505-4755

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 20, 2020

TO THE STOCKHOLDERS OF BRICKELL BIOTECH, INC.:

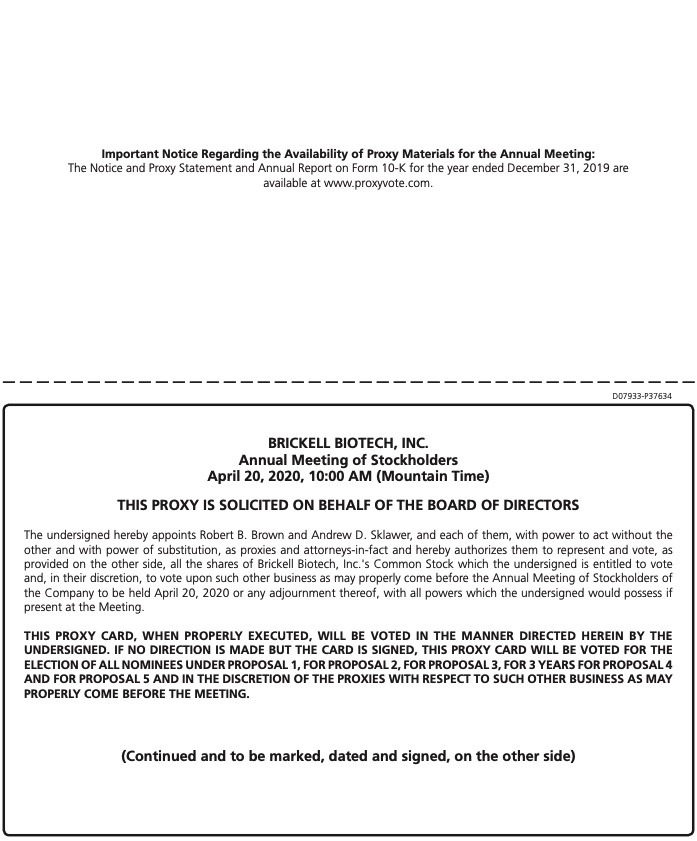

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Brickell Biotech, Inc., a Delaware corporation (the “Company”), will be held on Monday, April 20, 2020, at 10:00 a.m. (Mountain Time) at the offices of Brickell Biotech, Inc., 5777 Central Avenue, Suite 102, Boulder, Colorado 80301, for the following purposes:

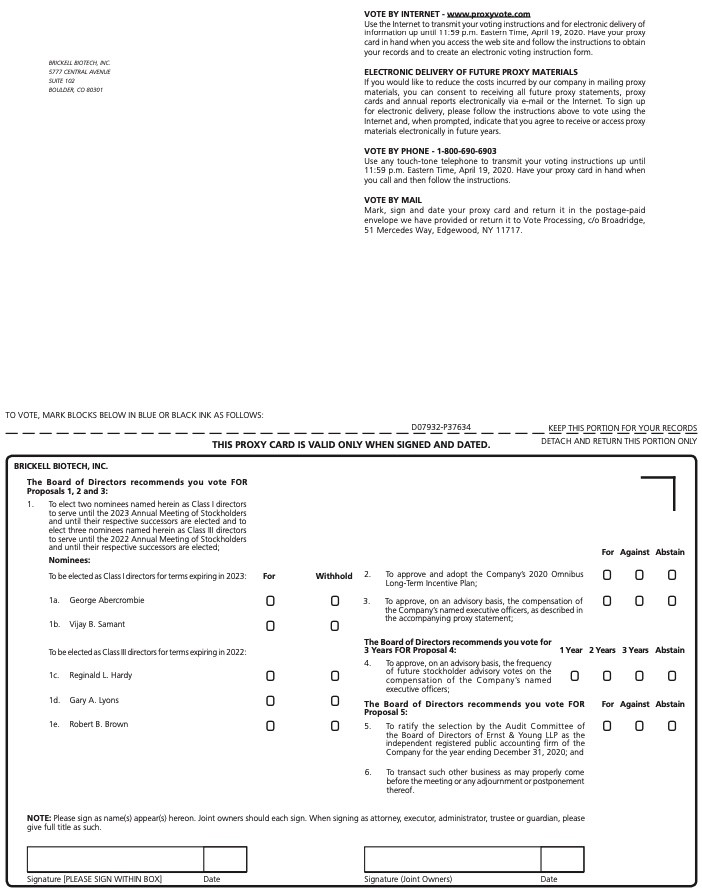

1. | To elect two nominees named herein as Class I directors to serve until the 2023 Annual Meeting of Stockholders and until their respective successors are elected and to elect three nominees named herein as Class III directors to serve until the 2022 Annual Meeting of Stockholders and until their respective successors are elected; |

2. | To approve and adopt the Company’s 2020 Omnibus Long-Term Incentive Plan; |

3. | To approve, on an advisory basis, the compensation of the Company’s named executive officers, as described in the accompanying proxy statement; |

4. | To approve, on an advisory basis, the frequency of future stockholder advisory votes on the compensation of the Company’s named executive officers; |

5. | To ratify the selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2020; and |

6. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this Notice.

The Board of Directors has fixed the close of business on March 13, 2020, as the record date for the Annual Meeting. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

By Order of the Board of Directors | |

/s/ ROBERT B. BROWN | |

Robert B. Brown | |

Chief Executive Officer | |

Boulder, Colorado | |

March 30, 2020 | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 20, 2020.

This Notice of Annual Meeting, the Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2019 are available at www.proxyvote.com.

TABLE OF CONTENTS

PROXY STATEMENT | ||

PROPOSAL 1 - ELECTION OF DIRECTORS | ||

PROPOSAL 2 - APPROVAL AND ADOPTION OF THE BRICKELL BIOTECH, INC. 2020 OMNIBUS LONG-TERM INCENTIVE PLAN | ||

PROPOSAL 3 - ADVISORY VOTE ON EXECUTIVE COMPENSATION | ||

PROPOSAL 4 - ADVISORY VOTE ON FREQUENCY OF FUTURE STOCKHOLDER ADVISORY VOTES ON EXECUTIVE COMPENSATION | ||

PROPOSAL 5 - RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | ||

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS | ||

Appendix A - Equity Incentive Plan | A-1 | |

BRICKELL BIOTECH, INC.

5777 Central Avenue, Suite 102

Boulder, CO 80301

(720) 505-4755

5777 Central Avenue, Suite 102

Boulder, CO 80301

(720) 505-4755

PROXY STATEMENT

FOR THE 2020 ANNUAL MEETING OF STOCKHOLDERS

To Be Held April 20, 2020

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We have provided you this proxy statement and, if this proxy was mailed to you, the enclosed proxy card, because the Board of Directors of Brickell Biotech, Inc. (the “Company”) is soliciting your proxy to vote at the 2020 Annual Meeting of Stockholders (the “Annual Meeting”). You are invited to attend the Annual Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the Annual Meeting to vote your shares. If you have received a printed copy of these materials by mail, you may complete, sign and return the enclosed proxy card or follow the instructions below to submit your proxy over the telephone or on the Internet. If you did not receive a printed copy of these materials by mail and are accessing them on the Internet, you may follow the instructions below to submit your proxy on the Internet.

We intend to mail a notice regarding the availability of proxy materials to our stockholders of record and to make this proxy statement available on or about March 30, 2020. We will pay for the cost of soliciting proxies to vote at the Annual Meeting.

What am I voting on?

There are five matters scheduled for a vote:

• | Election of the two nominees named herein as Class I directors to serve until the 2023 Annual Meeting of Stockholders and until their respective successors are elected and election of the three nominees named herein as Class III directors to serve until the 2022 Annual Meeting of Stockholders and until their respective successors are elected; |

• | Approval and adoption of the Company’s 2020 Omnibus Long-Term Incentive Plan; |

• | An advisory approval of the compensation of the Company’s named executive officers, as described in this proxy statement; |

• | An advisory approval of the frequency of future stockholder advisory votes on the compensation of the Company’s named executive officers; and |

• | Ratification of the selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2020. |

Why did I receive a Notice Regarding the Availability of Proxy Materials?

In accordance with rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), we make our proxy materials available to our stockholders on the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record. The Notice will instruct you as to how you may access and review all of the important information contained in the proxy materials. The Notice

1

also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a printed copy of our proxy materials, including a proxy card, you should follow the instructions for requesting such materials included in the Notice.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on March 13, 2020, will be entitled to vote at the Annual Meeting. On this record date, there were 9,669,402 shares of the Company’s common stock outstanding and entitled to vote.

Am I a stockholder of record?

If at the close of business on March 13, 2020, your shares were registered directly in your name with the Company’s transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record.

What if my shares are not registered directly in my name but are held in street name?

If at the close of business on March 13, 2020, your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares in your account.

If I am a stockholder of record of the Company’s shares, how do I cast my vote?

If you are a stockholder of record, you may vote in person at the Annual Meeting. We will give you a ballot when you arrive.

If you do not wish to vote in person or you will not be attending the Annual Meeting, you may vote by proxy. You may vote by proxy over the telephone, on the Internet, or using a proxy card that you may request or that we may elect to deliver at a later time.

The procedures for voting by proxy are as follows:

• | To vote by proxy on the Internet, go to http://www.proxyvote.com to complete an electronic proxy card. | |

• | To vote by proxy using a proxy card that may be delivered, complete, sign and date your proxy card and return it promptly in the envelope provided. If you wish to request a proxy card, please follow the instructions for requesting proxy materials in the Notice. | |

• | To vote by proxy over the telephone, dial the toll-free phone number listed on a proxy card that may be delivered under the heading “Vote by Phone” and follow the recorded instructions. | |

If you vote by proxy, your vote must be received by 11:59 p.m. Eastern Time on April 19, 2020, to be counted.

We provide Internet proxy voting to allow you to vote your shares on-line, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

2

If I am a beneficial owner of the Company’s shares, how do I vote?

If you are a beneficial owner of shares held in street name and you received a Notice by mail, you should have received the Notice from the organization that is the record owner of your shares rather than from us. Beneficial owners who received a Notice by mail from the record owner should follow the instructions included in the Notice to view the proxy statement and transmit their voting instructions. Beneficial owners who wish to vote in person at the Annual Meeting must obtain a valid proxy from the record owner. To request the requisite proxy form, follow the instructions provided by your broker or contact your broker.

What types of votes are permitted on each proposal?

For Proposal 1, the election of the nominees named herein as directors, you may either vote “For” each nominee to the Board of Directors or you may “Withhold” your vote for any of the nominees. For the other matters to be voted on, you may vote “For” or “Against” or you may “Abstain” from voting. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure that your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; and, with respect to other proposals, votes “For” and “Against,” abstentions and, if applicable, broker non-votes. Abstentions will be counted toward the vote total for each proposal, and will have the same effect as “Against” votes. A “broker non-vote” occurs when a stockholder of record, such as a broker, holding shares for a beneficial owner does not vote on a particular item because the stockholder of record does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner. Broker non-votes will be counted toward the presence of a quorum but will not be counted toward the vote total for any proposal. Proposal 5 (ratification of Ernst & Young LLP) is the only proposal that is considered “routine” under Nasdaq Stock Market (“Nasdaq”) rules. If you are a beneficial owner and your shares are held in the name of a broker or other nominee, the broker or other nominee is permitted to vote your shares on the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2020, even if the broker or other nominee does not receive voting instructions from you.

Is voting confidential?

Yes. Only the inspector of elections and our employees who have been assigned the responsibility for overseeing the legal aspects of the Annual Meeting, and Broadridge Financial Solutions, Inc. (“Broadridge”), our proxy solicitor, will have access to your proxy card. The inspector of elections will tabulate and certify the vote. Any comments written on the proxy card will remain confidential unless you ask that your name be disclosed.

3

How many votes are needed to approve each proposal?

• | For Proposal 1, the election of the nominees named herein as Class I and Class III directors, the nominees named herein receiving the most “For” votes (among votes properly cast in person or by proxy) will be elected. Broker non-votes will be counted toward the presence of a quorum but will have no effect on the result of the vote. | |

• | Proposal 2, the approval and adoption of the Company’s 2020 Omnibus Long-Term Incentive Plan, will be approved if it receives a “For” vote from the holders of a majority of shares either present in person or represented by proxy and entitled to vote. An “Abstain” vote will have the same effect as an “Against” vote. Broker non-votes will be counted toward the presence of a quorum but will have no effect on the result of the vote. | |

• | Proposal 3, the advisory approval of the compensation of the Company’s named executive officers, will be approved if it receives a “For” vote from the holders of a majority of shares either present in person or represented by proxy and entitled to vote. An “Abstain” vote will have the same effect as an “Against” vote. Broker non-votes will be counted toward the presence of a quorum but will have no effect on the result of the vote. | |

• | For Proposal 4, the advisory approval of the frequency of future stockholder advisory votes on the compensation of the Company’s named executive officers, the option of every year, every two years or every three years that receives the highest number of votes cast by stockholders (either in person or by proxy) will reflect the frequency for future say-on-pay votes that has been selected by stockholders. Broker non-votes will be counted toward the presence of a quorum but will have no effect on the result of the vote. | |

• | Proposal 5, the ratification of the selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2020, will be approved if it receives a “For” vote from the holders of a majority of shares either present in person or represented by proxy and entitled to vote. An “Abstain” vote will have the same effect as an “Against” vote. If you are a beneficial owner and your shares are held in the name of a broker or other nominee, the broker or other nominee is permitted to vote your shares on Proposal 5, even if the broker or other nominee does not receive voting instructions from you. Broker non-votes will be counted toward the presence of a quorum but will have no effect on the result of the vote. | |

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of the Company’s common stock you owned as of the close of business on March 13, 2020.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least one-third (1/3) of the outstanding shares are present at the meeting or represented by proxy. At the close of business on the record date for the meeting, there were 9,669,402 shares outstanding and entitled to vote. Thus 3,223,134 shares must be present at the Annual Meeting or represented by proxy to have a quorum.

Your shares will be counted toward the quorum only if you submit a valid proxy or vote at the Annual Meeting. If there is no quorum, a majority of the votes present at the Annual Meeting or represented by proxy may adjourn the Annual Meeting to another date.

What does it mean if I receive more than one Notice or proxy card?

If you received more than one Notice or proxy card, your shares are registered in more than one name or are registered in different accounts. Please follow the voting instructions included in each Notice and proxy card to ensure that all of your shares are voted.

4

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “For” the election of the five nominees for director in Proposal 1, “For” Proposal 2, the approval and adoption of the Company’s 2020 Omnibus Long-Term Incentive Plan, “For” Proposal 3, the advisory approval of the compensation of the Company’s named executive officers, for “3 Years” in Proposal 4, the advisory approval of the frequency of future stockholder advisory votes on the compensation of the Company’s named executive officers, and “For” Proposal 5, the ratification of the selection of Ernst & Young LLP. If any other matter is properly presented at the Annual Meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

What are the Costs of Soliciting these Proxies?

We will pay all of the costs of soliciting these proxies. Our officers, directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses. We have engaged Broadridge to assist us in soliciting proxies for the Annual Meeting. We will pay Broadridge a base fee of $6,995, plus reasonable out-of-pocket expenses, plus an additional fee based upon the number of contacts with stockholders made and work performed. We estimate the total amount payable to Broadridge will be approximately $10,000.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. You may revoke your proxy in any one of three ways:

• | You may submit another properly completed proxy card with a later date; | |

• | You may send a written notice that you are revoking your proxy to the Company’s Corporate Secretary at 5777 Central Avenue, Suite 102, Boulder, CO 80301; or | |

• | You may attend the Annual Meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy. | |

What is the deadline to submit a proposal for inclusion in the proxy materials for the 2021 Annual Meeting?

To be eligible for inclusion in the proxy materials for the 2021 Annual Meeting of Stockholders, a stockholder proposal must be received by the Company’s Corporate Secretary not less than 90 calendar days nor more than 120 calendar days prior to the date of our 2021 Annual Meeting of Stockholders. Stockholder proposals should be addressed to Brickell Biotech, Inc., Attn: Corporate Secretary, 5777 Central Avenue, Suite 102, Boulder, CO 80301.

What procedure should I follow if I intend to present a proposal or nominate a director from the floor at the 2021 Annual Meeting of Stockholders?

If you wish to submit a proposal that is to be included in next year’s proxy materials, you generally must do so not less than 90 calendar days nor more than 120 calendar days prior to the date of our 2021 Annual Meeting of Stockholders in order for the proposal to be considered at the meeting. If you wish to submit a director nomination for consideration at our 2021 Annual Meeting of Stockholders, you must do so by delivering at least 120 days prior to the meeting a written recommendation to the Nominating and Corporate Governance Committee. All proposals and nominations must be submitted in writing to Brickell Biotech, Inc., Attn: Corporate Secretary, 5777 Central Avenue, Suite 102, Boulder, CO 80301. You are also advised to review the Company’s Bylaws, which you may

5

request in writing from the Company’s Corporate Secretary at the address above and which contain additional requirements about advance notice of stockholder proposals and director nominations.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. We expect to report final voting results in a current report on Form 8-K within four business days after the Annual Meeting.

6

PROPOSAL 1

ELECTION OF DIRECTORS

On August 31, 2019, the Delaware corporation formerly known as “Vical Incorporated” completed a reverse merger transaction in accordance with the terms and conditions of the Agreement and Plan of Merger and Reorganization, dated June 2, 2019, as amended by Amendment No. 1 to the Agreement and Plan of Merger and Reorganization, dated August 20, 2019, and as further amended on August 30, 2019 (the “Merger Agreement”), by and among Vical Incorporated (“Vical”), Brickell Biotech, Inc. (“Private Brickell”) and Victory Subsidiary, Inc., a wholly-owned subsidiary of Vical formed in connection with the Merger (the “Merger Sub”), pursuant to which the Merger Sub merged with and into Brickell Biotech, Inc. with Brickell Biotech, Inc. surviving the merger as a wholly-owned subsidiary of Vical (the “Merger”). Additionally, on August 31, 2019, immediately after the completion of the Merger, the Company changed its name from “Vical Incorporated” to “Brickell Biotech, Inc.” (the “Company”).

Following the consummation of the Merger, we established three classes of directors serving staggered three-year terms. Our Board is presently comprised of six directors and one vacancy. Class I currently consists of two directors, Class II currently consists of one director and Class III currently consists of three directors. The Company did not hold an Annual Meeting of Stockholders in 2019. Consequently, two Class I directors are to be elected at this Annual Meeting to serve until our 2023 Annual Meeting of Stockholders and until their respective successors shall have been elected and qualified or until such director’s earlier resignation, removal from office, death or incapacity, and three Class III directors are to be elected at the Annual Meeting to serve until our 2022 Annual Meeting of Stockholders and until their respective successors shall have been elected and qualified or until such director’s earlier resignation, removal from office, death or incapacity. The term of the Class II director expires at our 2021 Annual Meeting of Stockholders.

The nominees for Class I directors are George Abercrombie and Vijay B. Samant, and the nominees for Class III directors are Reginald L. Hardy, Gary A. Lyons and Robert B. Brown. All of these persons are currently directors of the Company and have been nominated for election by our Board of Directors based on the recommendation of the Nominating and Corporate Governance Committee of our Board of Directors. It is our policy to encourage all directors to attend the Annual Meeting.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at a meeting. The nominees receiving the highest number of affirmative votes of the shares represented and entitled to vote at the Annual Meeting will be elected as directors of the Company. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominees named above. Shares represented by proxy cannot be voted for a greater number of persons than the number of nominees named. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as our Board of Directors may propose. The persons nominated for election have agreed to serve if elected, and our management has no reason to believe that the nominees will be unavailable for election.

The Board of Directors Recommends a Vote FOR the Election of the Named Nominees.

Set forth below is biographical information as of March 1, 2020, for the nominees and each person whose term of office as a director will continue after the Annual Meeting. There are no family relationships among our executive officers or directors.

7

Name | Age | Position(s) Held with Brickell | Director Since | |||

Reginald L. Hardy | 61 | Chairman of the Board | August 2019 | |||

George Abercrombie | 64 | Director | August 2019 | |||

Dennison T. Veru | 58 | Director | August 2019 | |||

Vijay B. Samant | 73 | Director | November 2000 | |||

Gary A. Lyons | 68 | Director | March 1997 | |||

Robert B. Brown | 58 | Chief Executive Officer and Director | August 2019 | |||

Nominees for Election for a Three-Year Term Expiring at the 2022 Annual Meeting

Reginald L. Hardy, Chairman of the Board

Mr. Hardy has over 30 years of experience in serving as the Chief Executive Officer and/or the President for publicly-traded and privately-held pharmaceutical companies. Prior to co-founding Private Brickell and serving as its Chief Executive Officer from inception in 2009 through 2018, Mr. Hardy was the co-founder and President of Concordia Pharmaceuticals, Inc., an oncology drug development company acquired by Kadmon Corporation, LLC in 2011. Mr. Hardy was co-founder and served as president of SANO Corporation, a pharmaceutical company focused on the development of novel transdermal drug delivery systems that was acquired by Elan Corporation in 1998, from 1992 to 1998. Prior to SANO, Mr. Hardy served as the president of the generics group at IVAX Corporation, a pharmaceutical company focused on the development and manufacture of medicines for pain, respiratory disease, oncology and women’s health. Mr. Hardy has also held various corporate roles with Hoechst-Roussel Pharmaceuticals, Inc. and Key Pharmaceuticals, Inc. Mr. Hardy earned his B.S. degree in pharmacy from the University of North Carolina—Chapel Hill and M.B.A. from UNC—Greensboro.

Robert B. Brown, Chief Executive Officer and Director

Mr. Brown joined Private Brickell as its Chief Executive Officer and Director in January 2019, after having spent over 30 years at Eli Lilly and Company (NYSE: LLY), where he most recently served as the Chief Marketing Officer and Senior Vice President of Marketing from 2009 through 2018. As Chief Marketing Officer, Mr. Brown was responsible for building and leading marketing capabilities across Eli Lilly and Company’s pharmaceutical business units, including diabetes, oncology, emerging markets and Lilly-BioMedicines, a business area focused on treatments for debilitating diseases. Prior to his role as Chief Marketing Officer, Mr. Brown held the position of Vice President and Chief Marketing Officer for Lilly USA from 2007 to 2009, in which he partnered with the business units to ensure Eli Lilly and Company continued to develop industry leading marketing capabilities, streamline and improve marketing processes, and transform marketing by building a consumer marketing center of excellence. From 2003 to 2007, Mr. Brown was the executive director of marketing for the Intercontinental region, including responsibility for Europe. As the head marketer for Eli Lilly and Company’s international operations, Mr. Brown was responsible for the marketing of all Eli Lilly and Company’s products outside the United States. Mr. Brown joined Eli Lilly and Company in 1985, after receiving a B.S. in economics from DePauw University and an M.S. in business administration from Indiana University. Mr. Brown currently serves on the board of trustees of Franklin College.

Gary A. Lyons, Director

Mr. Lyons has served as the President and Chief Executive officer of GL Advisors, a biotechnology advisory firm, since 2015. Mr. Lyons served as a member of the board of directors of Vical from 1997 until the consummation of the Merger in August 2019, as referenced above. Previously, Mr. Lyons held various positions with Neurocrine Biosciences, Inc. (Nasdaq: NBIX), a biopharmaceutical company, for 16 years through January 2008, including President, Chief Executive Officer and member of the board of directors. From 1983 to 1993, Mr. Lyons held various executive positions at Genentech, Inc., a biotechnology company, including Vice President of Business

8

Development, Vice President of Sales, and Director of Sales and Marketing. Mr. Lyons presently serves as a member of the board of directors of Neurocrine Biosciences, Inc. and Novus Therapeutics, Inc. (Nasdaq: NVUS) and is chairman of the board of directors of Rigel Pharmaceuticals, Inc. (Nasdaq: RIGL) and Retrophin, Inc. (Nasdaq: RTRX), all of which are publicly held biotechnology companies. In addition, Mr. Lyons served previously on the board of directors of PDL BioPharma, Inc., Facet Biotech Corporation, KaloBios Pharmaceuticals, Inc. and NeurogesX, Inc. Mr. Lyons holds a bachelor’s degree in marine biology from the University of New Hampshire and an M.B.A. degree from Northwestern University, JL Kellogg Graduate School of Management.

Nominees for Election for a Three-Year Term Expiring at the 2023 Annual Meeting

George B. Abercrombie, Director

Mr. Abercrombie served as a member of the board of directors of Private Brickell since 2010. Mr. Abercrombie is President and Chief Executive Officer of Abercrombie Advisors LLC, a pharmaceutical consulting firm, since 2011. Mr. Abercrombie served as Senior Vice President and Chief Commercial Officer of Innoviva, Inc. (Nasdaq: INVA), a royalty management company focused on respiratory assets partnered with Glaxo Group Limited, from June 2014 to September 2018. Mr. Abercrombie served as the President and Chief Executive Officer of Hoffmann-La Roche, Inc. (“Roche”) from 2001 to 2009 where he was primarily responsible for leading Roche’s North American Pharmaceutical Operations including the United States and Canada. Prior to joining Roche, Mr. Abercrombie served as Senior Vice President of U.S. Commercial Operations at Glaxo Wellcome Inc., with responsibilities encompassing pharmaceutical sales and marketing, electronic commerce, the U.S. managed care system, disease management, business planning and development, and late-stage clinical drug studies. He joined Glaxo Wellcome as Vice President and General Manager of the Glaxo Pharmaceuticals Division in 1993 following 10 years at Merck & Co., Inc. (NYSE: MRK) (“Merck”), where he held a broad range of positions in sales, marketing, executive sales management and business development. Mr. Abercrombie currently serves on the boards of directors of Biocryst Pharmaceuticals, Inc. (Nasdaq: BCRX), Hessian Pharmaceuticals, Inc., and the North Carolina GlaxoSmithkline Foundation. As an Adjunct Professor at Duke University’s Fuqua School of Business, he teaches second year M.B.A. candidates in Fuqua’s Health Sector Curriculum. Mr. Abercrombie received a B.S. degree in pharmacy from the University of North Carolina—Chapel Hill. He also earned an M.B.A. from Harvard University.

Vijay B. Samant, Director

Mr. Samant served as President and Chief Executive Officer of Vical from November 2000 until the consummation of the Merger in August 2019, as referenced above. Prior to joining Vical, he had 23 years of diverse U.S. and international sales, marketing, operations, and business development experience with Merck. From 1998 to 2000, he was Chief Operating Officer of the Merck Vaccine Division. From 1990 to 1998, he served in the Merck Manufacturing Division as Vice President of Vaccine Operations, Vice President of Business Affairs and Executive Director of Materials Management. Mr. Samant holds a master’s degree in management studies from the Sloan School of Management at MIT, a master’s degree in chemical engineering from Columbia University, and a bachelor’s degree in chemical engineering from the University of Bombay, University Department of Chemical Technology. Mr. Samant was a member of the board of directors of AmpliPhi Biosciences Corporation from 2015 to 2019, a member of the board of directors of Raptor Pharmaceutical Corporation from 2011 to 2014, and a member of the board of directors for BioMarin Pharmaceutical Inc. from 2002 to 2004. Mr. Samant was a Director of the Aeras Global TB Vaccine Foundation from 2001 to 2010, a member of the Board of Trustees for the National Foundation for Infectious Diseases from 2003 to 2012, and a member of the Board of Trustees for the International Vaccine Institute in Seoul, Korea from 2008 to 2012.

9

Directors Continuing in Office Until the 2021 Annual Meeting

Dennison (Dan) T. Veru, Director

Mr. Veru served as a member of the board of directors of Private Brickell since 2012. Mr. Veru has served as Chief Investment Officer and Co-Chairman of Palisade Capital Management, an independent asset management firm, since 2000. Mr. Veru has oversight responsibilities for all the investment strategies at Palisade Capital Management involving publicly traded securities. From 1992 through 1999, Mr. Veru was the President and Director of Research at Awad Asset Management (“Awad”) and helped oversee the firm’s growth. Prior to Awad, Mr. Veru worked at Drexel Burnham Lambert and later at Smith Barney Harris Upham where he held a variety of analytical roles. In addition to his professional responsibilities, Mr. Veru is a member of the Board of Overseers of the St. Lukes and Roosevelt Hospital, a member of the finance committee of the Dwight-Englewood School, and a member of the board of directors of the McCarton School for Autistic Children. Mr. Veru graduated from Franklin & Marshall College.

CORPORATE GOVERNANCE AND BOARD AND COMMITTEE MATTERS

Independence of the Board of Directors

Under the Nasdaq listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. Our Board of Directors consults with our counsel to ensure that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of their family members, and us, our senior management and our independent registered public accounting firm, our Board of Directors has affirmatively determined that all of our directors, except for Mr. Hardy and Mr. Brown, are independent directors within the meaning of the applicable Nasdaq listing standards.

See also “Certain Relationships and Related Person Transactions” below.

Board Leadership Structure and Risk Management

Our Chairman of the Board position is a non-executive position and is separate from the position of Chief Executive Officer. Separating these positions allows our Chief Executive Officer to focus on our day-to-day business, while allowing the Chairman of the Board to lead our Board in its fundamental role of providing advice to and independent oversight of management. Our Board recognizes the time, effort and energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our Chairman, particularly as the Board’s oversight responsibilities continue to grow. Our Board believes that having separate positions, with an independent, non-executive director serving as Chairman, is the appropriate leadership structure for our Company at this time and allows each of the positions to be carried out more effectively than if one person were tasked with both the day-to-day oversight of our business as well as leadership of our Board.

The Board has an active role in overseeing the Company’s risk management. The Board regularly reviews information presented by management regarding the Company’s business and operations risks, including those relating to liquidity, regulatory and compliance, and monitors risk through Board reports and discussions regarding risk at Board meetings. The Board also reviews and approves corporate goals and budgets on an annual basis. Further, pursuant to its charter, the Audit Committee reviews with the Board any issues that may arise in the performance of its duties, including those relating to the quality or integrity of the Company’s financial statements, the Company’s compliance with legal or regulatory requirements and its Code of Business Conduct and Ethics.

10

The Compensation Committee monitors risk related to compensation policies and the Nominating and Corporate Governance Committee monitors risk related to governance and succession planning.

Insider Trading Policy

We have an insider trading policy which establishes guidelines for the trading of our stock by our employees and our directors. The policy specifically restricts trading in our stock by employees and directors during specified time periods generally surrounding the anticipated release of our annual or quarterly financial results. The policy also prohibits individuals that are deemed to be insiders from holding our stock in a margin account or pledging our stock as collateral for a loan at any time. In addition, the policy prohibits insiders from engaging in short sales, transactions in put or call options or derivative transactions (including but not limited to forward sale contracts, zero-cost collars or other hedging or monetization transactions) with respect to our stock at any time.

Corporate Governance Guidelines

We are committed to the diligent exercise of sound corporate governance principles. Our Board of Directors has adopted Corporate Governance Guidelines to provide assistance to the Board in managing Board composition, representation, function and performance. The Corporate Governance Guidelines are attached as an exhibit to the charter of our Nominating and Corporate Governance Committee, which is available on our website at www.brickellbio.com.

Executive Sessions

As required under Nasdaq listing standards, our independent directors meet in regularly scheduled executive sessions at which only independent directors are present.

Stockholder Communications with the Board of Directors

Our Board of Directors has adopted a formal process for stockholder communications with the Board or individual directors. Information regarding this process is available on our website at www.brickellbio.com.

Committees of the Board of Directors

During the year ended December 31, 2019, our Board of Directors had three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee each operate under a written charter adopted by our Board, all of which are available on our website at www.brickellbio.com.

11

The following table provides membership and meeting information as of and for the partial year from the Merger date of September 1, 2019 to December 31, 2019, for each of the committees:

Name | Audit | Compensation | Nominating/ Governance | |||||||||||

George B. Abercrombie, R.Ph., MBA | X | X | * | |||||||||||

Robert B. Brown | ||||||||||||||

Reginald Hardy, R.Ph., MBA | X | * | ||||||||||||

Gary A. Lyons | X | X | ||||||||||||

Vijay B. Samant | X | X | ** | |||||||||||

Dennison T. Veru | X | * | X | |||||||||||

Total meetings held | 1 | — | 1 | |||||||||||

_________________

* | Chairperson |

** | Term began on committee in March 2020 |

Following the consummation of the Merger, each director attended at least 75% in the aggregate of the meetings of the committees on which he served during the year ended December 31, 2019.

Below is a description of each committee of our Board of Directors. Our Board has determined that each committee member is independent within the meaning of applicable Nasdaq listing standards.

Audit Committee

Our Board of Directors has a separately designated standing Audit Committee established in accordance with Section 3(a)(58)A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee oversees our corporate accounting and financial reporting processes, our systems of internal control over financial reporting and audits of our financial statements. Among other functions, the Audit Committee evaluates the performance of and assesses the qualifications of the independent registered public accounting firm; engages the independent registered public accounting firm; determines whether to retain or terminate the existing independent registered public accounting firm or to appoint and engage a new independent registered public accounting firm; confers with senior management and the independent registered public accounting firm regarding the adequacy and effectiveness of internal control over financial reporting; establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters and for the Company’s whistleblower policy; reviews and approves the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent registered public accounting firm on our audit engagement team as required by law; reviews annually the Audit Committee’s written charter and the Audit Committee’s performance; reviews the financial statements to be included in our Annual Report on Form 10-K; and discusses with management and the independent registered public accounting firm the results of the annual audit and the results in our quarterly financial statements. The Audit Committee has the authority to retain special legal, accounting or other advisors or consultants as it deems necessary or appropriate to carry out its duties.

Our Board of Directors has determined that Dennison T. Veru qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. In making such determination, the Board made a qualitative assessment of Mr. Veru’s level of knowledge and experience based on a number of factors, including his formal education and

12

experience. Our Board of Directors has determined that each member of the Audit Committee is independent under the Nasdaq rules and Rule 10A-3 under the Exchange Act.

The report of the Audit Committee is included herein on page 41.

Compensation Committee

The Compensation Committee oversees our overall compensation strategy and related policies, plans and programs. Among other functions, the Compensation Committee determines and approves the compensation and other terms of employment of our Chief Executive Officer; determines and approves the compensation and other terms of employment of our other executive officers, as appropriate; reviews and recommends to the Board the type and amount of compensation to be paid to Board members; recommends to the Board the adoption, amendment and termination of our 2020 Omnibus Long-Term Incentive Plan (the “Omnibus Plan”); administers the Omnibus Plan; and reviews and establishes appropriate insurance coverage for our directors and executive officers. The Compensation Committee has the authority to retain special legal, accounting or other advisors or consultants as it deems necessary or appropriate to carry out its duties. The Compensation Committee has broad power to form and delegate its authority to subcommittees pursuant to its charter.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for identifying, reviewing and evaluating candidates to serve on our Board of Directors; reviewing and evaluating our incumbent directors and the performance of our Board; recommending candidates to our Board for election to our Board of Directors; making recommendations to the Board regarding the membership of the committees of our Board; assessing the performance of our Board, including its committees; and developing a set of corporate governance guidelines for the Company.

Consideration of Director Nominees

Director Qualifications

The Nominating and Corporate Governance Committee believes that candidates for director should be diverse and possess certain minimum qualifications, including having the highest personal integrity and ethics and being able to read and understand basic financial statements. The Nominating and Corporate Governance Committee also considers factors such as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of our stockholders. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time.

Qualification of Current Directors

The composition of our current Board reflects diversity in business and professional experience and skills. When considering whether our current directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable our Board to satisfy its oversight responsibilities effectively in light of our Company’s business and structure, our Nominating and Corporate Governance Committee and Board focused primarily on the information discussed in each of the directors’ individual biographies set forth herein. In particular:

13

• | With regard to Mr. Abercrombie, our Board considered his extensive experience in the pharmaceutical industry, including his previous-held roles of Senior Vice President and Chief Commercial Officer of Innovia, Inc. and President and Chief Executive Officer of Hoffmann-La Roche, Inc. | |

• | With regard to Mr. Brown, our Board considered his extensive product development, management and international experience, including his previously-held roles as Chief Marketing Officer and Senior Vice President of Marketing at Eli Lilly and Company and General Manager of Lilly China. | |

• | With regard to Mr. Hardy, our Board considered his extensive experience in serving as the Chief Executive Officer and/or the President for publicly-traded and privately-held pharmaceutical companies, including his previously-held role as President of Concordia Pharmaceuticals, Inc. and co-founder and Chief Executive Officer of Private Brickell. | |

• | With regard to Mr. Lyons, our Board considered his extensive managerial experience, including his role as a Chief Executive Officer and other executive level positions at public and private companies in the biotechnology sector. | |

• | With regard to Mr. Samant, our Board considered his extensive experience in biopharmaceutical development and product commercialization, as well as his strong technical and entrepreneurial experience in diverse fields, and prior role as President and Chief Executive Officer of Vical. | |

• | With regard to Mr. Veru, our Board considered his public company investment and managerial experiences, including his role as Chief Investment Officer and Co-Chairman of Palisade Capital Management. | |

Evaluating Nominees for Director

The Nominating and Corporate Governance Committee reviews candidates for director nominees in the context of the current composition of our Board, our operating requirements and the long-term interests of our stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee considers age, experience, skills, and such other factors as it deems appropriate given the current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability. In addition, the Nominating and Corporate Governance Committee also considers diversity in its evaluation of candidates for Board membership. The Board of Directors believes that diversity with respect to viewpoint, skills and experience should be an important factor in board composition. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews such directors’ overall service to the Company during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee must be independent, which determination is based upon applicable Nasdaq listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of our Board of Directors. The Nominating and Corporate Governance Committee meets to discuss and consider such candidates’ qualifications and then selects a nominee for recommendation to our Board of Directors by majority vote. To date, neither the Nominating and Corporate Governance Committee nor any predecessor to the Nominating and Corporate Governance Committee has paid a fee to any third party to assist in the process of identifying or evaluating director candidates. To date, neither the Nominating and Corporate Governance Committee nor any predecessor to the Nominating and Corporate Governance Committee has rejected a timely director nominee from a stockholder, or stockholders, holding more than 5% of our voting stock.

Stockholder Nominations

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the

14

Nominating and Corporate Governance Committee to become nominees for election to the Board at an Annual Meeting of Stockholders must do so by delivering at least 120 days prior to the anniversary date of the mailing of our proxy statement for our last Annual Meeting of Stockholders a written recommendation to the Nominating and Corporate Governance Committee c/o Brickell Biotech, Inc., 5777 Central Avenue, Suite 102, Boulder, CO 80301, Attn: Corporate Secretary. Each submission must set forth: the name and address of the Company’s stockholder on whose behalf the submission is made; the number of the Company’s shares that are owned beneficially by such stockholder as of the date of the submission; the full name of the proposed candidate; a description of the proposed candidate’s business experience for at least the previous five years; complete biographical information for the proposed candidate; and a description of the proposed candidate’s qualifications as a director. Each submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

Board Meetings

During the year ended December 31, 2019, our Board of Directors held nine meetings following the consummation of the Merger.

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

We have adopted a Related Person Transactions Policy to monitor transactions in which the Company and any of the following have an interest: a director, executive officer or other employee or a nominee to become a director of the Company; a security holder known by the Company to be the record or beneficial owner of more than 5% of any class of the Company’s voting securities; an “immediate family member” of any of the foregoing, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law of such person, and any person (other than a tenant or employee) sharing the household of such person; and any firm, corporation or other entity in which any of the foregoing persons is an executive, partner or principal or holds a similar control position or in which such person directly or indirectly has a 5% or greater equity interest (collectively, “Related Persons”). The policy covers any transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which the Company is, was or will be a participant in which the amount involved exceeds $120,000 U.S. dollars and in which any Related Person had, has or will have a direct or indirect material interest (“Related Person Transactions”). Transactions involving compensation for services provided to the Company as an employee, consultant or director are not considered Related Person Transactions under this policy.

Under this policy, any proposed transaction that has been identified as a Related Person Transaction may be consummated or materially amended only following approval by the Audit Committee in accordance with the provisions of this policy. In the event that it is inappropriate for the Audit Committee to review the transaction for reasons of conflict of interest or otherwise, after taking into account possible recusals by Audit Committee members, then the Related Person Transaction shall be reviewed and decided upon by another independent member of the Board.

Executive Compensation and Employment Arrangements

Please see “Executive Compensation” for information on compensation arrangements with the Company’s executive officers.

CODE OF BUSINESS CONDUCT AND ETHICS

We have adopted a Code of Business Conduct and Ethics (“Code of Ethics”) and a whistleblower policy applicable to all of our officers, directors and employees, which can be accessed on our website at www.brickellbio.com. If we make any substantive amendments to our Code of Ethics and/or whistleblower policy or grant any waiver from

15

a provision of the Code of Ethics to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website.

EXECUTIVE OFFICERS

The following table sets forth information concerning our executive officers. Executive officers are elected annually by the Board and serve at the Board’s discretion.

Name | Age | Title | ||

Robert B. Brown | 58 | Chief Executive Officer and Director | ||

Andrew D. Sklawer | 36 | Chief Operating Officer and Secretary | ||

R. Michael Carruthers | 62 | Chief Financial Officer | ||

Adam Levy | 42 | Chief Business Officer | ||

Deepak Chadha | 50 | Chief Research and Development Officer | ||

Jose Breton | 31 | Controller and Chief Accounting Officer | ||

David McAvoy | 57 | General Counsel and Chief Compliance Officer | ||

Set forth below is a description of the background of our executive officers. Mr. Brown’s background is described above under “Proposal 1: Election of Directors.”

Andrew D. Sklawer, Co-Founder, Chief Operating Officer and Secretary

Mr. Sklawer co-founded Private Brickell and served as its Chief Operating Officer and Secretary since 2009. Prior to 2009, Mr. Sklawer served as the Head of Operations at Concordia Pharmaceuticals, Inc., an oncology drug development company that was acquired by Kadmon Corporation in 2011. Prior to joining Concordia, Mr. Sklawer held various positions at Verid, Inc., a developer of security technology prior to its acquisition by EMC Corporation. Mr. Sklawer holds a B.A. in marketing from the University of Florida and earned his M.B.A from the University of Miami. Mr. Sklawer currently serves as a board member for StartUp FIU, a Florida International University platform that supports researchers, inventors, innovators, and entrepreneurs to conceive, launch, and scale solutions, is a member of the Advisory Committee of Advancing Innovation in Dermatology Accelerator Fund and is a board member of the Colorado BioScience Association.

R. Michael Carruthers, Chief Financial Officer

Mr. Carruthers joined Private Brickell in 2017 and served as its Chief Financial Officer. He has over 20 years of experience serving as the Chief Financial Officer for publicly-traded pharmaceutical companies. Mr. Carruthers previously served as Interim President of Nivalis Therapeutics, Inc., a pharmaceutical company that focuses on the discovery and development of product candidates for cystic fibrosis, beginning in January 2017 until August 2017 and Chief Financial Officer and Secretary since February 2015. From 1998 to 2015, he served as Chief Financial Officer for Array BioPharma Inc., a biopharmaceutical company that focuses on the discovery, development, and commercialization of small molecule drugs to treat patients with cancer and other diseases, which was subsequently acquired by Pfizer Inc. Prior to this, his professional experience included serving as Chief Financial Officer of Sievers Instruments, treasurer and controller for the Waukesha division of Dover Corporation and accountant with Coopers & Lybrand. Mr. Carruthers received a B.S. in accounting from the University of Colorado and an M.B.A. from the University of Chicago.

Adam Levy, Chief Business Officer

Mr. Levy has served as Private Brickell’s Chief Business Officer since 2019. Prior to joining Private Brickell, Mr. Levy served from 2016 through 2019 as Chief Business Officer at miRagen Therapeutics, Inc. (Nasdaq: MGEN),

16

a clinical-stage biopharmaceutical company discovering and developing proprietary RNA-targeted therapies with a specific focus on microRNAs and their role in diseases where there is a high unmet medical need. Between 2000 through 2016, Mr. Levy held multiple investment banking positions at Merrill Lynch, Pierce, Fenner & Smith Incorporated, Jefferies Group and Wedbush Securities Inc. Mr. Levy received a B.S. in applied economics from Cornell University.

Deepak Chadha, Chief Research and Development Officer

Mr. Chadha joined Private Brickell in 2016 and served as its Chief Research and Development Officer and as its Chief Regulatory, Pre-clinical and Quality Compliance Officer from 2016 to 2018. Mr. Chadha served from 2014 to 2016 as Vice President, Global Regulatory Affairs at Suneva Medical, Inc. (“Suneva”), a medical technology company that develops, manufactures, and commercializes aesthetic products for the dermatology, plastic, and cosmetic surgery markets. During his time at Suneva, Mr. Chadha led the regulatory approval for BELLAFILL® dermal filler for acne scar correction and supported the company’s commercial products life cycle management. Prior to joining Suneva, Mr. Chadha worked at Allergan plc (f.k.a. KYTHERA Biopharmaceuticals, Inc.) from 2007 to 2014, where Mr. Chadha led the development of their product, KYBELLA®, from an early clinical phase to an NDA stage, and also supported the ex-U.S. regulatory activities. Mr. Chadha also served as Vice President of Global Regulatory Affairs at Allergan Medical (f.k.a. Inamed Corporation) from 2004 to 2007, where he assisted in building the organization’s Global Regulatory Affairs department, and was involved with the approval for JUVEDERM®, Bioenterics®, LAP-BAND® and Silicone gel-filled breast implants. Mr. Chadha holds a B.S. in pharmaceutical sciences from Berhampur University in Orissa, India, an M.S. in pharmaceutics from Hamdard University in New Delhi, India, and an M.B.A. in international business from California State University, Dominguez Hills.

Jose Breton, Controller and Chief Accounting Officer

Mr. Breton joined Private Brickell in 2013 and served as its Controller and Chief Accounting Officer. Mr. Breton was an auditor from 2014 to 2015 at Deloitte LLP. Mr. Breton began his career in 2012 as a Client Manager at Global Resource Partners, Inc., an accounting and business advisory firm. In this role, Mr. Breton had overall responsibility for clients’ financial reporting, planning and budgeting, systems of internal controls, corporate and benefits accounting and equity administration. Mr. Breton holds a B.B.A. degree in accounting and finance and a master’s degree in taxation from the University of Miami.

David McAvoy, General Counsel and Chief Compliance Officer

Mr. McAvoy joined Private Brickell in 2019 and served as its General Counsel and Chief Compliance Officer. He previously served as General Counsel, Vice President and Chief Compliance Officer for Endocyte, Inc., a publicly-traded nuclear medicine and oncology biotech company that was subsequently acquired by Novartis AG, from 2017 to 2018. Prior to joining Endocyte, Inc., Mr. McAvoy was at Eli Lilly and Company for 27 years serving in various leadership positions, including as General Counsel of Lilly Emerging Markets, and most recently, in an executive management business role running strategic alliances for the food animal production group at Eli Lilly and Company’s former Elanco Animal Health subsidiary. While at Eli Lilly and Company, Mr. McAvoy was lead counsel for and helped launch several blockbuster medicines, including Prozac® for depression, Gemzar® for pancreatic and lung cancers, and ReoPro®, one of the first interventional cardiology agents. Mr. McAvoy earned a J.D. and M.S. in environmental science from Indiana University and a B.A. in political science from the University of Notre Dame. He serves on the board of directors for The Villages of Indiana, Inc., championing families for abandoned and abused children.

17

EXECUTIVE COMPENSATION

The primary objectives of the Compensation Committee of our Board of Directors with respect to executive compensation are to attract, retain, and motivate the best possible executive talent. In doing so, the Compensation Committee seeks to tie short and long-term cash and equity incentives to achievement of measurable corporate and individual performance objectives, and to align executives’ incentives with stockholder value creation. To achieve these objectives, the Compensation Committee has maintained, and expects to further implement, compensation plans that tie a substantial portion of executives’ overall compensation to our research, clinical, regulatory, commercial, financial and operational performance.

Determination of Executive Compensation

After performing individual evaluations, the Chief Executive Officer (“CEO”) submits recommendations for approval to the Compensation Committee for salary increases, cash bonuses, and stock-based awards for the other executives. In the case of the CEO, his individual performance evaluation is conducted by the Compensation Committee, which determines his base salary, cash bonus, and stock-based awards. Annual base salary increases, annual stock-based awards, and annual cash bonuses, to the extent granted, will be implemented during the first calendar quarter of the year, beginning in year ending December 31, 2021.

In addition to corporate and individual goal achievement, the Compensation Committee also considers the following factors in determining an executive’s compensation package:

• | the executive’s role and performance within the Company and the compensation data for similar persons in peer group companies and subscription compensation survey data; | |||

• | the demand for executives with the executive’s specific expertise and experience; | |||

• | a comparison to other executives within the Company having similar levels of expertise and experience; and | |||

• | uniqueness of the executive’s industry skills. | |||

The Compensation Committee retains ultimate discretion as to whether any salary increases, cash bonuses or stock-based awards will be awarded for any year, including whether to accept or vary from the CEO’s recommendations for other executives.

Compensation Components

The components of our compensation package are as follows:

Base Salary

Base salaries for our executives are established based on the scope of their responsibilities and their prior relevant background, training, and experience, taking into account competitive market compensation paid by the companies represented in the compensation data we review for similar positions and the overall market demand for such executives at the time of hire. As with total executive compensation, we believe that if our executives meet the performance expectations of the Compensation Committee, then their base salaries should be in line with the median range of salaries for executives in similar positions and with similar responsibilities in the companies of similar size to us represented in the compensation data we review. An executive’s base salary is also evaluated together with other components of the executive’s other compensation to ensure that the executive’s total compensation is in line with our overall compensation philosophy.

Base salaries are reviewed annually as part of our annual performance program and increased for merit reasons, based on the executive’s success in meeting or exceeding individual performance objectives and an assessment of whether significant corporate goals were achieved. If necessary, we also realign base salaries with market levels

18

for the same positions in the companies of similar size to us represented in the compensation data we review, if we identify significant market changes in our data analysis. Additionally, the Compensation Committee adjusts base salaries as warranted throughout the year for promotions or other changes in the scope or breadth of an executive’s role or responsibilities.

Annual Bonus

Our compensation program includes eligibility for an annual performance-based cash bonus in the case of all executives and certain non-executive employees. The amount of the cash bonus depends on the level of achievement of the stated corporate, department, and individual performance goals, with a target bonus generally set as a percentage of base salary and in line with the employee’s employment agreement.

Long-Term Incentives

We believe that long-term performance is achieved through an ownership culture that encourages long-term participation by our executives through equity-based awards. Our Omnibus Plan allows the grant to executives of stock options, restricted stock, and other equity-based awards. We typically make an initial equity award of stock options to new employees and annual stock-based grants as part of our overall compensation program. The cumulative amount of stock options granted as part of our annual performance program is approved by the Compensation Committee. All equity-based awards granted to executives are approved by our Compensation Committee or our Board of Directors.

Retirement Plan

We intend to establish a 401(k) retirement savings plan that will allow eligible employees to defer a portion of their compensation, within limits prescribed by the Internal Revenue Code, on a pre-tax or after-tax basis through contributions to the plan. Our named executive officers will be eligible to participate in the 401(k) plan on the same general terms as other full-time employees. We intend to match contributions made by participants in the 401(k) plan up to a specified percentage, and these matching contributions are expected to be fully vested as of the date on which the contribution is made.

Other Compensation

We maintain broad-based benefits and perquisites that are offered to all employees, including health insurance, life and disability insurance and dental insurance. In particular circumstances, we may also utilize cash signing bonuses when certain executives join us. Whether a signing bonus is paid and the amount thereof is determined on a case-by-case basis under the specific hiring circumstances. For example, we will consider paying a signing bonus to compensate for amounts forfeited by an executive upon terminating prior employment, to assist with relocation expenses and/or to create additional incentive for an executive to join our Company in a position where there is high market demand. Additionally, the Company provides payment for corporate apartments to the Chief Executive Officer and General Counsel, in lieu of re-location expenses.

Acceleration of vesting of equity-based awards.

In addition to the severance provisions contained in the employment agreements with our CEO and our other executives, provisions of our 2020 Omnibus Long-Term Incentive Plan allow our Board of Directors to grant stock-based awards to employees and executives that provide for the acceleration of vesting in the event of a “change of control” (as defined in the Plan). Currently, all of our outstanding equity-based awards include provisions that accelerate vesting of such awards in the event of a change of control. The Compensation Committee believes that these provisions are properly designed to promote stability during a change of control and enable our executives to focus on corporate objectives during a change of control, even if their employment may be subsequently terminated.

19

Tax and Accounting Implications

Deductibility of executive compensation. As part of its role, the Compensation Committee reviews and considers the deductibility of executive compensation under Section 162(m) of the Internal Revenue Code (the “Code”), which provides that the Company may not deduct compensation of more than $1,000,000 that is paid to certain individuals. The Company believes that compensation paid under the management incentive plans is generally fully deductible for federal income tax purposes. However, in certain situations, the Compensation Committee may approve compensation that will not meet these requirements in order to ensure competitive levels of total compensation for its executives.

Accounting for stock-based compensation.

The Company accounts for stock-based compensation including its Stock Option Program, Long-Term Stock Grant Program, Restricted Stock Program and Stock Award Program in accordance with the requirements of FASB ASC Topic 718. The Compensation Committee considers the accounting impact of equity-based compensation when developing the Company’s compensation strategy.

The Role of Stockholder Say-on-Pay Votes.

We provide our stockholders with the opportunity to cast an annual advisory vote on executive compensation through a “say-on-pay” proposal.

SUMMARY COMPENSATION TABLE

The following table presents information regarding compensation earned by or awarded to the Company’s CEO, Chief Financial Officer and next highest-paid executive officer during the years ended December 31, 2019 and 2018.

Name and Principal Position | Year | Salary ($) | Bonus ($)(1) | Non-Equity Incentive Plan Comp. ($) | Option Awards ($)(2) | All Other Compensation ($) | Total ($) | ||||||||||||||

Robert B. Brown, CEO(3) | 2019 | 450,000 | — | — | 698,064 | 32,780 | (4) | 1,180,844 | |||||||||||||

Reginald L. Hardy, former CEO(3) | 2018 | 296,400 | 37,500 | — | 62,324 | — | 396,224 | ||||||||||||||

Andrew D. Sklawer, Chief Operating Officer | 2019 | 350,000 | 69,602 | — | 349,032 | — | 768,634 | ||||||||||||||

2018 | 296,100 | 37,500 | — | 415,503 | — | 749,103 | |||||||||||||||

R. Michael Carruthers, Chief Financial Officer | 2019 | — | — | — | 119,481 | 224,000 | (5) | 343,481 | |||||||||||||

2018 | — | — | — | 62,324 | 142,194 | (5) | 204,518 | ||||||||||||||

_________________

(1) | Annual bonuses are granted after the completion of each calendar year at the Compensation Committee’s discretion, taking into account the Company’s performance against corporate goals and, except with respect to our CEO, each named executive officer’s performance against his or her individual goals. |

(2) | These amounts represent the grant date fair value of equity-based awards granted by the Company during the years presented, determined in accordance with FASB ASC Topic 718. For a detailed discussion of our grant date fair value calculation methodology, including assumptions and estimates inherent therein, please refer to |

20

Note 9 to the financial statements contained in our Annual Report on Form 10-K for the year ended December 31, 2019 filed with the SEC on March 18, 2020.

(3) | Reginald L. Hardy was our CEO for the year ended December 31, 2018. In 2019, Mr. Hardy transitioned to Chairman of the Board. |

(4) | Relates to relocation assistance benefits provided pursuant to Mr. Brown’s employment agreement. See “Employment and Consultancy Agreements-Robert B. Brown” below. |

(5) | Relates to compensation paid under the Company’s consulting agreement with Mr. Carruthers. See “Employment and Consultancy Agreements-R. Michael Carruthers” below. |

OUTSTANDING EQUITY AWARDS AT YEAR-END

The following table provides details regarding outstanding stock-based awards for each of our named executive officers as of December 31, 2019.

Option Awards | Stock Awards | ||||||||||

Number of Securities Underlying Unexercised Options - Exercisable | Number of Securities Underlying Unexercised Options - Unexercisable | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested | Market Value of Shares or Units of Stock That Have Not Vested ($) | ||||||

Robert B. Brown | 34,906 | 104,720 | 16.45 | 12/15/28 | N/A | N/A | |||||

N/A | 207,128 | 4.76 | 8/30/29 | N/A | N/A | ||||||

Andrew D. Sklawer | 17,260 | N/A | 6.37 | 2/14/24 | N/A | N/A | |||||

12,082 | N/A | 12.17 | 4/22/25 | N/A | N/A | ||||||

12,082 | N/A | 12.17 | 12/23/25 | N/A | N/A | ||||||

8,630 | N/A | 12.17 | 12/15/26 | N/A | N/A | ||||||

3,624 | N/A | 16.69 | 12/15/27 | N/A | N/A | ||||||

8,630 | 25,891 | 16.45 | 12/15/28 | N/A | N/A | ||||||

N/A | 103,564 | 4.76 | 8/30/29 | N/A | N/A | ||||||

R. Michael Carruthers | 5,178 | N/A | 16.69 | 12/15/27 | N/A | N/A | |||||

1,294 | 3,884 | 16.45 | 12/15/28 | N/A | N/A | ||||||

N/A | 35,452 | 4.76 | 8/30/29 | N/A | N/A | ||||||

EMPLOYMENT AND CONSULTANCY AGREEMENTS

The Company has entered into employment and consultancy agreements with each of its named executive officers as described below.

Robert B. Brown

Under the terms of the employment agreement entered into between the Company and Robert B. Brown, Mr. Brown is entitled to an annual base salary of $450,000, and is eligible for the Company’s benefit programs, vacation benefits and medical benefits. In addition, Mr. Brown is entitled to a discretionary bonus of $225,000. Under the employment agreement, Mr. Brown is also eligible for reimbursement of relocation assistance of up to $3,000 a month for temporary living expenses for 36 months, up to a maximum amount of $75,000.

21

The agreement provides that upon written notice, either party may terminate the employment arrangement with or without cause, but 90 days’ notice is required if the agreement is terminated by Mr. Brown. In addition, the agreement provides that if the Company terminates Mr. Brown’s employment without good reason (whether or not in connection with a change in control), Mr. Brown will be eligible to receive:

• | any unpaid base salary through the effective date of termination; |

• | any accrued but unpaid vacation; |

• | any accrued by unpaid incentive compensation; |

• | base salary for a period of 12 months paid in a lump sum; and |

• | continuation of health benefits under COBRA for 12 months. |

The following definitions are used in Mr. Brown’s employment agreement (and have similar meanings in Andrew D. Sklawer, Adam Levy, David R. McAvoy, Deepak Chadha and Jose Breton’s employment agreement as described below):